Tax issues such as depreciation, net operating losses, worldwide taxation, and carry forwards probably set the record for inducing boredom, but I suspect most people also have little interest in a workforce issue known as “employment protection.”

But they should.

Job creation and wage levels can be adversely affected when politicians impose laws and regulations that sound nice, but have the unintended consequence of increasing the cost of employing people.

The good news is that this is an area where the United States gets a high score.

As shown in the chart, America is behind only Denmark in having a deregulated market for matters such as hiring, firing, and compensation.

Today, we’re going to examine some research about the impact of government intervention in labor markets.

Here are some excerpts from a new working paper for the European Central Bank, authored by Gerhard Rünstler, that looks at the impact of labor market deregulation in eurozone nations over the past 20-plus years.

This paper uses a narrative panel VAR to estimate the macro-economic effects of reforms in the euro area in between 1998 Q1 and 2018 Q4. …The narrative VAR finds that unemployment benefit reforms lead to a relatively quick increase in employment and a moderate decline in the real wage. In the medium term, the effect on employment remains, while real compensation reverts back to baseline. The responses to reforms of regular contract EPL are similar, but the response of employment builds up gradually and reaches its full scale only after about six years. …the effects of EPL reforms depend on the state of the business cycle: in states of low growth the response of real activity and employment is more delayed. Some of the reforms had sizeable medium-term effects. In particular, the German Hartz reforms and EPL reforms in Portugal after 2007 altogether raised GDP and employment by above 2% in these countries. Reforms in the Netherlands, Italy, and Spain had smaller but still significant effects.

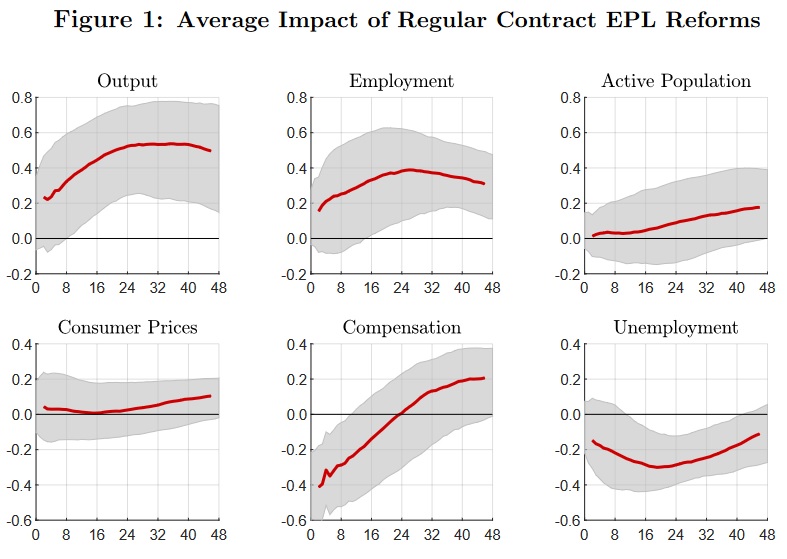

Here are some of the statistical estimates from the study, starting with a look at relaxing employment protection legislation.

Output and employment increase, which is good news, but the most important finding is an increase in long-run compensation.

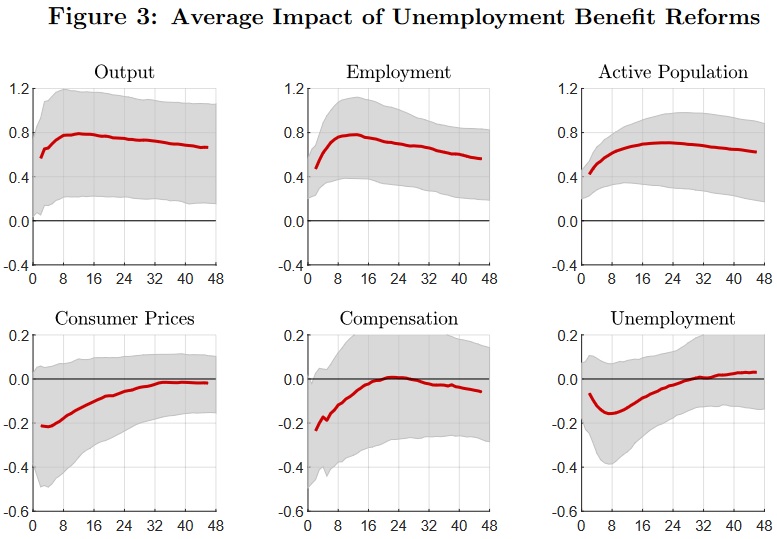

Here’s a look at what happens if the law is changed to reduce subsidies for joblessness.

