President Obama’s two biggest “achievements” since taking office are the so-called stimulus and government-run healthcare.

But neither one of those policies are popular, so the President largely ignored them during his state-of-the-union address and instead focused on using the tax code to promote “fairness.”

But fairness doesn’t mean treating everyone equally by adopting a flat tax. Instead, it means a class-warfare policy of higher tax rates.

The President’s home state of Illinois is a good test case of this approach. The politicians rammed through a big tax increase early last year, supposedly to stabilize state finances.

Unfortunately, Obamanomics isn’t working very well in Illinois. The state just got downgraded by Moody’s and ranks below even California.

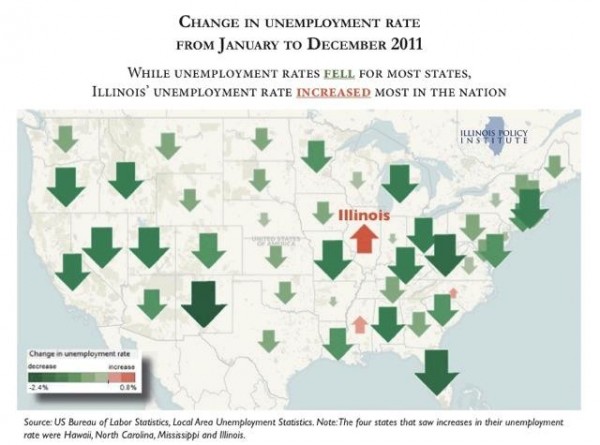

The most damning evidence, though, is what’s happened to the job market. Unemployment is still far too high across the nation, but the vast majority of states are seeing at least modest improvement.

But a tiny handful of states, led by Illinois, are moving in the wrong direction. Here’s a very powerful chart produced by the Illinois Policy Institute. The tax hike is about one-year old, and we’re already seeing strong evidence that jobs are fleeing the state.

Now close your eyes and envision a different map. Instead of American states, imagine a map of the world. And think what it will look like if Obama succeeds in imposing all the tax increases he had endorsed.

I suppose it won’t look as bad as this map because there are plenty of other nations engaging in suicidal tax policy. But it doesn’t take a vivid imagination to understand that Obama’s class-warfare approach would drive jobs and investment to the nations with better tax policies.