When I give speeches and presentations about fiscal policy, I explain that a sensible tax system should be based on these principles.

- Low marginal tax rates on productive behavior.

- No double taxation of saving and investment.

- No corrupt and distorting tax preferences.

- No taxation outside national borders.

But I confess that I normally don’t spend any time on the final bullet point (though, as shown below, at least I include it when presenting slides). We’re going to remedy that oversight today and highlight this oft-overlooked feature of a logical tax system.

Let’s start with some background information. Americans who live and work abroad obviously are subject to taxes where they reside.

But they are then forced to also pay taxes to the IRS on that already-taxed income because of America’s system of “worldwide taxation.”

Fortunately, they do get a credit for some of the taxes they pay to foreign governments. And there’s also a “Section 911” exclusion that allows them to avoid double taxation on income below a certain level.

But the overall effect is a system that – at best – is a compliance nightmare. And in many cases, it means overseas Americans are being taxed by two governments on the same income.

The reason we’re exploring this issue today is that Donald Trump recently said he wants to help overseas Americans by addressing this problem. Here are some excerpts from a report by Richard Rubin and Alex Leary in the Wall Street Journal.

Republican presidential nominee Donald Trump said he supports lowering taxes on U.S. citizens who live abroad… The U.S. has an unusual system for taxing its citizens on their total income regardless of where they earned it and where they live, making America alone among major countries with such a rule. …Essentially, an American living in Paris would have tax obligations to both France and the U.S., though the U.S. tax code already contains features meant to mitigate double taxation. A French citizen residing in New York typically wouldn’t owe France any taxes on U.S. income. …Roughly 4.4 million U.S. citizens lived abroad in 2022… Some 2.8 million of those were 18 years or older and eligible to vote in their former states… The Trump campaign is hoping the proposal will appeal to many of those voters.

I’ll be the first to admit that Trump almost certainly is engaged in election-year pandering.

But unlike some of his other vote-buying initiatives (such as no taxes on tips or overtime), his proposal to get rid of worldwide taxation is very good policy.

The flat tax, for instance, gets rid of worldwide taxation and replaces it with territorial taxation.

And many experts have written in favor of making this shift. Here are some excerpts from a recent column by Kristian Fors for the Independent Institute.

The American tax-net extends far beyond the country’s borders and applies to Americans who are living abroad, even those who have not been in the United States for decades. The United States is one of only two countries in the entire world with a global taxation policy, the other being the East African country, Eritrea. Most countries operate on a residency-based taxation system, meaning that people owe taxes to the country where they physically reside. …For many Americans living abroad, this means that their American citizenship is more of a liability than an asset. According to Forbes, from 2005 to 2009, less than 2,500 Americans gave up their citizenship, whereas from 2010 to 2020, the number was a staggering 36,840. …Even former British Prime Minister Boris Johnson gave up his US citizenship in 2016, stating that it was outrageous to tax American citizens “everywhere, no matter what.” A 2024 survey by Greenback Expat Tax Services reveals that nearly 1 in 3 American expats plan to renounce their US citizenship.

Michael Rubin of the American Enterprise Institute wrote about this issue a few years ago, hoping that President Biden might be good on the issue.

Biden fancies himself as a globalist, but he now presides over a country whose taxation system punishes people who embrace the globalized economy. While most countries tax income earned in that country, the United States taxes income based on the citizenship of those earning money, regardless of whether or not they live in the U.S. …Not only is citizenship-based taxation unfair, subjecting Americans abroad to double taxation, …it also exposes expatriate Americans to onerous regulations. …The frustrating thing for almost every person caught in the expatriate tax mess is that few people, if anyone, defend the current system. …It is not just an issue of fairness and revenue. …It is time to stop punishing Americans abroad. There literally is nothing to lose and everything to gain by switching to residency-based taxation.

Needless to say, Biden was not good on that issue.

Now let’s travel back in time to 2018, when Kurt Couchman addressed the problem for National Review.

