by Dan Mitchell | May 14, 2021 | Taxation

There are three important principles for sensible tax policy. Low marginal tax rates on productive behaviorNo tax bias against capital (i.e., saving and investment)No tax preferences that distort the economy Today, let’s focus on #2. I’ve written many times about...

by Dan Mitchell | May 13, 2021 | Big Government, Blogs, Economics, Welfare and Entitlements

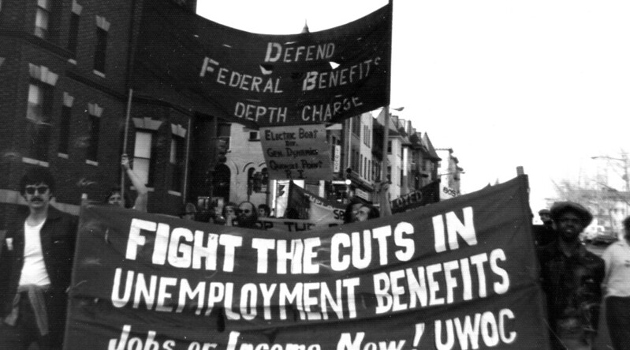

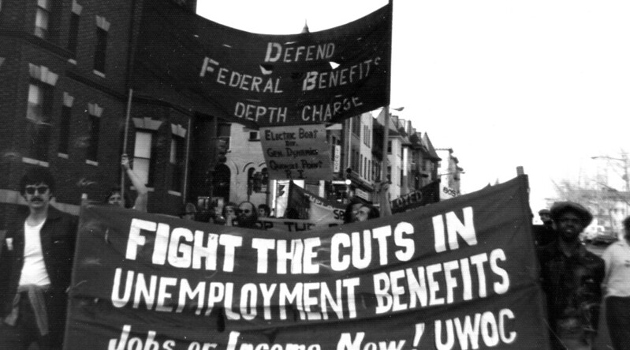

I wrote two days ago about subsidized unemployment, followed later in the day by this interview. This controversy raises a fundamental economic issue. I explained in the interview that employers only hire people when they expect a new worker will generate at...

by Dan Mitchell | May 12, 2021 | Blogs, Taxation

Back in 2015, I joked that my life would be simpler if I had an “automatic fill-in-the-blanks system” for columns dealing with the Organization for Economic Cooperation and Development. Here’s what I proposed. We can use this shortcut today because the OECD has...

by Dan Mitchell | May 11, 2021 | Blogs

Back in 2010, I applauded Paul Krugman for acknowledging that government unemployment benefits can encourage joblessness. And I even cited Krugman in this 2012 debate on the topic. We’re debating this issue again today, but it’s an even bigger problem...

by Dan Mitchell | May 10, 2021 | Big Government, Blogs, Economics, Supply Side, Taxation

The United States conducted an experiment in the 1980s. Reagan dramatically lowered the top tax rate on households, dropping it from 70 percent to 28 percent. Folks on the left bitterly resisted Reagan’s “supply-side” agenda, arguing that “the rich won’t pay...