by Dan Mitchell | Nov 19, 2020 | Big Government, Blogs

More than ten years ago, I narrated this video in hopes of convincing politicians and bureaucrats that anti-money laundering laws (and associated regulations) were a costly and intrusive failure. Sadly, my efforts to bring sanity to so-called AML policy (sometimes...

by Dan Mitchell | Nov 18, 2020 | Big Government, Blogs

Most Republicans and Democrats have a self-interested view of divided government. They obviously prefer if their party controls everything. After all, that’s how Republicans got tax reform in 2017 and it’s how Democrats got Obamacare in 2010. But they also like...

by Dan Mitchell | Nov 17, 2020 | Blogs, Economics

Japan is an interesting country to examine if you want insights about public policy. We can study the impact of population aging on fiscal outcomes. We can learn about the utter failure of Keynesian economics. We can understand why it’s a very bad idea to impose a...

by Dan Mitchell | Nov 16, 2020 | Blogs, Taxation

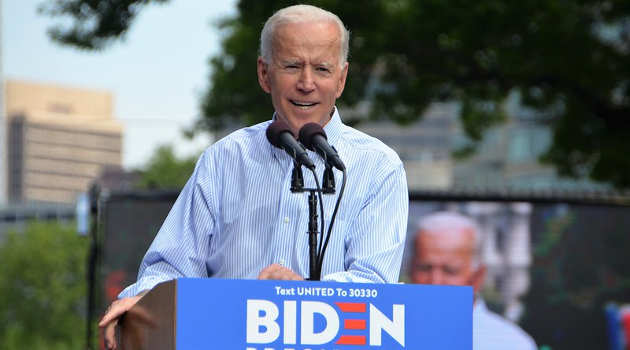

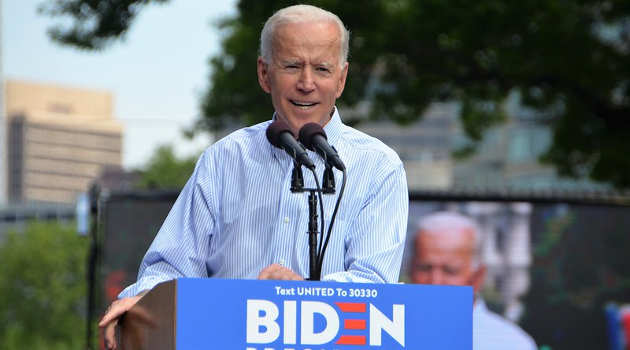

In Part I of this series, I expressed some optimism that Joe Biden would not aggressively push his class-warfare tax plan, particularly since Republicans almost certainly will wind up controlling the Senate. But the main goal of that column was to explain that the...

by Dan Mitchell | Nov 15, 2020 | Blogs, Economics

I’m a big fan of New Zealand because the nation is a great example of how sweeping free-market reforms lead to very good results. The Kiwis got rid of all agriculture subsidies and farmers benefited. The Kiwis put the clamps on government spending, both in the 1990s...