This article appeared on The Daily Caller on January 29, 2016.

President Obama has proven time and again his willingness to abuse executive power to sidestep Congress and avoid Constitutional checks and balances. Of all his abuses, perhaps none has been more outrageous than politically motivated, targeted harassment of businesses by “Operation Choke Point.” It surely counts, along with “Operation Fast and Furious,” which allowed Mexican drug lords to purchase firearms, as one of the most harebrained schemes of the Obama White House. The good news is that Congress might finally put a stop to the abuse and rein in the operation.

Choke Point was designed to use the power of the federal government to destroy legal businesses that the White House found distasteful. Kicked off in secret by bureaucrats from the Department of Justice (DOJ), the Consumer Financial Protection Bureau (CFPB) and the Federal Deposit Insurance Corporation (FDIC), the government pressured financial institutions into not extending credit to businesses that the administration did not favor.

In 2011, the FDIC released an internal list of 30 “high-risk” industries that it later advised financial institutions to avoid. Congress investigated the matter and determined that the White House sought to “choke out” companies the administration considered objectionable, despite the fact that they were legal businesses. A House Oversight Committee report found that “FDIC explicitly intended its list of ‘high-risk merchants’ to influence banks’ business decisions. FDIC policymakers debated ways to ensure that bank officials saw the list and got the message.” Short-term lenders, third party payment processors, gun stores, an Indian tribe, tobacco stores and even porn stars were denied access to banking services based on bureaucratic pressure.

The goal of the initiative is to deny these merchants access to the banking and payments networks that every business needs to survive, and thus effectively put them out of business without the bureaucrats getting their hands dirty. In that regard the plan backfired, as public outrage was swift and intense once the operation become public, and the FDIC was recently forced to admit wrongdoing.

It took some time, but Congress is now also finally taking the necessary steps to ensure Operation Choke Point does not rise from the dead.

Reps. Blaine Luetkemeyer (R-MO) and Jeb Hensarling (R-TX), persistent leaders in the fight against Operation Choke Point, have introduced legislation that will be taken up next week to limit the ability of Federal banking regulators to abuse their authority by pressuring a depository financial institution to terminate a specific customer’s accounts. It would require, among other protections, that bank examiners indicate what law or regulation they believe a bank or its customer to be violating in order to recommend or require account termination, and to do so in writing.

In other words, the Luetkemeyer/Henserling bill provides that a Federal bank regulator must have a material reason that is not based solely on the easily abused concept of “reputation risk” to question an account. There would have to be a specific national security circumstance for the regulator to be allowed to request the termination of an account.

In an age of increasing encroachment on civil rights in the name of law enforcement and fighting terrorism, these common sense reforms are absolutely necessary to prevent similar such gross violations in the future. Congress should act quickly to protect American businesses from overzealous bureaucrats and get the legislation to the president’s desk.

———

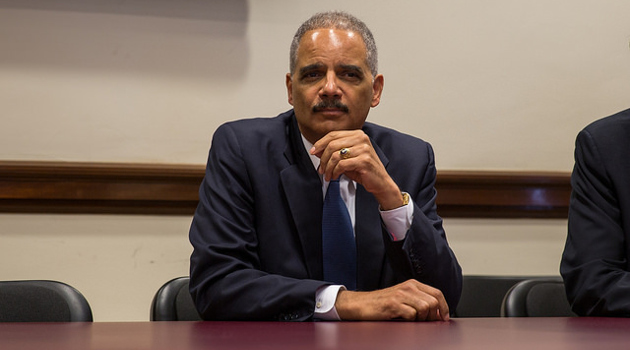

Image credit: North Charleston | CC BY-SA 2.0.