The good news is that there will be a record reduction next year in the burden of government spending. Unfortunately, the bad news is that this reduction will only occur because of gigantic spending increases this year.

In this webinar, I explain how fiscal policy is being affected by coronavirus, and then explain why a spending cap is the way to restore fiscal sanity.

You can watch the full webinar, organized by Lebanon’s Modern University for Business and Science, by clicking here.

But if you don’t want to watch the entire event, or even my 11-minute presentation, all you really need to understand is that red ink is exploding this year. Not just in the United States, but in other nations as well.

The fiscal wreckage, as illustrated in this chart I shared for the audience, is greater than the world experienced during the financial crisis/great recession.

For what it’s worth, I wish the chart specified how much of the debt is caused by additional spending and how much is caused by declining tax revenues.

It’s also worth noting that these numbers will probably deteriorate even further over the next few months. Politicians are likely to approve more handouts and subsidies. And if there’s not a rapid economic recovery (I express doubt about that outcome in my remarks), tax revenue will continue to fall far short of baseline estimates.

The sad reality is that we don’t know the full degree of the coronavirus-caused fiscal wreckage. That being said, it’s safe to assume that – sooner or later – there will be a big debate in Washington over how to reverse the damage. And in other nations as well.

In my presentation, I explained why a Swiss-style spending cap is the right approach. In other words, simply impose a limit so that government grows slower than the private economy – i.e., fiscal policy’s Golden Rule.

I’d like to be able to specifically show how a spending cap would undo the current mess, but that’s not possible because we can only make wild guesses about the full extent of the fiscal fallout.

That being said, I’ll share two pieces of evidence to show the value of a spending cap.

That being said, I’ll share two pieces of evidence to show the value of a spending cap.

First, here’s an estimate I prepared earlier this year to show how America’s fiscal situation would have been much stronger today if a spending cap had been imposed back in 2000.

Needless to say, it would have been nice if the U.S. had big surpluses when the coronavirus hit.

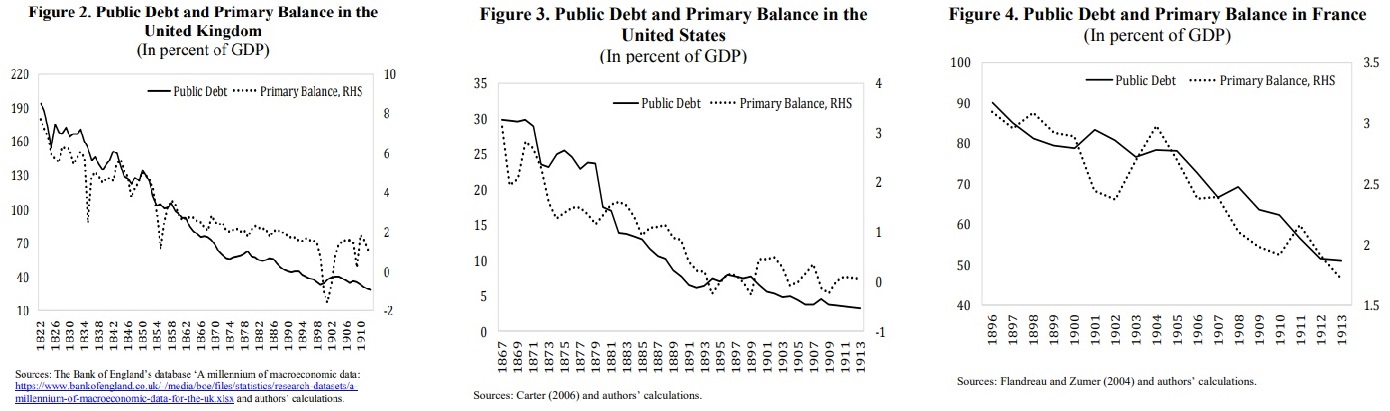

Our second piece of evidence is the experience of the U.S., France, and the U.K. in the decades before World War I.

All three nations had enormous debt burdens as a result of previous conflicts.

And all three countries dramatically reduced debt by using the same strategy of long-run spending restraint.

And all three countries dramatically reduced debt by using the same strategy of long-run spending restraint.

The bottom line is that spending restraint has worked in the past and it can work in the future.

Unfortunately, I doubt that either Donald Trump or Joe Biden is interested in that approach.

P.S. One thing we can say for certain is that responding with tax increases almost surely will make a bad situation even worse.