I wrote last September that the budget plan put forward by Erskine Bowles and Alan Simpson was fatally flawed. There were some positive features in the plan, to be sure, such as lower marginal tax rates. And I suppose it’s worth noting that the burden of government…

Daily Analysis

It’s Tax Freedom Day, So Congratulations (if You Don’t Live in New York, California, New Jersey, Illinois, etc)

It’s time to celebrate. That’s because we have reached Tax Freedom Day, meaning that – in the aggregate – we have finally earned enough money to pay for all the federal, state, and local taxes that will be imposed on us this year by our political masters. But we’re…

There’s Not Much Hope for Tax Reform

In recent months, I’ve displayed uncharacteristic levels of optimism on issues ranging from Obamacare to the Laffer Curve. But this doesn’t mean I’m now a blind Pollyanna. We almost always face an uphill battle in our efforts to restrain the power and greed of the…

New GAO Study Mistakenly Focuses on Make-Believe Tax Expenditures

I’m very leery of corporate tax reform, largely because I don’t think there are enough genuine loopholes on the business side of the tax code to finance a meaningful reduction in the corporate tax rate. That leads me to worry that politicians might try to “pay for”…

A Tax Haven Primer for the New York Times

I could only use 428 words, but I highlighted the main arguments for tax havens and tax competition in a “Room for Debate” piece for the New York Times. I hope that my contribution is a good addition to the powerful analysis of experts such as Allister Heath and…

Burden of Government Spending Will Be $2 Trillion Higher in 2023 According to Obama’s Budget

If you include all the appendices, there are thousands of pages in the President’s new budget. But the first thing I do every year is find the table showing how fast the burden of government spending will increase. That’s Table S-1 of the budget, and it shows that the…

According to Washington Post Exposé, People Who Utilize Tax Havens Are Far More Honest than Politicians

Using data stolen from service providers in the Cook Islands and the British Virgin Islands, the Washington Post published a supposed exposé of Americans who do business in so-called tax havens. Since I’m the self-appointed defender of low-tax jurisdictions in…

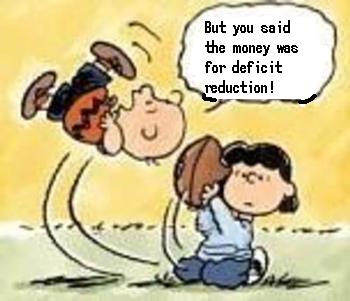

Early Details Show Obama Will Propose a Bait-and-Switch Budget Plan Containing Higher Taxes and More Spending

Are we about to see a new kinder-and-gentler Obama? Has the tax-and-spend President of the past four years been replaced by a fiscal moderate? That’s certainly the spin we’re getting from the White House about the President’s new budget. Let’s look at this theme,…

What’s the Right Point on the Laffer Curve?

Back in 2010, I wrote a post entitled “What’s the Ideal Point on the Laffer Curve?“ Except I didn’t answer my own question. I simply pointed out that revenue maximization was not the ideal outcome. I explained that policy makers instead should seek to maximize…

Ranking the States for Economic and Personal Freedom

Sometimes I myopically focus on fiscal policy, implying that the key to prosperity is small government. But I’ll freely admit that growth is maximized when you have small government AND free markets. That being said, our goal should be to expand freedom, not merely to…