Americans who live and work around the world face crushing burdens from U.S. tax laws. …The December 2017 Tax Cuts and Jobs Act replaced an anti-competitive global system with pro-growth territorial taxation for businesses. Companies now pay income taxes where they produce, not where they’re based. This smart move leveled the playing field between U.S.-headquartered firms and their foreign competitors. Individual Americans should also pay taxes based on residence, rather than citizenship. …This is easy to fix. …Even if more Americans were to seek their livelihoods abroad, the increased economic activity would more than offset any lost revenue. …Of course, the main idea is to remove foolish barriers to flourishing, not to fixate on filling government coffers. …Adopting territorial taxation for individual Americans is good policy.

Last but not least, we have another column from 2018.

Writing for the Foundation for Economic Education, Ross Marchand explained why territorial taxation is the way to go. Here are some excerpts.

Under American law, citizens working abroad must report their income to the Internal Revenue Service (IRS) and pay their “fair share” to Uncle Sam in addition to host country government levies. This global assertion of US taxation power puts America in league with Eritrea as one of the only countries to subject citizens to taxation regardless of location. Moving back to the system of territorial taxation for individuals would be fair and would stem the flow of American citizens renouncing their citizenships. …the US system of global individual taxation creates undue burdens for individuals seeking to make a living abroad. …Tax compliance rules drive more than 5,000 Americans each year to renounce their citizenship, a figure that usually increases each year. …By nixing an absurd and cumbersome system, policymakers can restore fairness and decency for citizens everywhere.

There are many other articles I could cite, but I’ll simply close with something for wonky readers.

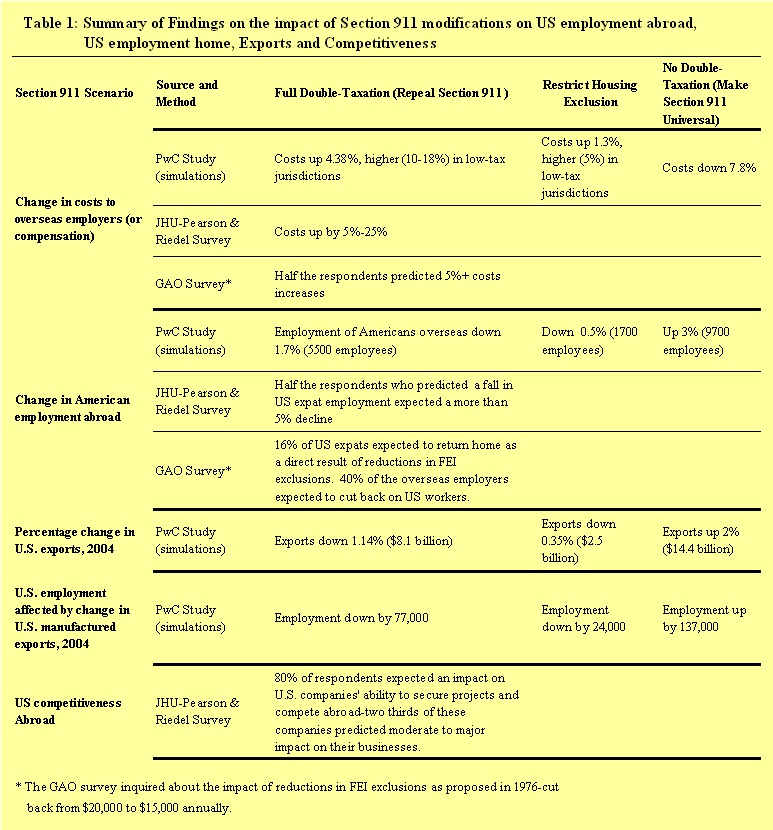

Back in 2006, the Center for Freedom and Prosperity did a report on America’s unfair system of worldwide taxation and included this table looking at some of the research that existed at the time.

The bottom line is that worldwide taxation is a bad idea. Trump’s 2017 tax bill sort of fixed the problem of worldwide taxation for businesses.

If he wins, let’s hope he is serious about getting rid of worldwide taxation for individuals.