by Brian Garst | Nov 1, 2016 | Opinion and Commentary

This article appeared in Cayman Financial Review on November 1, 2016. According to the simple Civics 101 view of American government, laws are passed by the legislative branch, interpreted by the judicial branch, and enforced by the executive branch. In reality, both...

by Brian Garst | Oct 31, 2016 | Blogs, Competition, Free Market

Halloween is typically scary mostly only for small children, but this year the millions of adults who wear contact lenses have reason to be frightened, particularly for their pocketbooks. That’s because an effort is under way to limit competition in the contact...

by Brian Garst | Oct 21, 2016 | Opinion and Commentary

This article originally appeared on The Daily Caller on October 13, 2016. Last month, a judge in the Southern District of New York overturned a Department of Justice decision that could alter consumer access to music. The DoJ oversees the licensing practices of the...

by Brian Garst | Sep 30, 2016 | Big Government, Blogs, Government Spending

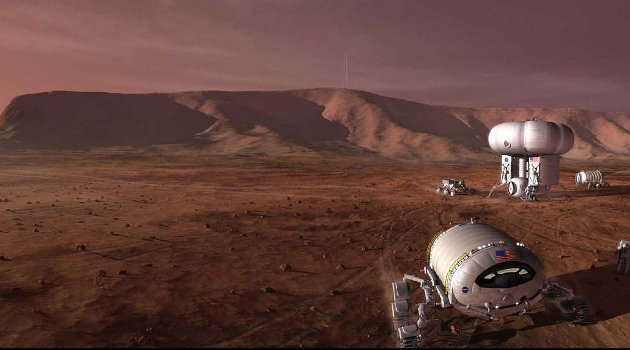

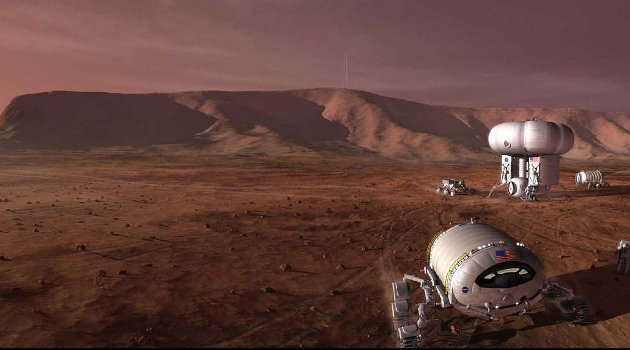

Earlier this week Elon Musk gave a long-awaited presentation outlining his vision for colonizing Mars. Futurists, technophiles, and science fiction lovers were all no doubt entertained. I was certainly among them. As Stephen Hawking has explained, long term human...

by Brian Garst | Sep 16, 2016 | Blogs, Europe, Tax Competition, Taxation

To justify its recent $14.5 billion ruling against Apple, the EU claimed that Apple benefited from “a significant advantage over other businesses that are subject to the same national taxation rules.” If they had provided any evidence of a special...