Let’s take another look at America’s extravagant welfare system.

- In Part I of this series, I shared a map showing which states provided the biggest TANF handouts (just one of many welfare programs).

- In Part II of this series, I shared a comparison of total welfare benefits in each state compared to the median salary in each of those states.

- In Part III of this series, I shared data on state per-capita welfare spending, which ranked states based on generosity of benefits and share of the population trapped in dependency.

The message from all three columns is that Thomas Sowell is right. The welfare state traps people in poverty by reducing incentives for living a productive life.

You get subsidized for doing nothing and you get taxed for working. Which leads to predictable results.

For today’s column, let’s look at a new study for the American Institute for Economic Research by Thomas Savidge.

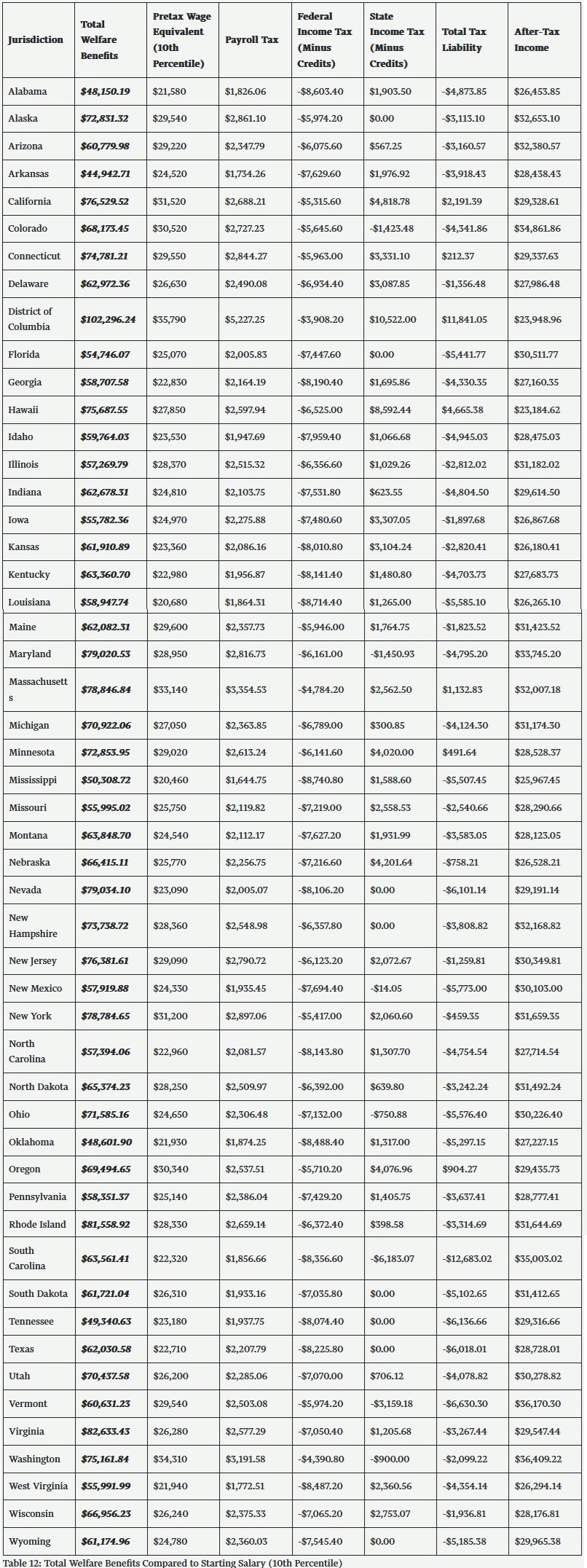

Here’s a very depressing table from his report. It shows total welfare benefits exceed a starting wage in every single state.

That’s the terrible news.

Now let’s share the news that is merely bad rather than terrible.

