On election day, most people focus on the big-ticket partisan battles, such as this year’s contest between Trump and Biden.

Let’s not forget, though, that there are sometimes very important referendum battles at the state (or even local) level.

- In 2019, I was very pleased when Colorado voters upheld their state’s TABOR spending cap.

- In 2018, I was quite disappointed when Arizona voters sided with teacher unions against school choice.

- In 2016, I was delighted by the landslide vote against single-payer health care in Colorado.

- In 2014, I was definitely happy that Tennessee voters barred any consideration of a state income tax.

- In 2012, I was dismayed – but not surprised – that California voters embraced class-warfare taxation.

- In 2010, I was ecstatic that voters in the state of Washington rejected an income tax.

This year, the most important referendum will be in Illinois, where hypocritical Governor J.B. Pritzker wants voters to approve an initiative to replace the state’s flat tax with a discriminatory progressive tax.

I’ve already explained that the flat tax is the only thing saving Illinois from going further and faster in the wrong direction. Let’s add some additional evidence, starting with excerpts from this editorial in the Wall Street Journal.

The last state to adopt a progressive income tax was Connecticut in 1996, and we know how that turned out. Now Democrats in Illinois want to follow Connecticut down the elevator shaft with a referendum replacing the state’s flat 4.95% income tax with progressive rates… Public unions have long wanted to enact a progressive tax

to pay for increased spending and pensions, and they think the political moment has finally arrived. Democratic Gov. J.B. Pritzker says a progressive tax will hit only the wealthy… Don’t believe it. There aren’t enough wealthy in the state to pay for his spending promises, so eventually Democrats will come after the middle class. …Illinois has no fiscal room to fail. Since 2015 Illinois’s GDP has grown a mere 1% annually, about half as fast as the U.S. and slower than Ohio (1.4%), Indiana (1.7%), Wisconsin (1.7%) and Michigan (2.1%). About 11% of Illinois residents have left since 2001, the second biggest state exodus after New York. Taxpayer flight has been accelerating as income and property taxes have risen. …A progressive tax would be a gift to Florida and Texas.

The head of the Illinois Chamber of Commerce, Todd Maisch, also worries that other states will benefit if voters make the wrong choice. Here are excerpts from his column in the Chicago Sun-Times.

The rest of the nation’s states are cheering on Illinois’ efforts to enact a progressive income tax. That’s because they know it will be one more self-inflicted blow to our state’s economy, certain to drive dollars, jobs and families into their waiting arms. …The reality is that this proposal is intended to do just one thing:

Make it easier to raise taxes on all Illinoisans. …the spenders in Springfield are coming for you too, sooner or later. Proponents of the progressive tax know something they don’t want to tell you. Taxing millionaires will in no way meet their appetite for state spending. There simply isn’t enough money at the higher income levels to satisfy their demands. Tax rates will go up and tax brackets will reach lower and lower incomes. …Other states already are benefiting from the outmigration of Illinoisans and their money. Illinois passing the progressive tax is exactly what they are hoping for.

Amen. We already have lots of evidence showing that taxpayers move from high-tax states to low-tax states. And Illinois already has been bleeding taxable income to other states, so it’s very likely that a progressive tax would dramatically worsen the state’s position.

Illinois voters can and should learn from what’s happened elsewhere.

For instance, Orphe Divounguy of the Illinois Policy Institute shares evidence from California about the adverse impact of class-warfare taxation.

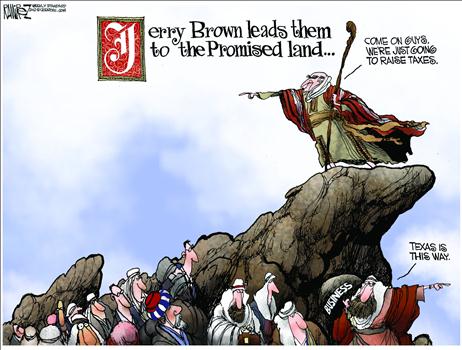

Illinois Gov. J.B. Pritzker finds himself in the same place as then-California Gov. Jerry Brown was in back in 2012 – trying to convince voters that a progressive state income tax hike will fix state finances in crisis. Brown claimed the burden of those tax hikes would only harm those earning $250,000 or more – the top 3% of earners.

That’s exactly what Pritzker promises with his “fair tax” proposal. Brown was wrong. …Here are the main findings of the new study… The negative economic effects of the tax hike wiped out nearly half of the expected additional tax revenue. Among top-bracket California taxpayers, outward migration and behavioral responses by stayers together eroded 45% of the additional tax revenues from the tax hike… The “temporary” income tax hike, which has now been extended through 2030, made it about 40% more likely wealthy residents would move out of California, primarily to states without income taxes.

Illinois voters also should learn from the painful experiences of taxpayers in Connecticut and New Jersey.

The Wall Street Journal editorialized this morning about their negative experiences.

Illinois is the nation’s leading fiscal basket case, with runaway pension liabilities and public-union control of Springfield. But it has had one saving grace: a flat-rate income tax that makes it harder for the political class to raise taxes. Now that last barrier to decline is in jeopardy on the November ballot.

…the pattern of other blue states is instructive. Democratic governors have often lowballed voters with modest rates when introducing a new tax, only to ratchet up the levels in each administration. …New Jersey first taxed individual income in 1976 amid a national revenue slump, with a top rate of 2.5%. …Democratic Gov. James Florio raised the tax to 7%… A decade later Democrats raised the top rate to 8.97%, and last year Gov. Murphy added the 10.75% rate… Or take Connecticut… For decades its lack of an income tax lured New York workers and businesses, but Gov. Lowell Weicker introduced the tax in 1991…and the original 1.5% rate has since been raised five times to today’s 6.99%.

And here’s the chart that every taxpayer should memorize before they vote next month.

And never forget that ever-increasing tax rates on high earners inevitably are accompanied by ever-increasing tax rates on everyone else – exactly as predicted by the Sixth Theorem of Government.

So if middle-class Illinois voters approve the so-called Fair Tax initiative, they’ll have nobody to blame but themselves when their tax rates also climb.

P.S. If voters in very-blue Illinois reject Pritzker’s class-warfare tax referendum, I wonder if that will discourage Democrats in Washington from embracing Biden’s class warfare agenda next year (assuming he wins the election)?

P.P.S. There’s a debate whether ballot initiatives and other forms of “direct democracy” are a good idea. Professor Garett Jones of George Mason University persuasively argues we’ll get better governance with less democracy. On the other hand, Switzerland is a very successful, very well-governed nation where voters directly decide all sorts of major policy issues.