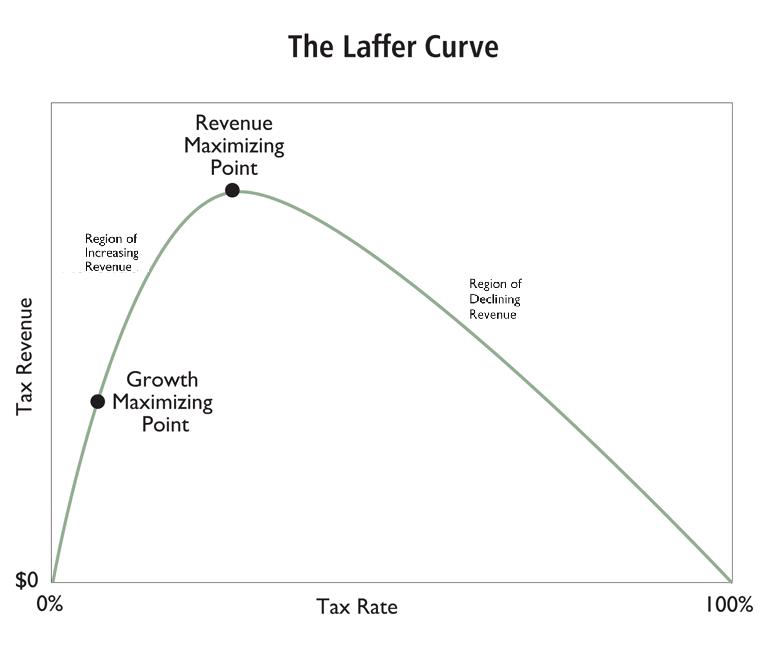

I feel like I’m on the witness stand and I’m being badgered by a hostile lawyers. Readers keep asking me to identify the revenue-maximizing point on the Laffer Curve. But I don’t like that question. In the past, I’ve explained that the growth-maximizing point on the…

Daily Analysis

Why Art Laffer’s Unfortunate Endorsement of an State Sales Tax Cartel Is Misguided

Art Laffer has a guaranteed spot in the liberty hall of fame because he popularized the common-sense notion that you can’t make any assumptions about tax rates and tax revenue without also figuring out what happens to taxable income. Lot’s of people on the left try to…

What’s the Right Point on the Laffer Curve?

Back in 2010, I wrote a post entitled “What’s the Ideal Point on the Laffer Curve?“ Except I didn’t answer my own question. I simply pointed out that revenue maximization was not the ideal outcome. I explained that policy makers instead should seek to maximize…

Another Victory for Good Fiscal Policy

Our lords and masters in Washington have taken a small step in the direction of recognizing the Laffer Curve. Here are some details from a Politico report. Here’s one Republican victory that went virtually unnoticed in the slew of budget votes last week: The Senate…

Revenge of the Laffer Curve…Again and Again and Again

If I live to be 100 years old, I suspect I’ll still be futilely trying to educate politicians that there’s not a simplistic linear relationship between tax rates and tax revenue. You can’t double tax rates, for instance, and expect to double tax revenue. Simply…

The Laffer Curve Bites Ireland in the Butt

Cigarette butt, to be more specific. All over the world, governments impose draconian taxes on tobacco, and then they wind up surprised that projected revenues don’t materialize. We’ve seen this in Bulgaria and Romania, and we’ve seen this Laffer Curve effect in…

If Obama Wants More Tax Revenue, He Should Lower the Corporate Tax Rate

Regular readers know that I’m a big advocate of the Laffer Curve, which is the common-sense notion that higher tax rates will cause people to change their behavior in ways that reduce taxable income. But that doesn’t mean “all tax cuts pay for themselves.” Yes, that…

The New York Times Calls (again) for Higher Taxes on Middle-Class Americans

ll statists want much bigger government, but not all of them are honest about how to finance a Greek-sized welfare state. The President, for instance, wants us to believe that the rich are some sort of fiscal pinata, capable of generating endless amounts of tax…

The Laffer Curve KO’s the IRS

What’s the revenue-maximizing tax rate? Since I’m interested in the growth-maximizing tax rate instead, I don’t think that’s even a legitimate question. That being said, it seems like everyone – both on the left and on the right – should agree that it makes no sense…

Rather than Helping the Poor, Higher Tax Rates Redistribute Rich People

Daniel Hannan is a member of the European Parliament from England. He is one of the few economically sensible people in that body, as demonstrated in these short clips of him speaking about tax competition and deriding the European Commission’s corrupt racket. And as…