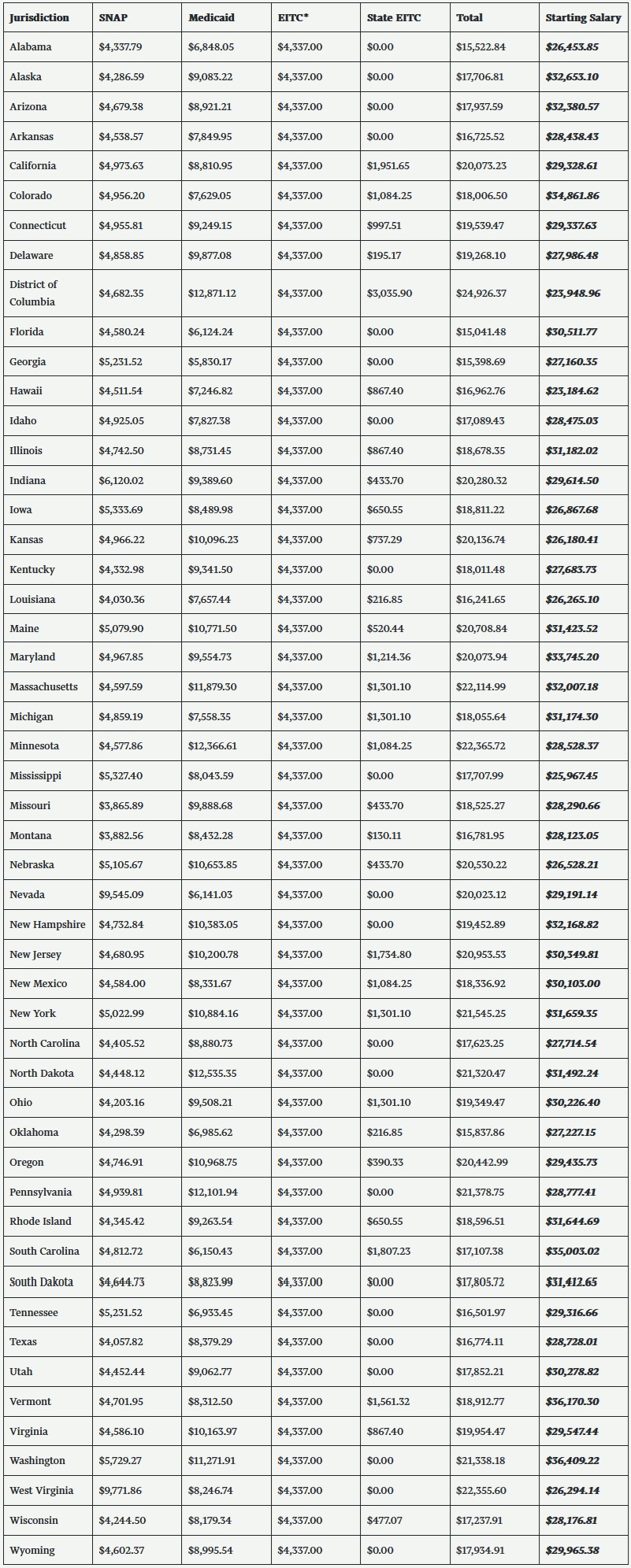

Savidge then compared the generosity of the most commonly used redistribution programs (Medicaid, food stamps, and EIC) with the starting wage in each state.

Even with that restriction, those three handouts are more than 50 percent of the starting salary in every state other than Florida and South Carolina (and more than the starting salary in DC!).

Here are some excerpts from Savidge’s study.

This paper will examine eleven welfare programs and the total monetary value of benefits provided to a hypothetical family with a single parent and two dependent children in all 50 states and the District of Columbia. …These papers examined several combinations of welfare programs and compared these programs to minimum wage as well as a starting salary. This comparison provided a clear picture of the incentives Americans face when choosing to work or receive welfare. …the US Census Bureau found that 99.1 million people (30 percent of the US population) participated in at least one welfare program… As a caveat, while it is likely for a recipient to be enrolled in multiple welfare benefits programs, it is unlikely for a recipient to be enrolled in all programs… While welfare provides short-term relief to recipients, the generosity of these benefits punishes work by incentivizing recipients to remain on welfare for as long as possible. …Excessively generous welfare programs are likely to reduce work efforts, especially when welfare benefits compare favorably to the post-tax median wage. The way forward is a combined effort of welfare, tax, and regulatory reform to help Americans escape welfare traps and find gainful employment, which is the true path out of poverty.

I’ll close by reiterating that the solution to this mess is to get Washington out of the business of income redistribution.

That already happened to a limited extent with Bill Clinton’s welfare reform.

The recipe is simple: Take the existing amount of money that the federal government is spending on the 100-plus different anti-poverty programs that currently exist, turn it into a block grant, and send that money to the states.

But the part most people miss is that the block grant should then gradually be reduced and ultimately eliminated. States should have full control – and full responsibility – for designing and funding their income redistribution programs.

We’ll then have a much greater opportunity of seeing what works and what doesn’t work.

P.S. I shared research in 2015 about relative welfare benefits in Europe and I subsequently wrote a three-part series (here, here, and here) about the damage to European economies.

P.P.S. This cartoon strip probably does a better job of teaching about incentives to supply labor than the average college course.