Did President Obama and his team of Chicago cronies deliberately target the Tea Party in hopes of thwarting free speech and political participation? Was this part of a campaign to win the 2012 election by suppressing Republican votes? Perhaps, but I’ve warned that…

Daily Analysis

The Tax Foundation 1 – New York Times 0

Whether it’s American politicians trying to extort more taxes from Apple or international bureaucrats trying to boost the tax burden on firms with a global corporate tax return, the left is aggressively seeking to impose harsher fiscal burdens on the business…

Rand Paul Debunks the Shameful Demagoguery against Apple

Senator Rand Paul is perhaps even better than I thought he would be. He already is playing a very substantive role on policy, ranging from his actions of big-picture issues, such as his proposed budget that would significantly shrink the burden of government…

Four Reasons to Applaud Apple’s Tax Planning

The Senate is holding a Kangaroo Court designed to smear Apple for not voluntarily coughing up more tax revenue than the company actually owes. Here are four things you need to know. Apple is fully complying with the tax law. There is no suggestion that Apple has done…

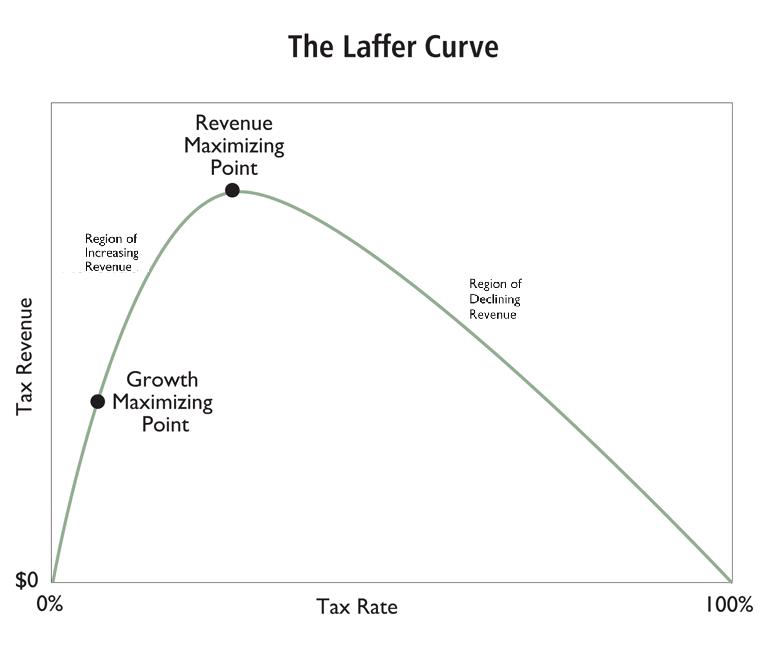

Quit Dodging the Issue and Tell Us the Revenue-Maximizing Point on the Laffer Curve

I feel like I’m on the witness stand and I’m being badgered by a hostile lawyers. Readers keep asking me to identify the revenue-maximizing point on the Laffer Curve. But I don’t like that question. In the past, I’ve explained that the growth-maximizing point on the…

UFOs, Faked Moon Landings, and Fiscal Policy

I was very pleased to report the other day that the people of France overwhelmingly favor spending cuts, even when they were asked a biased question that presupposed that Keynesian-style spending increases would “stimulate” the economy. Now I have some polling data…

OECD Study Admits Income Taxes Penalize Growth, Acknowledges that Tax Competition Restrains Excessive Government

I have to start this post with a big caveat. I’m not a fan of the Paris-based Organization for Economic Cooperation and Development. The international bureaucracy is infamous for using American tax dollars to promote a statist economic agenda. Most recently, it…

Going Galt: More Americans Vote with their Feet against Obama

I’ve written many times about how investors, entrepreneurs, small business owners and other successful people migrate from high-tax states to low-tax states. Well, the same thing happens internationally, as France’s greedy politicians are now learning. It’s a lot…

MarketPlace Fairness Act Thwarts Tax Competition

The Marketplace Fairness Act, a misguided attempt to allow expanded sales tax collection online, passed the Senate on Monday, though its fate in the House is less clear. Also less clear is whether the law passes constitutional muster. At the very least it severely…

Why the So-Called Marketplace Fairness Act Is a Misguided Expansion of Power for State Governments

I’m either a total optimist or a glutton for punishment. I recently explained the benefits of “tax havens” for the unfriendly readers of the New York Times. Now I’m defending a different form of tax competition for CNN, another news outlet that leans left. In this…