Unsurprisingly, there’s more output and more employment (a lesson we’ve learned in the United States).

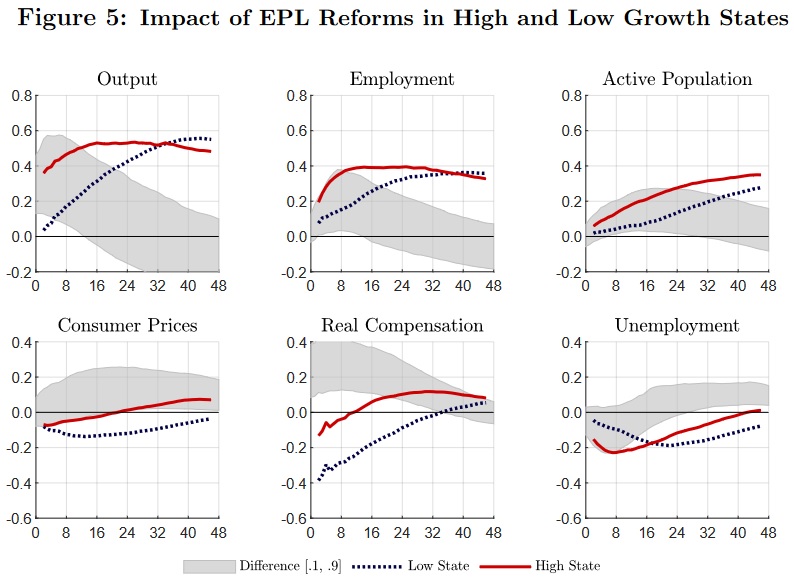

I’ll include one final graphic from the study.

Figure 5 shows that the benefits may be larger, or materialize more quickly, depending on the economy’s underlying health.

The bottom line is that it is always a good idea to reduce government intervention in labor markets. If you want more jobs and higher pay, deregulate when the economy is weak and deregulate when the economy is strong.

By the way, the European Central Bank is not the only international organization to reach this conclusion.

I also want to share some passages from last year’s Doing Business report from the World Bank.

…firms should…be free to conduct their business in the most efficient way possible. When labor regulation is too cumbersome for the private sector, economies experience higher unemployment—most pronounced among youth and female workers. …Flexible labor regulation provides workers with the opportunity to choose their jobs and working hours more freely, which in turn increases labor force participation. …For example, if France were to attain the same degree of labor market flexibility as the United States, its employment rate would rise by 1.6 percentage points, or 14% of the employment gap between the two countries. When Sweden increased labor market flexibility, by giving firms with fewer than 11 employees the freedom to exempt two workers from their priority list, labor productivity in small firms increased 2–3% more than it did at larger firms. …Many high- and upper-middle-income economies, including Denmark…and the United States, have flexible labor regulation. In other advanced economies, including Luxembourg, Slovenia, and Spain, strict labor rules make the process of hiring employees arduous. Research shows that strict employment protection legislation shapes firms’ incentives to enter and exit the economy, which in turn has implications for job creation and economic growth. …When faced with rigid employment protection laws, firms lose the freedom to conduct business efficiently. …A firm’s ability to adjust to shocks is adversely affected by rigid labor regulation. Moreover, firms invest less in new product creation in such an environment.

The moral of the story is that when politicians impose laws to “protect” workers, they’re actually making it less likely that businesses will hire workers.

P.S. This cartoon aptly captures what happens when well-intentioned people expand government (by the way, most politicians are not well-intentioned).

———

Image credit: National Cancer Institute | Public Domain.