There’s an old saying that there’s no such thing as bad publicity. That may be true if you’re in Hollywood and visibility is a key to long-run earnings. But in the world of public policy, you don’t want to be a punching bag. And that describes my role in a book…

Daily Analysis

Corporate Tax in Japan, Benefits for American Veterans, and Overweight British Kids

The title of this post sounds like the beginning of a strange joke, but it’s actually because we’re covering three issues today. Our first topic is corporate taxation. More specifically, we’re looking at a nation that seems to be learning that it’s foolish the have a…

France Wipes Out on the Laffer Curve

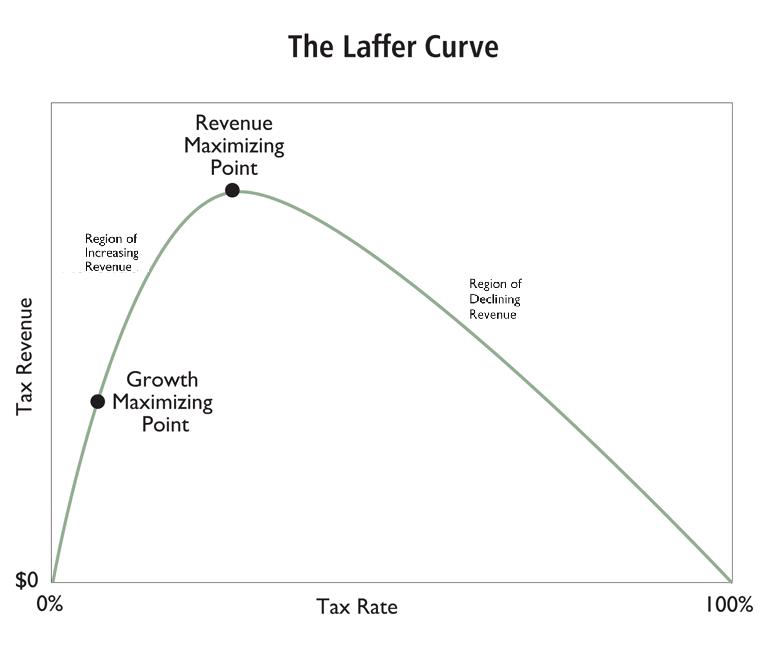

If you appreciate the common-sense notion of the Laffer Curve, you’re in for a treat. Today’s column will discuss the revelation that Francois Hollande’s class-warfare tax hikes have not raised nearly as much money as predicted. And after the recent evidence about the…

A Primer on the Laffer Curve to Help Understand Why Obama’s Class-Warfare Tax Policy Won’t Work

My main goal for fiscal policy is shrinking the size and scope of the federal government and lowering the burden of government spending. But I’m also motivated by a desire for better tax policy, which means lower tax rates, less double taxation, and fewer corrupting…

Boost Worker Pay – and Make the United States More Competitive – by Gutting the Corporate Income Tax

The business pages are reporting that Chrysler will be fully owned by Fiat after that Italian company buys up remaining shares. I don’t know what this means about the long-term viability of Chrysler, but we can say with great confidence that the company will be better…

Turning New York City into Detroit?

I recently speculated whether Detroit’s fiscal problems should be a warning sign for the crowd in Washington. The answer, of course, is yes, though it’s not a perfect analogy. The federal government is in deep trouble because of unsustainable entitlement programs…

The Common-Sense Case for Dynamic Scoring

As regular readers know, one of my great challenges in life is trying to educate policy makers about the Laffer Curve, which is simply a way of illustrating that government won’t collect any revenue if tax rates are zero, but also won’t collect much revenue if tax…

Are Higher Taxes Solving Fiscal Problems, either in Washington or California?

The budget deficit this year is projected to be significantly smaller than it has been in recent years and some of our statist friends claim that this shows the desirability and effectiveness of higher taxes. I’m not persuaded, mostly because our big long-run fiscal…

Getting High with the Laffer Curve

Two of my favorite things in life are the Laffer Curve and the Georgia Bulldogs. So you know I’m going to approve when an economics professor from the University of Georgia writes a column about the power of the Laffer Curve. And since I’m a libertarian and the…

Two Lessons from Calvin Coolidge

Last month, Amity Shlaes came to Cato to discuss her superb new book about Calvin Coolidge. I heard her discuss the book back in January while participating in Hillsdale College’s conference on the 100th anniversary of the income tax, but the book is so rich with…