I’ve already shared a bunch of data and evidence on the importance of low tax rates.

A review of the academic evidence by the Tax Foundation found overwhelming support for the notion that lower tax rates are good for growth.

An economist from Cornell found lower tax rates boost GDP.

Other economists found lower tax rates boost job creation, savings, and output.

Even economists at the Paris-based OECD have determined that high tax rates undermine economic performance.

And it’s become apparent, with even the New York Times taking notice, that high tax rates drive away high-achieving people.

We’re going to augment this list with some additional evidence.

In a study published by a German think tank, three economists from the University of Copenhagen in Denmark look at the impact of high marginal tax rates on Danish economic performance.

Here’s what they set out to measure.

…taxation distorts the functioning of the market economy by creating a wedge between the private return and the social return to a reallocation of resources, leaving socially desirable opportunities unexploited as a result. …This paper studies the impact of taxation on the mobility and allocation of labor, and quantifies the efficiency loss from misallocation of labor caused by taxation. …labor mobility responses are fundamentally different from the hours-of-work responses of the basic labor supply model… Our analysis builds on a standard search theoretic framework… We incorporate non-linear taxation into this setting and estimate the structural parameters of the model using employer-employee register based data for the full Danish population of workers and workplaces for the years 2004-2006. The estimated model is then used to examine the impact of different changes in the tax system, thereby characterizing the distortionary effects of taxation on the allocation of labor.

They produced several sets of results, including a look at the additional growth and output generated by moving to a system of lump-sum taxation (which presumably eliminates all disincentive effects).

But even when they looked at more modest reforms, such as a flat tax with a relatively high rate, they found the Danish economy would reap significant benefits.

…it is possible to reap a very large part of the potential efficiency gain by going half the wayand replace the current taxation with a at tax rate of 30 percent on all income. This shift from a Scandinavian tax system with high marginal tax rates to a level of taxation in line with low-tax OECD countries such as the United States increases total income by 20 percent and yields an efficiency gain measured in proportion to initial income of 10 percent. …a transition from a Scandinavian system with high marginal taxes to a system along the lines of low-tax OECD countries such as the United States. This reduces the rate of non-employment by around 10 percentage points, increases aggregate income by almost 20 percent (relative to the Scandinavian income level), and gives an efficiency gain measured in proportion to income of 9.9 percent. Thus, almost 80 percent of the efficiency loss from marginal taxation (9.7% divided by 12.4%) would be eliminated by shifting from a Scandinavian tax system to the system of a low-tax OECD country according to these estimates.

The authors also confirmed that lower tax rates would generate revenue feedback. In other words, the Laffer Curve exists.

We may also use the reform experiment to compute the marginal excess burden of taxation as described above. When measured in proportion to the mechanical loss of tax revenue, we obtain an estimate of 87 percent. …this estimate also corresponds to the degree of self-financing of the tax cut. Thus, the increase in tax revenue from the behavioral response is 87 percent of the mechanical loss in tax revenue.

Too bad we can’t get the Joint Committee on Taxation in Washington to join the 21st Century. Those bureaucrats still base their work on the preposterous assumption that taxes have no impact on overall economic performance.

Since we just looked at a study of the growth generated by reducing very high tax rates, let’s now consider the opposite scenario. What happens if you take medium-level tax rates and raise them dramatically?

The Tax Foundation looks at precisely this issue. The group estimated the likely results if lawmakers adopted the class-warfare policies proposed by Thomas Piketty.

Piketty suggests higher taxes on the wealthiest among us. He calls for a global wealth tax, and he recommends establishing a top income tax rate of 80 percent, with a next-to-top income tax rate of 50 or 60 percent for the upper-middle class. …This study…provides quantitative estimates of what his proposed tax rates would mean for capital formation, jobs, the level of income, and government revenue. This study also estimates how Piketty’s proposed income tax rates would affect the distribution of income in the United States.

Piketty, of course, thinks that even confiscatory levels of taxation have no negative impact on economic performance.

Piketty claims people (or at least the upper-income people he would tax so heavily) are totally insensitive to marginal tax rates. In his world view, upper-income taxpayers will work and invest just as much as before even if dramatically higher taxes reduce their after-tax rewards to a fraction of what they were previously. …Piketty’s vision of the world strains credulity.

When the Tax Foundation crunched the numbers, though, its experts found that Piketty’s proposal would be devastating.

