by Dan Mitchell | Feb 15, 2023 | Blogs

Last year’s three-part series on corporate tax rates (here, here, and here) primarily focused on the case for low rates in the United States. Today, we’re going to look at why the United Kingdom should have a low corporate tax rate. Though the...

by Dan Mitchell | Feb 14, 2023 | Blogs

The economics of tax policy is largely the economics of incentives. When governments impose high tax rates on something, you get less of that thing. My left-leaning friends acknowledge this is true, but only selectively. They openly agitate for higher...

by Dan Mitchell | Feb 13, 2023 | Big Government, Blogs, Bureaucracy

My primary problem with bureaucrats is that they often work for agencies and departments that should not exist. My secondary problem is that they generally get overcompensated compared to workers in the economy’s productive sector. And my...

by Dan Mitchell | Feb 12, 2023 | Big Government, Blogs

My Fourteenth Theorem of Government explains that when government intervenes for the ostensible purpose of providing help to poor people in the short run, it is all but inevitable that such policies will hurt poor people in the long run. It...

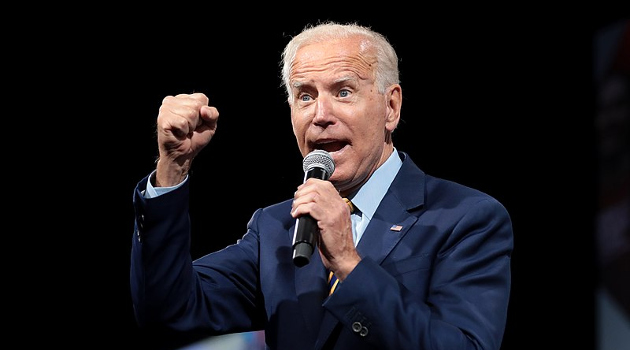

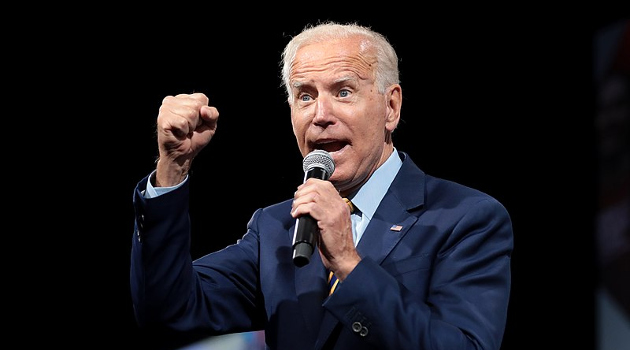

by Dan Mitchell | Feb 11, 2023 | Blogs, Capital Gains, Taxation

In 2020 and 2021, I wrote a four-part series (here, here, here, and here) about Biden’s class-warfare tax agenda. And I also wrote a series of columns about some of his worst ideas. Biden wants America to have the developed world’s highest...