Because it has universal application, the recipe for growth and prosperity is like a Swiss Army knife.

- It is the best approach for rich nations.

- It is the best approach for poor nations.

- It’s also the best approach for war-damaged nations.

The last bullet point is relevant for today’s discussion, which will focus on creating prosperity for Syria.

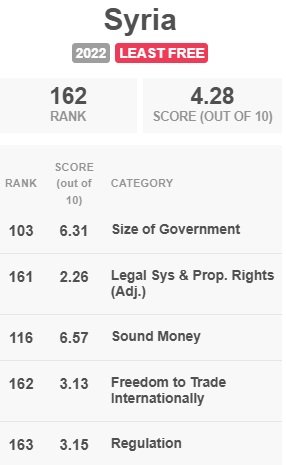

The first thing to understand is that the former dictator, Bashar al-Assad, had horrible economic policy. According to the most-recent edition of Economic Freedom of the World, Syria was #162 out of 165 nations.

That’s worse that every country in the world other than the basket cases of Sudan, Zimbabwe, and Venezuela.

As you can see, Syria has bad grades for fiscal policy and monetary policy and horrible bottom-of-the-barrel grades for trade, regulation, and quality of governance.

Syria’s low ranking is not just a function of war-related turmoil. Even during its “best” year for economic liberty, which was 2011, it ranked #135, which was still in the bottom quartile.

But now that Assad has been overthrown, maybe things will improve.

Here are some excerpts from a report in the Washington Post by Louisa Loveluck and Zakaria Zakaria.

Thirteen years of civil war have left Syria’s economy in ruins. …large parts of the capital go dark when the sun sets. …The country’s interimpresident, Ahmed al-Sharaa…faces a daunting task…the government’s coffers are bare. Economic progress requires support from the outside world… Syria’s economy contracted by 85 percent during the civil war, according to the World Bank. More than 80 percent of Syrians now live in poverty. Before the war, the Syrian pound traded at 47 to the dollar. On the eve of the regime’s collapse, the rate was 14,000. …The government’s short-term strategy is simply survival… More challenging for Sharaa and his interim government will be how to address a bloated public sector. Under Assad, mismanagement and corruption produced payrolls padded with overstaffing and even “ghost employees,” who took salaries but did not work.

Those passages help show the current state of Syria’s economy.

Now let’s look at what’s being done.

Unfortunately, the first thing mentioned in the article is a pay raise for bureaucrats.

In early January, the new finance minister, Mohammed Abazeed, said the government would increase salaries for many public-sector employees by up to 400 percent.

Because of massive inflation, it might be that some bureaucrats should get a pay raise. But the article says nothing about reducing a “bloated public sector,” including all the no-show jobs.

So that’s some evidence that the new government is going in the wrong direction.

But there was one passage that I interpret as good news. It’s now legal to use foreign currencies.

…the ban on foreign currency has been lifted…, prompting U.S. dollars to flood the market.

What should be done, of course, is to fully dollarize, like Panama, El Salvador, and Ecuador (and perhaps Argentina). Or they can adopt the euro, like Montenegro.

All that matters is getting rid of their own central bank since history has shown that Syrian politicians will use the printing press to fund excessive spending.

Amazingly, bureaucrat pay hikes and foreign currency legalization are the only two policies listed in the entire article.

It goes without saying that Syria needs bold and aggressive reform.

I’m tempted to say it should copy the decent economic policies of its neighbor, Israel.

But I’m sure that’s a non-starter, so instead I’ll give the same advice that I gave about Ukraine back in 2022. Syrian officials should look around the world and then copy the most laissez-faire policies that are in place in other nations.

Sadly, I don’t expect that to happen. Unless, of course, the new dictator magically becomes the Arab version of Javier Milei.