Would you want to live in a city with no income, sales or capital gains taxes? Well you can soon move to Honduras and get your chance: Small government and free-market capitalism are about to get put to the test in Honduras, where the government has agreed to let an…

Daily Analysis

The Wall Street Journal’s Primer on Capital Gains Taxation

One of the principles of good tax policy and fundamental tax reform is that there should be no double taxation of income that is saved and invested. Such a policy promotes current consumption at the expense of future consumption, which is simply an econo-geek way of…

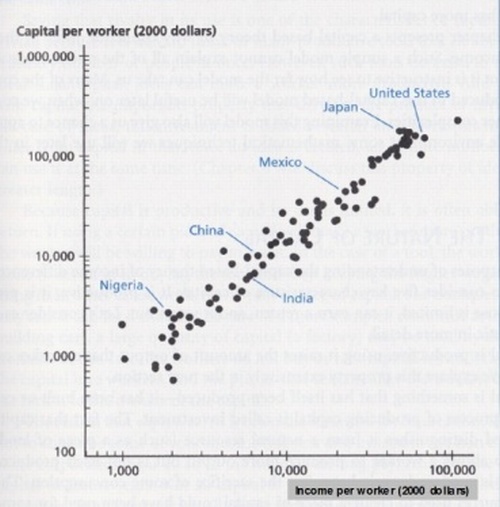

If You Want To Understand Why Obama’s Tax Agenda Is Bad for Workers, this Picture Says a Thousand Words

A good tax system (like the flat tax) does not impose extra layers of tax on income that is saved and invested. I’ve tried to emphasize this point with a flowchart, and I’ve defended so-called trickle-down economics, which is nothing more than the common-sense notion…

The Right Capital Gains Tax Rate Is Zero

The silly debate about the “Buffett Rule” is really an argument about the extent to which there should be more double taxation of income that is saved and invested. Politicians conveniently forget that dividends and capital gains get hit by the corporate income tax….

How Can Obama Look at these Two Charts and Conclude that America Should Have Higher Double Taxation of Dividends and Capital Gains?

As discussed yesterday, the most important number in Obama’s budget is that the burden of government spending will be at least $2 trillion higher in 10 years if the President’s plan is enacted. But there are also some very unsightly warts in the revenue portion of the…

Debating at U.S. News & World Report, I Explain Double Taxation to the Economic Heathens

Never let it be said I back down from a fight, even when it’s the other team’s game, played by the other team’s rules, and for the benefit of the wrong person. And that definitely went through my mind when U.S. News & World Report asked me to contribute to their…

Romney: A Total Failure on Double Taxation

Last night’s GOP debate did nothing to change my sour opinion of Mitt Romney. During a discussion about tax reform, he attacked Newt Gingrich for the supposed crime of not wanting to double tax capital gains. Here’s how Politico reported the exchange. Newt Gingrich…

In Defense of “Trickle-Down” Economics

Back in September, I posted a flowchart showing how the current tax system is biased against saving and investment. Simply stated, the federal government largely leaves you unmolested if you consume your after-tax income, but there are as many as four extra layers of…

Grading Perry’s Flat Tax: Some Missing Homework, but a Solid B+

Governor Rick Perry of Texas has announced a plan, which he outlines in today’s Wall Street Journal, to replace the corrupt and inefficient internal revenue code with a flat tax. Let’s review his proposal, using the principles of good tax policy as a benchmark. 1….

Explaining the Perverse Impact of Double Taxation with a Chart

Whether I’m criticizing Warren Buffett’s innumeracy or explaining how to identify illegitimate loopholes, I frequently write about the perverse impact of double taxation. By this, I mean the tendency of politicians to impose multiple layers of taxation on income that…