If asked to name my least-favorite international bureaucracy, the easy answer would be the Organization for Economic Cooperation and Development. After all, it was only a few days ago that I outlined different ways that the Paris-based bureaucracy is seeking to expand…

Daily Analysis

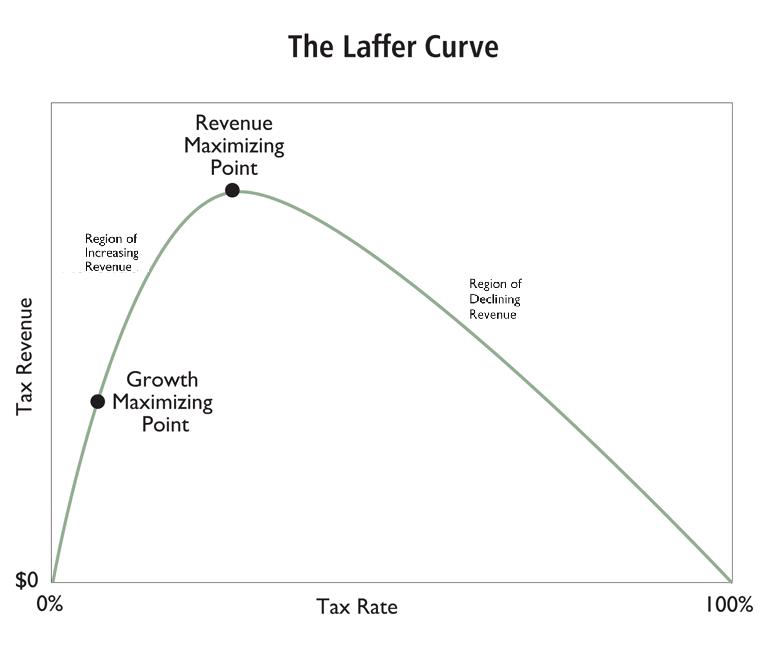

Revenge of the Laffer Curve…Again and Again and Again

If I live to be 100 years old, I suspect I’ll still be futilely trying to educate politicians that there’s not a simplistic linear relationship between tax rates and tax revenue. You can’t double tax rates, for instance, and expect to double tax revenue. Simply…

California’s Golden Bureaucrat Snags $400K of Yearly Compensation – for the Rest of Her Life!

Check out some of the ridiculous details about the woman who has earned the title of California’s Golden Bureaucrat. Alameda County supervisors have really taken to heart the adage that government should run like a business — rewarding County Administrator Susan…

Good News: We’re Heading in the Wrong Direction at a Slower Pace

In recent months, people have asked me why I’m acting all giddy and optimistic. Am I hooked on cocaine? Have I fallen in love? Did I inherit several million dollars? These questions started after I said the fiscal cliff was a smaller loss than I expected. Then people…

Targeting Multinationals, the OECD Launches New Scheme to Boost the Tax Burden on Business

I’ve been very critical of the Organization for Economic Cooperation and Development. Most recently, I criticized the Paris-based bureaucracy for making the rather remarkable assertion that a value-added tax would boost growth and employment. But that’s just the tip…

(Almost) Everything You Ever Wanted to Know about the Fiscal Policy Debate in a Single Chart

I’m a sucker for a good flowchart because they either can help to simplify analysis or they can show how something is very complex. Some of my favorites include: This explanation of double taxation. This depiction of the no-win Greek economic crisis. Portrayals of…

The Laffer Curve Bites Ireland in the Butt

Cigarette butt, to be more specific. All over the world, governments impose draconian taxes on tobacco, and then they wind up surprised that projected revenues don’t materialize. We’ve seen this in Bulgaria and Romania, and we’ve seen this Laffer Curve effect in…

If Obama Wants More Tax Revenue, He Should Lower the Corporate Tax Rate

Regular readers know that I’m a big advocate of the Laffer Curve, which is the common-sense notion that higher tax rates will cause people to change their behavior in ways that reduce taxable income. But that doesn’t mean “all tax cuts pay for themselves.” Yes, that…

More Entrepreneurs Say “Au Revoir” to the Administration Fiscale, Escape France’s Confiscatory Tax Regime

As a general rule, it’s not right to take pleasure at the misfortune of others. But I think we’re allowed an exception to that Schadenfreude rule when the “others” are greedy politicians pursuing spiteful policies. We want the political elite to suffer misfortune…

The IMF, Higher Taxes, and Mitchell’s Law

Here are three common-sense principles. Higher taxes are misguided. They undermine prosperity and finance bigger government. Bailouts also are misguided. They facilitate corruption and encourage moral hazard. And international bureaucracies are misguided. They promote…