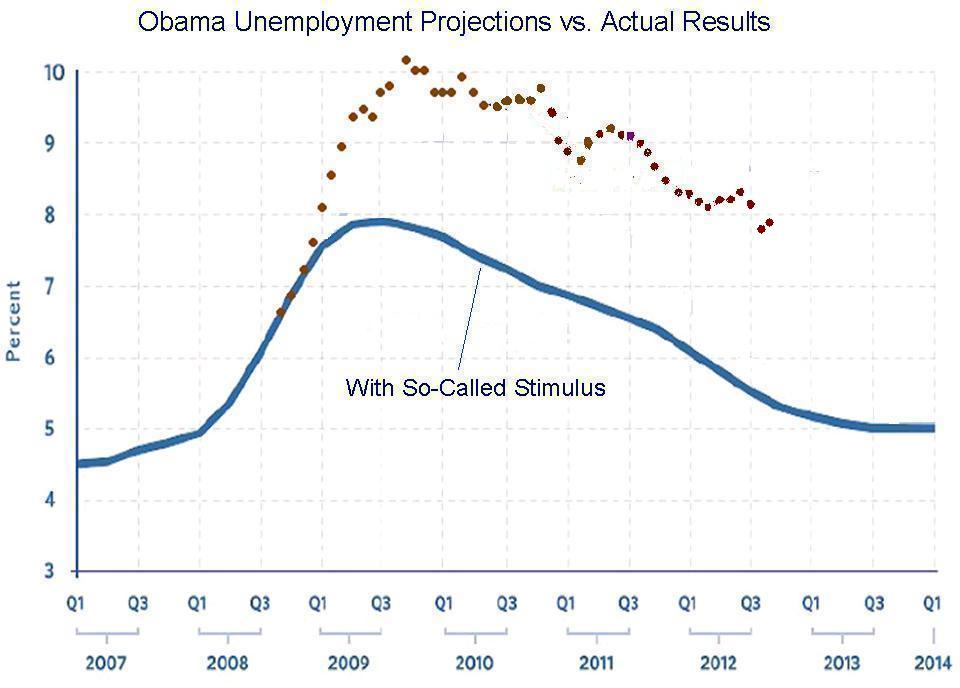

In some sense, the President is fortunate. I predicted a long time ago that he would win re-election if the unemployment rate was under 8 percent. Well, the new numbers just came out and the joblessness rate is 7.9 percent. So even though his stimulus failed, and even…

Daily Analysis

Will Obama Benefit from Bad Jobs Numbers that Look Good?

That’s a clunky title for this post, but I couldn’t think of any other way of expressing the potential political impact of a very muddled employment situation. Let’s start with the obvious. The White House is very happy about the recent numbers showing that the…

How Will Economic Freedom Fare in Honduras?

Would you want to live in a city with no income, sales or capital gains taxes? Well you can soon move to Honduras and get your chance: Small government and free-market capitalism are about to get put to the test in Honduras, where the government has agreed to let an…

OECD Presses Big Government Agenda

The Organization for Economic Cooperation and Development (OECD) is heavily subsidized by US taxpayers, but spends a lot of time pushing an agenda against taxpayer interests. Richard Billies recently did a good job recounting the OECD’s ongoing list of big…

Jobless Rate Climbs to 8.3 Percent, Creating More Anxiety for Obama and the Left

Can we finally all agree that Keynesian economics is a flop? The politicians in Washington flushed about $800 billion down the toilet and we got nothing in exchange except for anemic growth and lots of people out of work. Indeed, we’re getting to the point where the…

Why Western Europe Became Rich in the Past…and How It Can Regain Prosperity Today

I’m in Vilnius, Lithuania, where I just finished speaking to a regional conference of the European Students for Liberty. I subjected the kids to more than 90 minutes of pontificating and 73 PowerPoint slides, but I could have saved them a lot of time if I simply…

Three Cheers for Tax Competition

CF&P’s Brian Garst, in an editorial for the Daily Caller yesterday, observes a disturbing trend in the rhetoric of this year’s Presidential campaign. An unholy alliance of political opportunists and long-time opponents of tax competition has formed and…

Estonia and Austerity: Another Exploding Cigar for Paul Krugman

I have great fondness for Estonia, in part because it was the first post-communist nation to adopt the flat tax, but also because of the country’s remarkable scenery. Most recently, though, I’ve been bragging about Estonia (along with Latvia and Lithuania, the other…

More Sub-Par Employment Numbers

The Labor Department just released its monthly employment report and the White House is probably not happy. There are several key bits of data in the report, such as the unemployment rate, net job creation, and employment-population ratio. At best, the results are…

A Fiscal Policy Tutorial: Everything You Need to Know about the Economics of Government Spending

Almost exactly one year ago, I did a post entitled “A Laffer Curve Tutorial” because I wanted readers to have all the arguments and data in one place (and also because it meant I wouldn’t have to track down all the videos when someone asked me for the full set)….