by Andrew F. Quinlan | Oct 8, 2016 | Opinion and Commentary

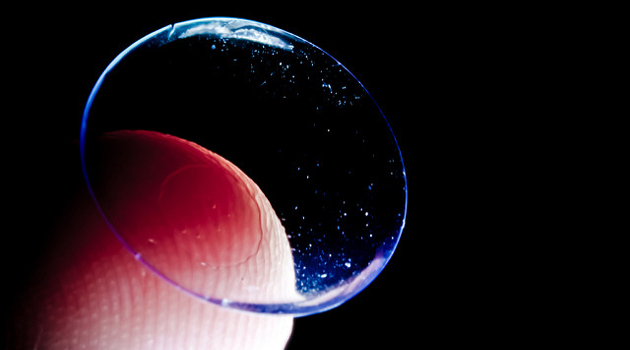

This article originally appeared on The Daily Caller on October 6, 2016. Contact lenses are big business. A $4 billion industry, in fact. That’s not much of a surprise when you consider that an estimated 40 million Americans wear contacts. Also not a surprise: the...

by Andrew F. Quinlan | Sep 8, 2016 | Opinion and Commentary

This article appeared on AL.com on September 6, 2016. When average Americans find themselves in significant debt, the obvious choice is to cut unnecessary expenses and work to get the family budget back on track. The same should be true for politicians and government,...

by Andrew F. Quinlan | Aug 29, 2016 | Opinion and Commentary

This article appeared in the Washington Examiner on August 29, 2016. Every day seems to bring new tales of human suffering and economic woe from defiantly socialist Venezuela. The once thriving nation put its faith in a backward economic system that relies on central...

by Andrew F. Quinlan | Aug 14, 2016 | Opinion and Commentary

This article appeared on Inside Sources on August 9, 2016. An historically slow recovery with weak economic growth has created enough economic angst to fuel multiple populist, outsider campaigns this election season. At least one apparent bright spot in the economy,...

by Andrew F. Quinlan | Aug 5, 2016 | Opinion and Commentary

This article originally appeared on The Daily Caller on August 4, 2016. It was announced this week that one of Elon Musk’s companies, Tesla Motors, will buy one of his other companies, SolarCity, for an all-stock deal worth $2.6 billion. The merger was first proposed...