Under Piketty’s 55 and 80 percent tax brackets, people in the new, ultra-high tax brackets will work and invest less because they will be able to keep so little of the reward from the last hour of work and the last dollar of investment. …As the supplies of labor and capital in the production process decline, the economy’s output will also contract. Although it is only people with upper incomes who will directly pay the 55 and 80 percent tax rates, people throughout the economy will indirectly bear some of the tax burden. For example, the average person’s wages will be lower than otherwise because middle-income workers will have less equipment and software to enhance their productivity, and wages depend on productivity. Similarly, people throughout the economy will have fewer employment opportunities and will lose desirable goods and services, because businesses will grow more slowly and be less innovative.

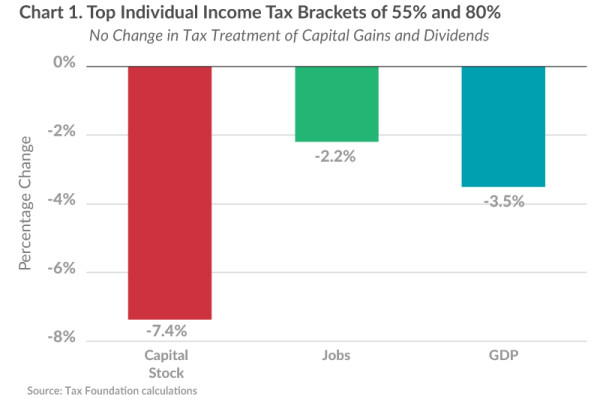

The magnitude of the damage would depend on whether the higher tax rates also applied to dividends and capital gains. Here’s what the Tax Foundation estimated would happen to the economy if dividends and capital gains were not hit with Piketty-style tax rates.

These are some very dismal numbers.

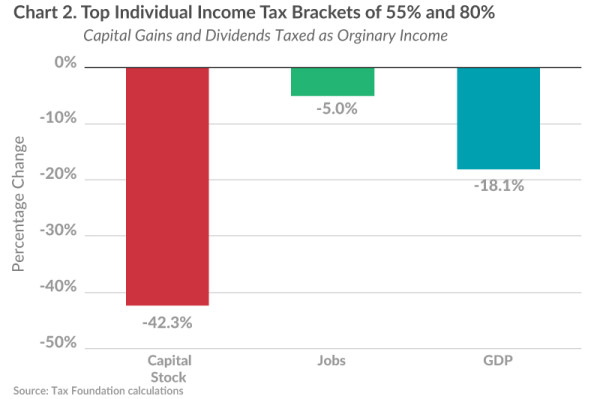

But now look at the results if tax rates also are increased on dividends and capital gains. The dramatic increase in double taxation (dwarfing what Obama wanted) would have catastrophic consequences for overall investment (the “capital stock”). This would lead to a big loss in jobs and a dramatic reduction in overall economic output.

The Tax Foundation then measures the impact of these policies on the well-being of people in various income classes.

Needless to say, upper-income taxpayers suffer substantial losses. But the rest of us also suffer as well.

…the poor and middle class would also lose. They would suffer a large, but indirect, tax burden as a result of the smaller economy. Their after-tax incomes would fall over 3 percent if capital gains and dividends retain their current-law tax treatment and almost 17 percent if capital gains and dividends are taxed like ordinary income.

And since I’m sure Piketty and his crowd would want to subject capital gains and dividends to confiscatory tax rates, the 17 percent drop is a more realistic assessment of their economic agenda.

Though, to be fair, Piketty-style policies would make society more “equal.” But, as the Tax Foundation notes, some methods of achieving equality are very bad for lower-income people.

…a reasonable question to ask is whether a middle-income family is made better off if their income drops 3.2 percent while the income of a family in the top 1 percent drops 21.0 percent, or their income plummets 16.8 percent while the income of a family in the top 1 percent plummets 43.3 percent.

Of course, if Margaret Thatcher is correct, the left has no problem with this outcome.

But for those of us who care about better lives for ordinary people, this is confirmation that envy isn’t – or at least shouldn’t be – a basis for tax policy.

Sadly, that’s not the case. We’ve already seen the horrible impact of Hollande’s Piketty-style policies in France. And Obama said he would be perfectly content to impose higher tax rates even if the resulting economic damage is so severe that no additional revenue is collected.