My recent book explains that we are stumbling our way to a fiscal crisis.

If there’s any hope of avoiding a disaster, it will probably happen when and if good members of Congress (a vanishing breed) refuse to allow an increase in the debt limit without attaching some much-needed spending restraint.

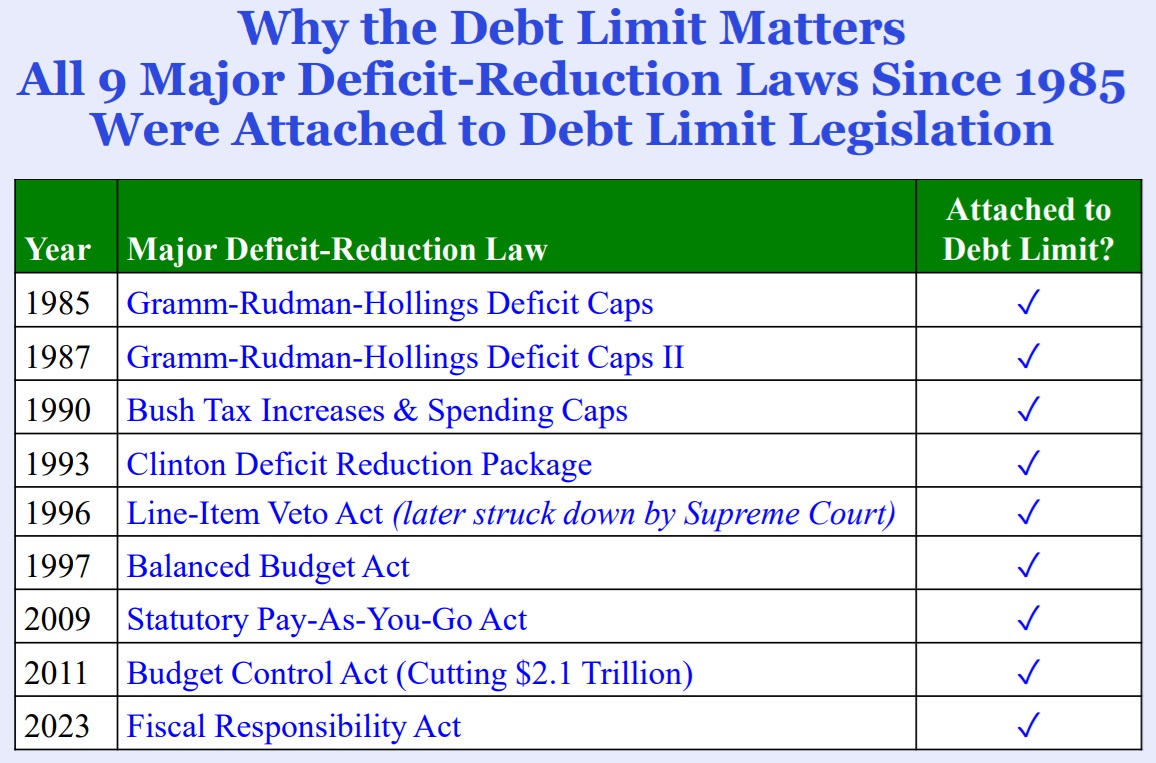

It doesn’t need to happen that way, but this table from Brian Riedl’s chartbook shows that the only attempts to deal with America’s fiscal problems in the past 40 years have relied on the debt limit.

By the way, not all of the laws on Brian’s list were good.

In some cases, such as the 1990 Bush tax increase and 1993 Clinton tax increase, they made fiscal policy worse rather than better.

But at least lawmakers were forced to do something instead of simply kicking the can down the road.

The campaign to get rid of the debt limit has created unusual alliances. Trump doesn’t like it, but neither does Peter Orszag, who was in charge of the budget under Obama. He has a column in the Washington Post on this topic.

Here are some excerpts.

The United States is weaker, not stronger, because of the debt limit. …Now that President-elect Donald Trump is calling to get rid of it, lawmakers should take advantage of the opportunity… Imagine there is a test you take every so often in which you roll three dice, and if you get all ones, something terrible happens. Otherwise, nothing happens. In almost all instances (215 out of the 216 possible scenarios), all three dice will not come up ones. But you’ll understandably worry about the extreme case. …This, in a nutshell, is what the U.S. debt limit has become. …the debt ceiling imposes no discipline on our fiscal policy. It only creates risks. …Defaulting…could erode trust in the dollar, the world’s reserve currency, and damage the global economy and financial markets.

For what it’s worth, I agree with some of his analysis.

It would not be good to bump into the debt limit. Yes, it would be possible to “prioritize” spending at that point, but it would be a mess. An unprecedented mess.

In an ideal world, we would not be rolling the three dice in Orszag’s example.

Now for some disagreement. Orszag does not seem to appreciate that we’ve already rolled three ones. Based on current projections, the United States is going to suffer a Greek-style fiscal crisis.

We don’t know whether it will have in five years or 25 years, but it’s inevitable in the absence of desperately needed entitlement reform.

The bottom line is that there is a small risk of something bad happening when politicians fight over the debt limit, but there’s a guaranteed disaster if we let politicians keep kicking the can down the road.

I’ll close with an analogy. If you’re a drug addict, you may suffer severe withdrawal symptoms if you stop using. That would not be fun, I’m sure. But if you keep using hard drugs, you almost surely will have a terrible life and die early. Given those two options, I know which one I would prefer.

P.S. I have disagreed in the past with Orszag’s views on value-added taxes and the Congressional Budget Office.

P.P.S. Since Trump and Democrats are agreeing about the debt limit, this is a good time to remind people that bipartisanship often is a bad thing.