Within the first minute of my recent video on trade and protectionism, I remarked that ”Trump simply does not understand trade.”

Today, I want to give another example of why “Tariff Man” has the wrong approach.

He just announced that he will be imposing a 25 percent tax on American manufacturers who buy foreign steel and aluminum.

Trump did the same thing in his first term, so this is – as Yogi Berra said, – “deja vu all over again.”

Let’s look at some research that measured whether those tax increases in his first term were successful.

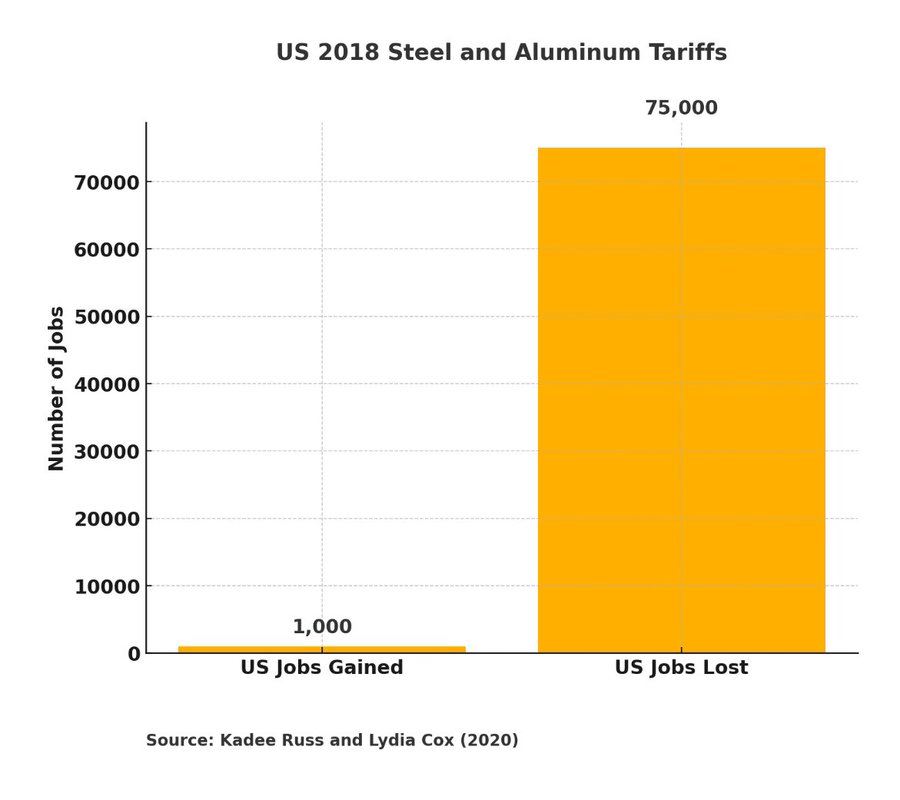

For the 1,000 people who were estimated to have gained jobs in the protected industries, the answer might be yes. But, as shown by the chart, there were an estimated 75,000 workers who would say no.

The reason for the net loss of 74,000 jobs is that there are far more jobs in the metal-using sectors than there are in the metal-making sectors.

Consider the case of steel. Here are some excerpts from a news story about Trump’s first-term mistake.

There are more than 12 million jobs in industries that use steel in their production process. Almost 2 million of these jobs are in industries that use steel intensively, where “intensively” means that steel inputs represent 5 percent or more of the industry’s total (input) requirements. This criterion includes both the industry’s direct use of steel and its indirect use through inputs made of steel, like machinery and equipment. Steel-intensive U.S. industries include manufacturers of auto parts and motorcycles; household appliances; farm machinery; machinery used in mining, oil extraction, and construction; batteries; and military vehicles. …Estimates from a study…by Aaron Flaaen and Justin Pierce at the Federal Reserve Board of Governors show that by mid-2019, increased input costs due to the steel and aluminum tariffs are associated with 0.6 percent fewer jobs in the manufacturing sector than would have been the case without the tariffs. …this amounts to about 75,000 fewer jobs in manufacturing attributable to the March 2018 tariffs on steel and aluminum, not counting additional losses among U.S. exporters facing tariffs other countries levied in retaliation.

There are fewer than 100,000 Americans in the steel-producing sector, so Trump is using the coercive power of government to help them, but simultaneously hurting the much larger group of workers in the steel-using sectors.

So why would Trump repeat this mistake?

Frederic Bastiat has part of the answer, and Alex Tabarrok has the rest of the answer.

