by Dan Mitchell | Jul 26, 2021 | Blogs, Economics, Socialism

I like cross-country comparisons – such as North Korea vs South Korea and East Germany vs. West Germany – because they can be very informative when comparing the results of socialism vs. markets. One of the most dramatic examples is Cuba vs....

by Dan Mitchell | Jul 25, 2021 | Big Government, Blogs, Government Spending

Back in 2009, there was strong and passionate opposition to Bush’s corrupt TARP scheme and Obama’s fake stimulus boondoggle – both of which had price tags of less than $1 trillion. Today, Biden has already squandered $1.9 trillion on his...

by Dan Mitchell | Jul 24, 2021 | Blogs, Capital Gains, Taxation

It’s presumably not controversial to point out that the Washington Post (like much of the media) leans to the left. Indeed, the paper’s bias has given me plenty of material over the years. As you can see, what really irks me is when the bias translates...

by Dan Mitchell | Jul 23, 2021 | Blogs, Economics, Free Market

In my four-part series on inequality (here, here, here, and here), I argue that that it is more important to instead focus on reducing poverty – especially since we know the policies needed to achieve that latter goal. In this discussion, I contemplate...

by Dan Mitchell | Jul 22, 2021 | Blogs, Economics, Free Market

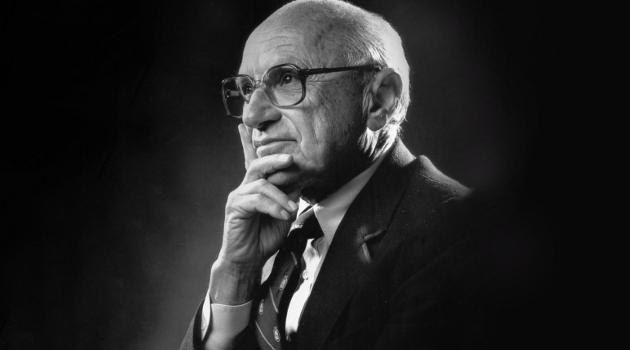

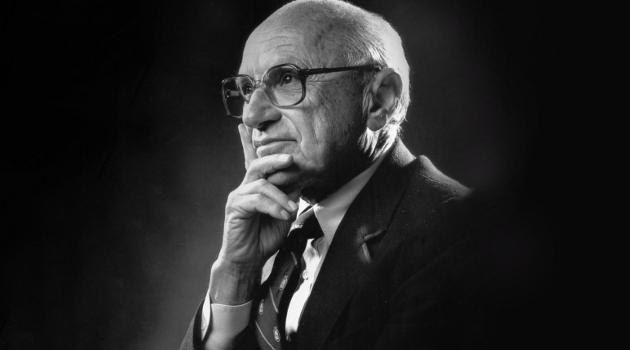

Last year, I weighed in on the debate about whether companies should be operated for the benefit of owners (shareholders) or for the broader community (stakeholders). Unsurprisingly, I sided with Milton Friedman and argued that businesses have a...