It’s understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare state.

After all, it’s a very bad idea to copy the economic policies of nations such as Italy, France, and Greece (unless, of course, you want much lower living standards).

But let’s not forget that that the United States also has some big economic challenges that existed before President Biden ever took office.

Most notably the entitlement programs.

Medicaid and Medicare are the biggest problems, but let’s focus today on Social Security.

Richard Rahn has a column in the Washington Times that summarizes the program’s grim outlook. Here are some excerpts.

Politicians love to talk about the Social Security “trust fund” and assure us that it will not be raided. But the unfortunate fact is the “trust fund” is an accounting fiction without any real assets. In actuality, Social Security is a giant Ponzi scheme operated by the government. Benefits that are paid to existing retirees come from the current taxes from those working today and borrowing. …But now, Americans have fewer children, and life expectancies are growing rapidly. …There is no easy way out. Future Social Security benefits will be cut (probably by not fully indexing for inflation), and/or taxes will be greatly and continuously increased until the system collapses.

The fact that Social Security is a Ponzi scheme isn’t necessarily fatal. After all, the government has the ability to coerce new workers into the system.

The problem is that there are fewer and fewer of those new workers to support the growing number of people getting benefits.

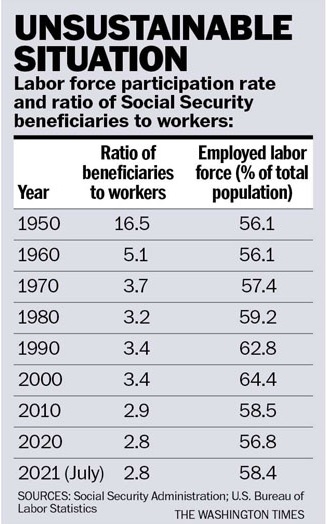

Here are the numbers from Richard’s column. As the old saying goes, read ’em and weep.

Richard ends his column by fretting that the United States is on a dangerous path.

The world has seen this play before. In 1906, Argentina on a per-capita income basis was one of the richest countries in the world, rivaling the United States. It has bountiful agricultural and mineral resources and had a relatively well-educated population of mainly European origin. But after a century of fascist/socialist/welfare-state governments, it is now a poor country. Venezuela went from a rich country with civil liberties to a poor oppressed country in only two decades. As Margaret Thatcher famously said, “the problem with socialism is that eventually, you run out of other peoples’ money.” The Greeks built a nice welfare state, largely using German taxpayers’ money – the Euro – until the Germans said, “no more.” As a result, the Greeks have seen a drop in real incomes of more than 30 percent in seven or so years.

The good news is that our economic policy won’t be nearly as bad as Argentina and Venezuela, even if some of Biden’s crazy ideas – such a massive per-child handouts – are enacted.

The bad news is that we could become a lot more like Greece.

And that’s where Margaret Thatcher’s famous warning could become an American reality.

There is a solution to this problem, by the way. It’s been implemented in a couple of dozen nations around the world.

Sadly, American politicians are more interested in making the problem worse (with predictable consequences).

———

Image credit: 401kcalculator.org | CC BY-SA 2.0.