People are responding in predictable ways.

Daily Analysis

The Feel-Good Map of 2023

More than half of the states have now joined the tax-cutting club.

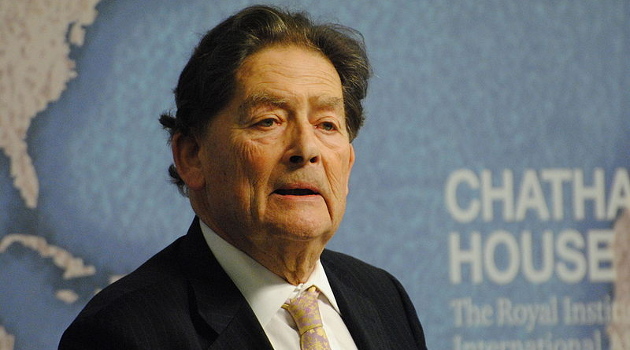

Thatcher, Lawson, and Pro-Growth Tax Policy

Thatcher had the wisdom to appoint principled and capable people to her cabinet.

The Laffer Curve and Trump’s 21 Percent Corporate Tax Rate

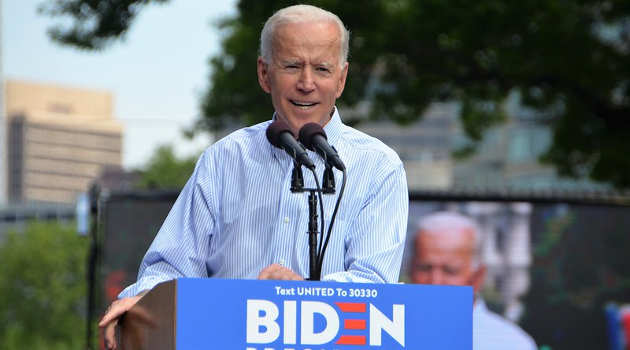

Evidence that Biden’s plan is very misguided.

The Tradeoff Between Tax Progressivity and Economic Output

Why you don’t want to be at the revenue-maximizing point of the Laffer Curve.

The Importance of Low Marginal Tax Rates

It’s the tax on the next dollar earned that matters.

Prosperity and Taxation: What Can We Learn from the 1930s

What will happen if Biden succeeds in raising taxes on the rich.

Big Government vs. “Trickle-Down Economics”

Biden is not an honest redistributionist.

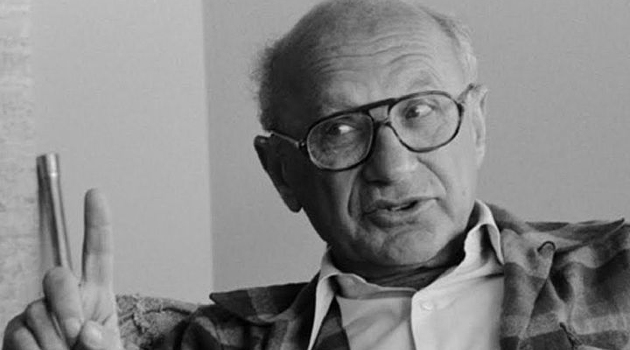

Milton Friedman on Taxation

The master was right.

OECD Data: Higher Tax Rates Don’t Necessarily Mean Higher Tax Revenue

There’s a lot of “revenue feedback” when tax rates are changed.