As illustrated by the changes in my state tax rankings between 2018 and 2023, there’s been a lot of progress.

Several red states have shifted to flat taxes and lowered tax rates, putting the class-warfare blue states at an even bigger disadvantage (and some of those left-leaning states actually want to make their tax regimes even less competitive!).

While I cheer the shift to better tax policy, I’ve been disappointed that no state in recent years (or recent decades) has made the ultimate leap and joined the no-income-tax club.

That may be about to change.

State lawmakers in Mississippi have passed a law designed to phase out the income tax over 15 years.

Alex Rosado of Reason has some of the details.

Mississippi has joined a small club of nine other states in passing legislation eliminating the state income tax—an outcome that will benefit Mississippians and hopefully encourage other states to follow suit. …The new legislation will gradually lower Mississippi’s state income tax, currently sitting at 4.4 percent, to 3 percent by 2030. Further annual cuts depend on “growth triggers” linked to state revenue. …States with low-income taxes enjoy greater economic prosperity. Just compare Texas, which has no personal income tax, and Oklahoma, which has a top rate of 4.75 percent. Last month, the Tax Foundation found that Texas’ economy grew roughly 35 percent faster than Oklahoma’s over the last two decades, with Texas’ personal incomes and gross state product being notably higher too. A 2008 longitudinal study that analyzed economic growth in the States from 1964 to 2004 found that states with higher income taxes stifled economic growth, entrepreneurialism, and access to capital.

Douglas Carswell of the Mississippi Center for Public Policy played an important role in the reform.

In a column for the Foundation for Economic Education, he writes about this important development.

Mississippi has made history as the latest state (and the first since Alaska in 1980) to pass legislation banning a state income tax. …Beginning next year, Mississippi’s income tax rate will drop in 0.25% increments, sliding from 4% to 3% by 2030. After that, further reductions will hinge on the state’s budget surplus. Given Mississippi’s recent track record of substantial surpluses, the income tax could vanish entirely by the mid-2030s. …The push to eliminate the income tax has been a cornerstone of Governor Reeves’s agenda, with serious legislative efforts kicking off in 2022 under then-House Speaker Philip Gunn. Gunn’s genius was to simplify the state’s variable tax rates into a flat 4% on income above $10,000. While this didn’t eliminate the tax outright, it leveled the playing field for Mississippi households, setting the stage for broader support of full elimination. …this is great news for our state. Already there is evidence that in 2024, by some measures, Mississippi performed well economically, and may have been one of the fastest growing states in America that year. This tax reform will only add to this Mississippi momentum.

Let’s also look at some excerpts from an editorial in the Wall Street Journal.

Gov. Tate Reeves signed a bill last month that puts Mississippi on a path to zero income tax, albeit in about 14 years. Yet the messaging is right, as the state tries to lure business investment. Mississippi is sandwiched between two economic powerhouses, Texas and Florida, which don’t tax their residents’ incomes. Neither does Tennessee next door. …a law passed in 2022 is already set to cut that next year to 4%. But under the bill Mr. Reeves signed, the plan is to keep going to 3% by 2030. Reductions after that, until the tax is phased out, are conditioned on hitting revenue triggers. …The important point is that the path to zero is now enshrined in law, which is a big deal that workers and employers won’t fail to notice. The economic success of the eight states that don’t tax personal income has created a race in GOP-run states to join them, or at least to cut rates and get as close as politically possible.

Last but not least, Russ Latino’s column in National Review celebrates the abolition of the income tax and other good reforms.

Under the Build Up Mississippi Act, the Magnolia State will become the tenth state to operate without a tax on work. Only one other state, Alaska, has ever eliminated an income tax once in effect. The particulars aren’t all that sexy. The state’s flat income tax will phase down to 3 percent by 2030, marking an annual cut of some $647 million by conclusion of the phase-in. From there, revenue growth triggers will be used to pare the rate down to zero. …Since the passage of Bryant’s education reforms in 2013, Mississippi leads the nation in both math and reading gains on the National Assessment of Education Progress tests. Once last, Mississippi’s fourth graders now rank ninth in reading and 16th in math. …When you start behind, there’s a lot of room for improvement. That certainly remains true here. Getting off the bottom requires taking risks that require intestinal fortitude. But conservative ideas are working, and Mississippi has momentum.

By the way, all of the above articles note that the bill contains a typo that actually makes it easy to meet the aforementioned revenue triggers.

I’ll close, however, by focusing on an issue that is far more important.

I like that the Magnolia State has a goal of eliminating the income tax. Such a reform would be great for jobs and growth.

But what will really determine success is not a typo in the bill, but rather a commitment to long-run spending restraint.

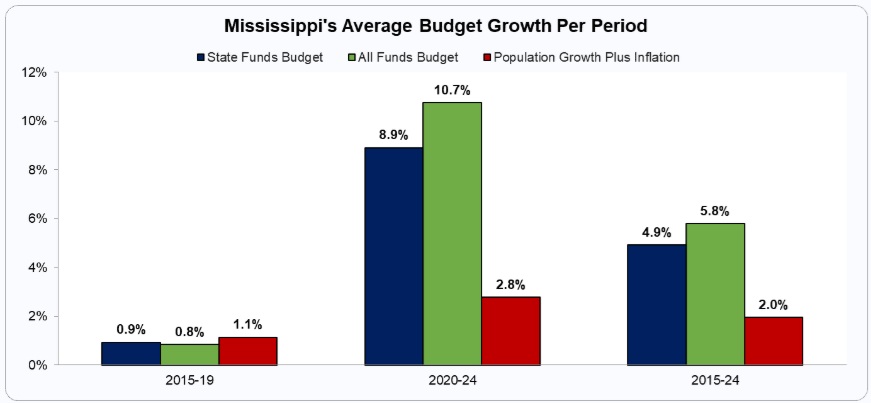

Here is a look at the state’s performance in recent years. As you can see, the fiscal constraint last decade evaporated this decade.

Looks like Mississippi needs a Colorado-style spending cap. Given TABOR’s strong track record, that would be the best way of making sure future politicians don’t mess things up.

P.S. Louisiana also is looking at how to abolish its income tax (once again, a TABOR-style spending cap is key).