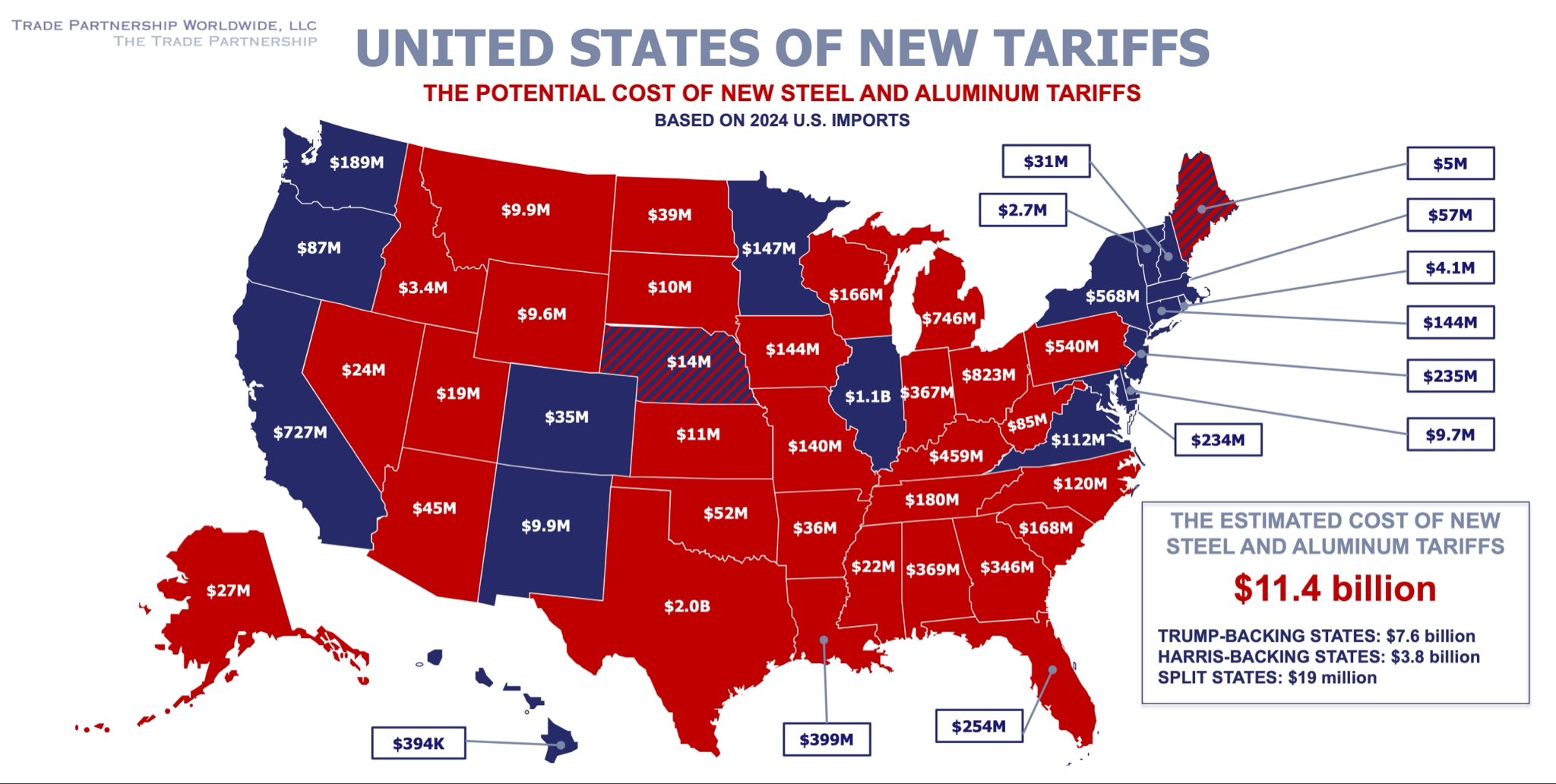

P.S. Interestingly, the economic damage from the new taxes on steel and aluminum will be twice as large for states that supported Trump in 2024 compared to states that supported Kamala Harris.

I don’t care about the politics, so I’ll make a final point about the damage caused by protectionism.

The $11.4 billion cost of Trump’s tax increase means that Americans will have $11.4 billion less to use in other parts of the economy. In other words, it’s not just the metal-using sectors that are hurt. There are negative ripple effects throughout the economy.

P.P.S. We saw similar damage when Trump imposed tax increases on foreign-produced dishwashers during his first term.

P.P.P.S. And don’t forget the damage caused when other countries retaliate.

———

Image credit: Steve Jurvetson | CC BY 2.0.