In Part I of this series, I groused that Donald Trump and Kamala Harris are both very irresponsible about Social Security. Instead of proposing good reforms (or even bad reforms!), they want to kick the can down the road and pretend the problem doesn’t exist.

Even though that will create an even bigger crisis in the future.

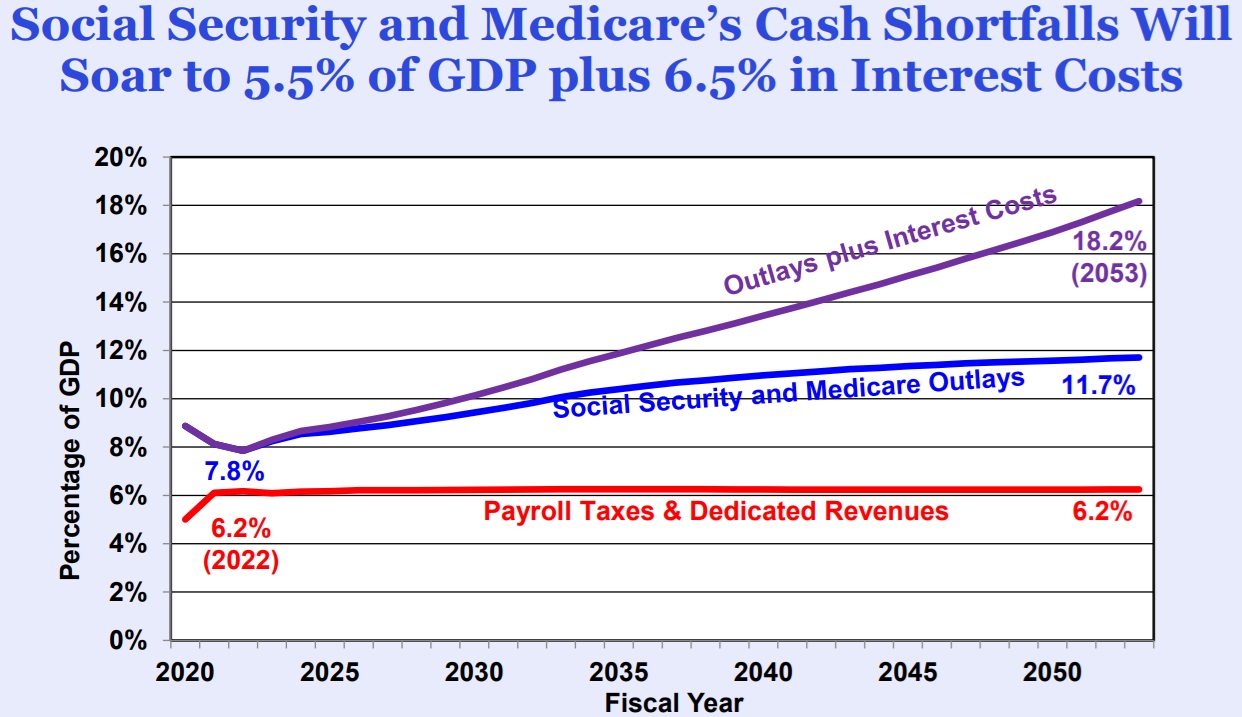

Today, let’s broaden the discussion by also considering Medicare. And we’ll start with these grim numbers from Brian Riedl’s Chart Book.

The obvious takeaway from this chart is that 100 percent of the problem is on the spending side of the budget.

Revenues going into the programs are stable, but spending burdens are soaring.

