I frequently call attention to the “anti-convergence club” because of the many real-world examples showing that nations with free markets and limited governments enjoy much better economic performance.

Here are just a few case studies.

All this seems like a strong argument for smaller government. And it is.

But all this data I’ve been sharing may understate the case for economic liberty.

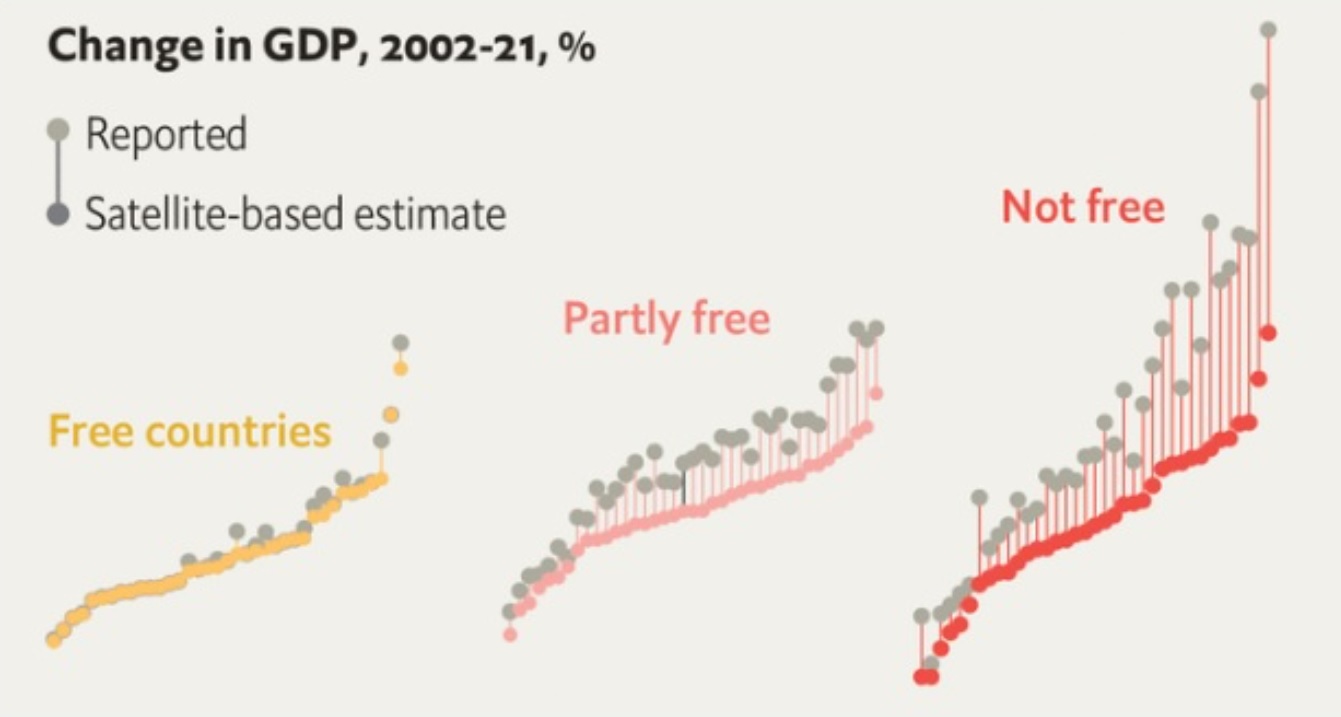

I wrote last October about how satellite-based measures of nighttime light (a proxy for economic vitality) show that nations with less political freedom have a tendency to exaggerate economic performance.

So what happens if we measure the relationship between economic liberty and economic performance using this more-accurate satellite-based data?

Sean P. Alvarez, Vincent Geloso, and Macy Scheck answered that question. Here are some excerpts from their new study.

…the well-documented proclivity of dictators to fudge GDP numbers biases our estimations of the effects of economic freedom on economic development. Since dictatorships are generally also countries with low economic freedom, overstated GDP numbers can fool us into finding more modest effects of economic freedom. To test our argument, we employed newly generated adjustments to GDP numbers based on artificial nighttime light intensity that corrected for the overstatements that dictators made… Swapping unadjusted and adjusted GDP numbers as dependent variables in similar econometric setups allowed us to estimate how large is the bias. For income levels between 1992 and 2013, we find that the true effect of economic freedom is between 1.1 and 1.33 times larger than estimations based on manipulated GDP numbers. For income growth, we find smaller effect for the economic freedom index as a whole but some signs that some components (size of government and the security of property rights) have underestimated positive effects that should not be neglected.

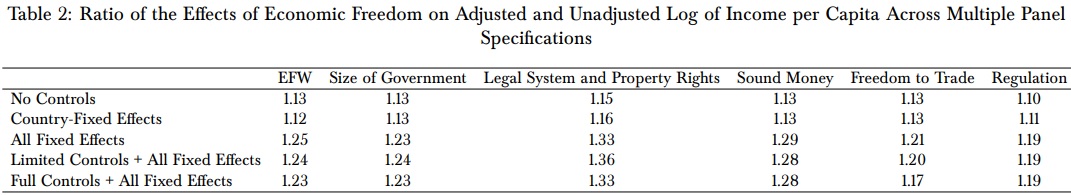

Wonky readers may be interested in the results contained in Table 2 from the study.

And here’s some of the text discussing those results.

…the use of adjusted GDP figures suggests that the effect of economic freedom (i.e., the aggregate index) is roughly 25% larger than estimated with unadjusted GDP figures. For the different components of the index, the use of adjusted GDP figures has an uneven effect. For example, regulation and freedom to trade suggest that the true effects are roughly 20% larger than when using the unadjusted GDP figures. In contrast, the true effects for the component that speaks to the protection of property rights are more than 33% stronger. These are economically significant results that speak to a large bias against finding a pro-development effect of economic freedom.

The bottom line is that economic liberty apparently matters even more than we thought – about 25% more.

So if you want to know why I’ve been so critical of Bush, Obama, Trump, and Biden, that’s part of the answer.

———

Image credit: germantown | Pixabay License.