I testified before the House Ways & Means Committee earlier today. As always, my trip inside the belly of the beast was an interesting adventure.

The tax-writing committee was holding a hearing on the value-added tax. I was on a panel with five other witnesses, and all of the other people testifying were sympathetic to a VAT. But since I had truth on my side, that made it a fair fight (though it did cross my mind that it’s not a good sign when a Republican-controlled committee stacks the witnesses in favor of a European-style tax system).

I made two points. First, a VAT is less destructive than the current income tax. As such, if we somehow repealed the 16th Amendment and replaced it with something ironclad that would prevent the income tax from ever again haunting the land, I would gladly make a trade.

But that’s not going to happen, so my second point was to warn that the VAT would be a recipe for bigger government. And even though some of my fellow witnesses said the revenue could be used to reduce deficits, I pointed out that Europe adopted VATs beginning in the 1960s and that hasn’t stopped welfare states such as Greece and Portugal from spending themselves into a fiscal crisis.

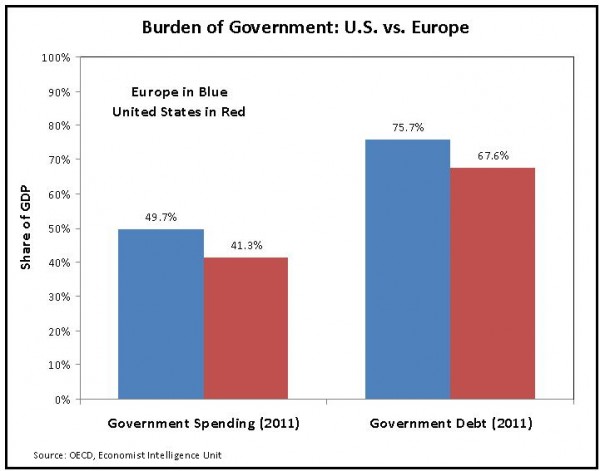

This chart, which is similar to what I included in my testimony, compares spending and debt levels in EU-15 nations (Western Europe) and the United States. As you can see, the burden of spending and debt is onerous in America (red columns), but even worse in Europe (blue columns).

That doesn’t prove that a VAT causes bigger government and more debt, to be sure, but it certainly seems to suggest that the other side is smoking dope when they claim a VAT will lead to deficit reduction. Instead, it seems like Milton Friedman was right when he warned that, “In the long run government will spend whatever the tax system will raise, plus as much more as it can get away with.”

I made some of these points in my VAT video.

P.S. Here are three very good cartoons on the VAT (here, here, and here).