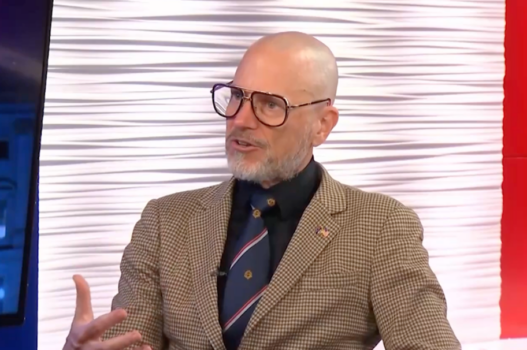

Daniel J. Mitchell – President

Daniel J. Mitchell is the President of the Center for Freedom and Prosperity and the Center for Freedom and Prosperity Foundation. Dr. Mitchell advocates limited government and fundamental tax reform, and is the nation’s leading opponent of tax harmonization schemes developed by the Brussels-based European Union, the Paris-based Organization for Economic Cooperation and Development (OECD), and the United Nations. In addition to fiscal policy, Dr. Mitchell is a trenchant observer of economic developments and an expert on Social Security reform – particularly the fiscal policy impact of reform and what the US can learn from other nations that have created personal retirement accounts.

Dr. Mitchell’s by-line can be found in such national publications as the Wall Street Journal, New York Times, Investor’s Business Daily, and Washington Times. He is a frequent guest on radio and television and a popular speaker on the lecture circuit. Dr. Mitchell holds a Ph.D. in Economics from George Mason University and master’s and bachelor’s degrees in economics from the University of Georgia. He is also a Visiting Professor at Universidad de Libertad in Mexico City. Mitchell was a senior fellow with the Cato Institute and The Heritage Foundation, and an economist for Senator Bob Packwood and the Senate Finance Committee. He also was on the editorial board of the Cayman Financial Review, served on the 1988 Bush/Quayle transition team, and was Director of Tax and Budget Policy for Citizens for a Sound Economy.

Brian Garst – Vice President

Brian Garst joined CF&P in 2010 and serves as Vice President. He writes regularly on tax and free-market issues, and has been published by national and international outlets such as Offshore Investment, RealClearPolicy, Cayman Financial Review, China Offshore, Thomson Reuters Accelus, IFC Review, The Washington Examiner, The Daily Caller, Human Events, and Townhall.

Prior to joining the Center, Mr. Garst interned at the American Legislative Exchange Council as a research assistant for the Education and Health & Human Services Task Forces, and the Cato Institute as a foreign policy researcher. Originally from Florida, he has a Master’s in Political Science from the University of West Florida, and a B.S. in Computer Science from the Florida Institute of Technology.

Sven R. Larson – Associate Scholar

Sven R. Larson is a political economist whose research focuses on macroeconomics and the welfare state. He is the author of several peer-review articles and books, including Industrial Poverty (Gower 2014) about the European economic crisis and The Rise of Big Government (Routledge 2018) about the egalitarian roots of the American welfare state. He has worked for several free-market think tanks, including a previous project with the Center for Freedom and Prosperity. He has provided numerous testimonies before legislative committees and is a sought-after policy advisor and public speaker.

Darren Brady Nelson – Associate Scholar

Darren Brady Nelson is a senior economist and expert in competition, fiscal, monetary and regulatory policies. Mr. Nelson is the inventor of applying CPI Minus X (CPI-X) to cutting and controlling state and federal government spending. His articles have appeared in the Cayman Financial Review, Concurrences, Daily Caller, Investing News, Quadrant, Red State, Spectator, Townhall, as well as other publications in the U.S. and Australia. Mr. Nelson has been interviewed on ABC Radio Australia, American Syndicated Radio, OANN, Rebel News, Sky News Australia, TNT Radio, as well as other TV, radio, and podcast shows in the U.S. and Australia. He has testified before the Australian Senate Select Committee on Lending to Primary Production Customers and Maine Committee on Taxation, as well as making many submissions to governments and regulators around the English-speaking world. Mr. Nelson has spoken at a number of conferences in the U.S. and Australia, including a Cost of Living Summit which he organized and hosted. He is the author of the book Ten Principles of Regulation & Reform and contributed a chapter to the book Why Competition?.