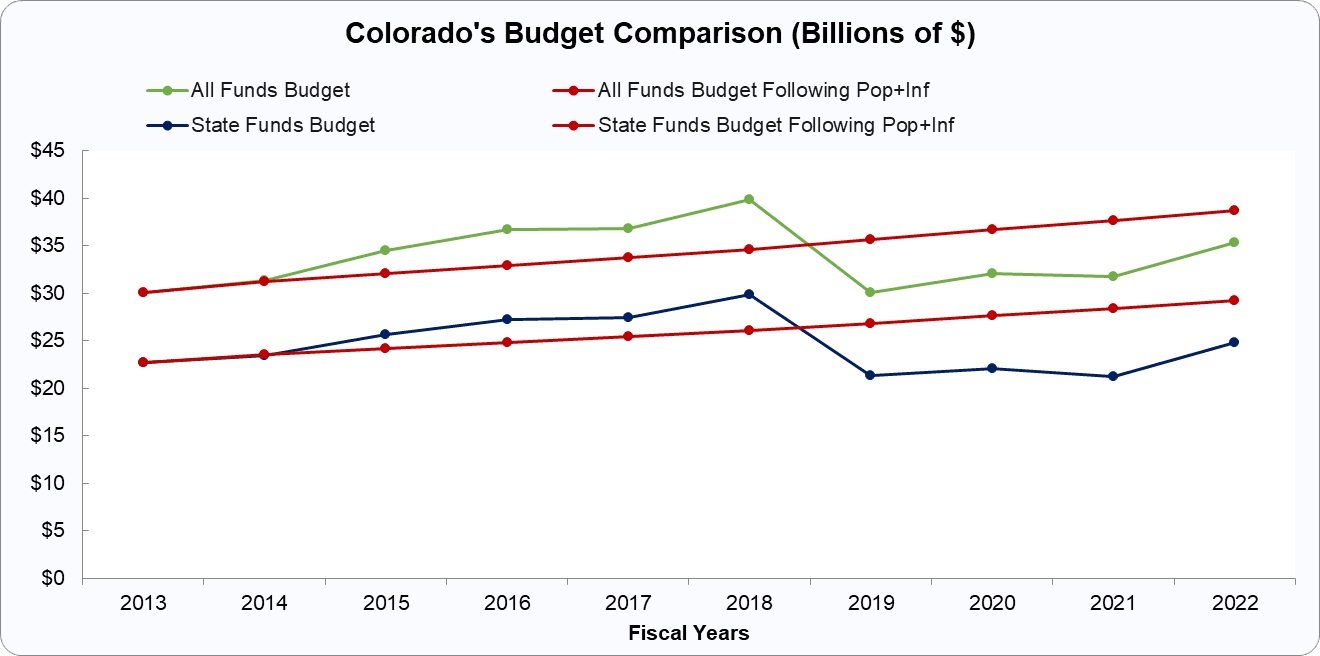

Colorado has the best fiscal rule in the United States. The Taxpayer Bill of Rights (TABOR) limits state government spending so that it cannot grow faster than inflation plus population.

Does Colorado’s spending cap work perfectly? Of course not.

Politicians in the Centennial State have spent decades coming up with ways evade and avoid TABOR’s restrictions.

But let’s not make the perfect the enemy of the good.

A study published last year shows that TABOR has saved taxpayers $8.2 billion.

And taxpayers in Colorado may soon keep even more of their money according to an article by Brian Eason in the Colorado Sun. Here are the relevant excerpts.

…the budget will be squeezed primarily by two seemingly minor factors. One, U.S. Census estimates now say the state’s population grew by less than the state’s demographer had anticipated. That means the state revenue cap under the Taxpayer’s Bill of Rights, which tracks inflation and population growth, can only increase by 5.8% this budget year rather than the 6.1% legislative forecasters were expecting. Two, the state is now expected to collect $185 million more in road usage fees and retail delivery charges this year than last, under the legislative staff estimates. Taken together, the two forecast changes mean state lawmakers could have to issue larger than expected TABOR refunds to Coloradans next year, leaving the state with fewer General Fund tax dollars to spend… That would translate to a nearly $400 refund for the average single-filer in 2025 under the current refund formula, which is tiered based on income.

I’m tempted to call this the feel-good story of 2024. Politicians get less money to waste and taxpayers get more of their money returned.

No wonder TABOR is the gold standard for good fiscal policy at the state level. And Switzerland shows that spending caps also are very effective at the national level.

By contrast, there is very little evidence that balanced-budget rules produce good results.

P.S. Perhaps the best evidence for TABOR is that the pro-spending lobbies in Colorado are always trying to trick voters into approving ballot initiatives that would allow more spending. But as we saw in 2013, 2019, and 2023, the voters of left-leaning Colorado keep voting to to maintain their spending cap.