California’s top fiscal problem is an ever-growing burden of government spending. In case anyone thinks that is just empty rhetoric, the state budget over the past three decades has risen at twice the rate of inflation.

One consequences of ever-expanding government is that California arguably has terrible tax policy.

- California is #48 for fiscal freedom according to Freedom in the 50 States.

- California is #48 according to the State Tax Business Climate Index.

A main reason for the low scores is that spiteful state lawmakers have turned the income tax into a vehicle for class warfare.

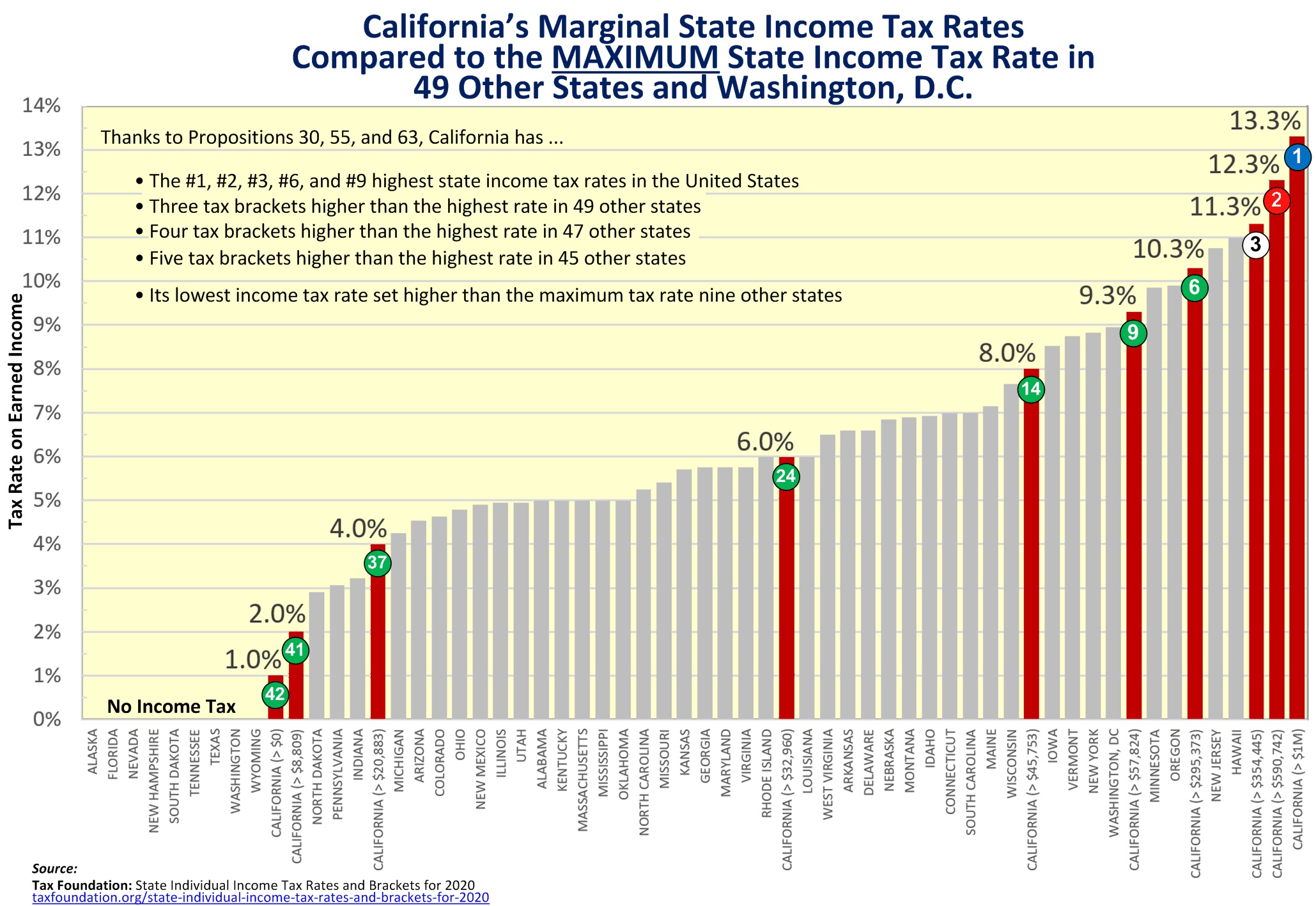

Here’s a chart shared by Grover Norquist showing that not only does California have the highest tax rate among the states, but it actually has the nation’s three-highest tax rates.

To make a bad situation worse, the not-so-Golden State also has the country’s 6th-highest corporate tax rate, so both individuals and businesses in California are mistreated.

But just like a mistreated dog might run away from home, the same is true for taxpayers. Notwithstanding the state’s major advantages (climate, recreation, topography, etc), it is losing residents at a startling rate.

Including some major taxpayers (and some of the ones that stay have figured out how to dramatically slash their tax bills).

And it’s also losing businesses. Here are some excerpts from a 2022 editorial in the Wall Street Journal.

The report by Hoover senior fellow Lee Ohanian and Spectrum Location Solutions President Joseph Vranich finds that 352 companies moved their headquarters from California between 2018 and 2021. Twice as many businesses left last year (153) than in 2020 and 2019 and three times as many as in 2018. The top destinations: Texas (132), Tennessee (31), Nevada (25), Florida (24) and Arizona (21). What do they have in common? Low taxes… California’s high top marginal income-tax rate (13.3%) punishes small pass-through businesses that pay income taxes at the individual rate as well as managers in C-suites.

The following year, Eric Boehm of Reason added even more evidence.

For decades, California has been a desirable destination for Americans… That dream is over for an estimated 343,000 Californians who fled the state between July 2021 and July 2022… Those heading out of state tend to be wealthier residents, and their exit threatens to blow a hole in the state’s finances. California lost about $343 million in tax revenue during 2021 due to out-migration… Combine that with the fact that more jobs can be done from anywhere, and Americans on average are wealthier than ever. As a result, more people have the means and incentive to actively choose where to live, work, and pay taxes. States must adjust to this new reality. Otherwise, they will discover, as California is, that punishing prosperity comes at a cost.

This trend continued in 2024 and I’m sure it will continue in 2025. And Beyond.

Which raises the interesting question: When will there so many people riding in the wagon that there no longer will be enough people to pull the wagon?

P.S. California’s policies are so terrible that it’s the only state to have generated multiple humor columns (see here, here, here, here, here, and here).