I’ve already condemned the foolish people of California for approving a referendum to raise the state’s top tax rate to 13.3 percent. This impulsive and misguided exercise in class warfare surely will backfire as more and more productive people flee to other states –…

Daily Analysis

Once Obama’s Policies Are Implemented Next Year, U.S. Capital Gains Tax Rate Will be 70 percent Higher than Global Average

Back in September, I shared a very good primer on the capital gains tax from the folks at the Wall Street Journal, which explained why this form of double taxation is so destructive. I also posted some very good analysis from John Goodman about the issue….

Will Obama Learn from England’s Laffer Curve Mistake?

Obama’s main goal in the fiscal cliff negotiations is to impose a class-warfare tax hike. He presumably thinks this will give the government more money to spend, but recent evidence from the United Kingdom suggests that he won’t get nearly as much money as he thinks….

A Laffer Curve Warning about the Economy and Tax Revenue for President Obama and other Class Warriors

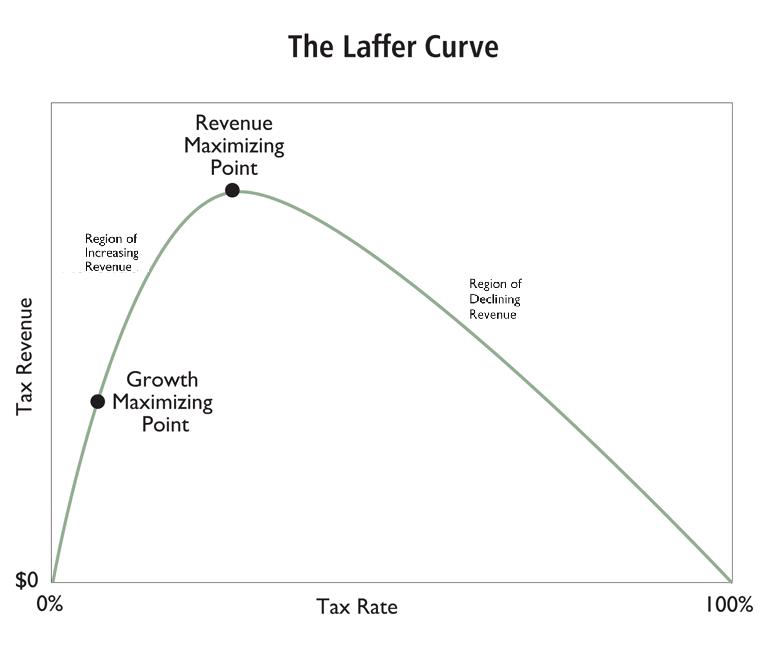

Being a thoughtful and kind person, I offered some advice last year to Barack Obama. I cited some powerful IRS data from the 1980s to demonstrate that there is not a simplistic linear relationship between tax rates and tax revenue. In other words, just as a restaurant…

Higher Taxes Mean Bigger Government, not Lower Deficits

President Obama and other statists in Washington want a big class-warfare tax hike. They claim the additional revenue is necessary to reduce red ink. But their ideological crusade is based on some blatant distortions. They tell us that tax increases are necessary, but…

Two Cheers for Spain’s Anti-Tax “Carrot Rebellion”

If there was a prize for fighting back against tax authorities, the Italians would probably deserve first place. I’m not aware of any other country where tax offices get firebombed. The Italians also believe in passive forms of resistance, with tens of thousands of…

The Joint Committee on Taxation’s Head-in-the-Sand Approach to the Laffer Curve

I’m a big believer in the Laffer Curve, which is the common-sense proposition that changes in tax rates don’t automatically mean proportional changes in tax revenue. This is because you also have to think about what happens to taxable income, which can move up or down…

New International Monetary Fund Study Inadvertently Provides Very Strong Evidence against the Value-Added Tax

I’m not a big fan of the International Monetary Fund, largely because the folks in charge oftentimes advocate toxic policies such as bailouts, higher taxes, and currency devaluation. But there are some top-rate economists working at the IMF, and the bureaucracy has…

The Laffer Curve Strikes Again: Revenues Falling in Spite of (or Perhaps Because of) Spain’s Punitive Corporate Tax Rate

I’ve shared evidence from around the world (England, Italy, the United States, and France) and from various states (Illinois, Oregon, Florida,Maryland, and New York) to argue that it is foolish to ignore the Laffer Curve. Not that it makes any difference. I’m slowly…

France’s Fiscal Suicide

I try to be self aware, so I realize that I have the fiscal version of Tourette’s. Regardless of the question that is asked, I’m tempted to blurt out that the answer is to reduce the burden of government spending. But sometimes that’s exactly the right prescription,…