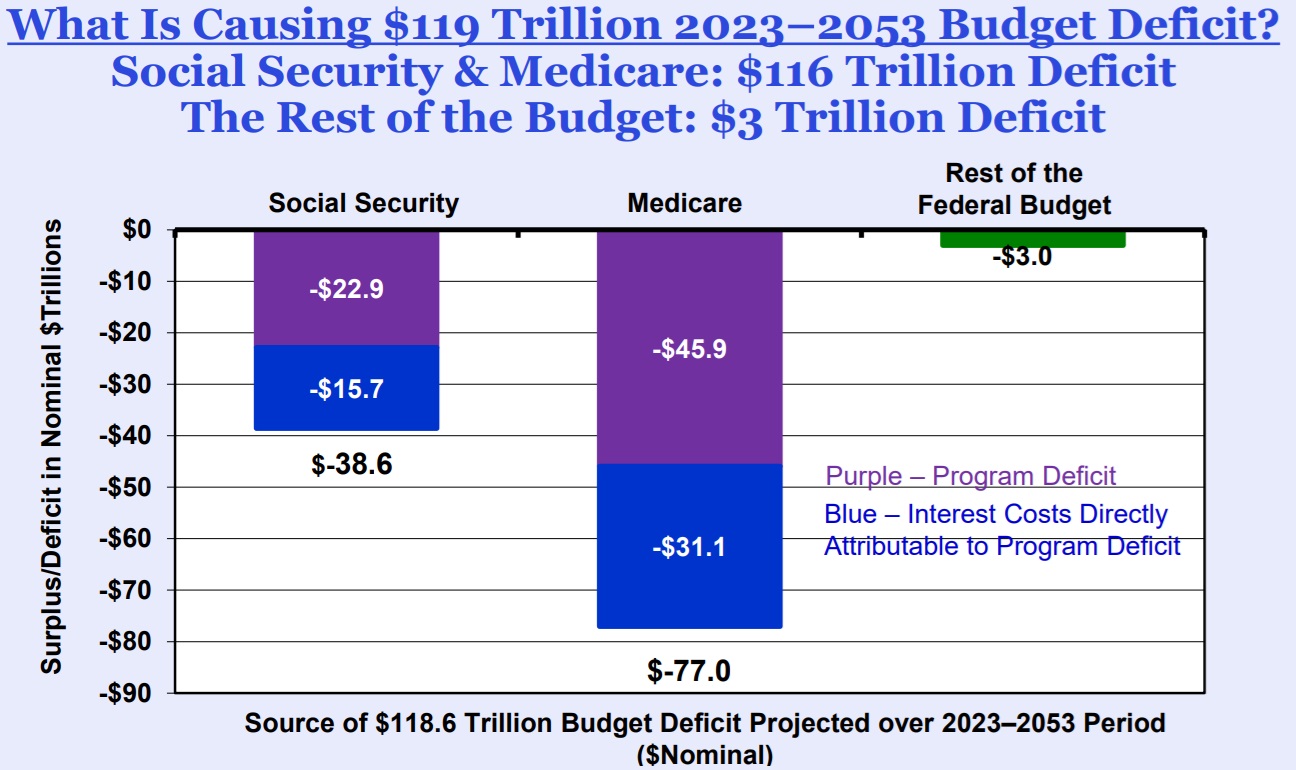

And here’s another one of Brian’s charts. This one shows that nearly 100 percent of America’s long-run fiscal problem is just Social Security and Medicare.

As far as Trump and Harris are concerned, this is just fine.

To the extent they want to make change, they want to dig the hole deeper.

Fortunately, not every person in politics is equally short-sighted. Former Vice President Mike Pence’s group, Advancing American Freedom, has just released a report that correctly argues that we need to control entitlement spending.

After decades of ignoring the significance of profligate federal spending, the consequences are finally starting to catch up to us. As has been the case, the problem is not a lack of revenue, but rather a lack of willingness to make hard choices to rein in spending and have the courage to say ‘no’ to wasteful programs. Federal revenue has experienced strong growth…but spending continues to grow at a faster pace. A sustainable federal budget is impossible to achieve without addressing the root cause of our spiraling debt and deficit: unchecked spending. America faces a bleak future as…our economy stagnates under the drag of an unsustainable burden… Those problems will only compound on themselves the longer we fail to address the drivers of our debt and cut spending… The vast majority of federal government spending is on autopilot. … there is no restriction on the unchecked growth of these programs. This funding category includes the biggest government programs like Medicare, Medicaid, Obamacare, Social Security, Supplemental Nutrition Assistance Program, Federal civilian retirement, and unemployment compensation.

For what it’s worth, I don’t think this report is perfect. For instance, it does not call for some of the reforms (such as block-granting Medicaid and modernizing Medicare to be a choice-based, premium-support system) that made the Ryan budgets so impressive.

And I also am troubled that the report identified some very bad tax loopholes, but failed to specify that any revenues gained by shutting down those special preferences should be used to lower tax rates and/or reduce double taxation.

But let’s not make the perfect the enemy of the good. It’s refreshing to have a politician, even just a former one, correctly identify the problem and actually propose some long-overdue spending restraint.