When people in other nations ask me for evidence in favor of low taxes, I often will ask them to compare the economic performance of a high-tax nation like France with the performance of a nation such as Switzerland with less onerous taxes.

If I’m asked by Americans, I generally suggest that they compare different states. For instance, I show them evidence that California has a much more punitive tax system than Texas. And when you look at all the available state rankings, it’s clear that there’s a big difference.

*Tax burdens as a share of state income.

*The State Tyranny Index.

*Mercatus State Fiscal Ranking.

*State Business Tax Climate Index.

*Tax Foundation’s Tax Freedom Day.

*State Freedom Index.

*Death Spiral states.

And I then ask folks to compare economic performance. There’s lots of evidence that Texas is growing much faster and creating far more jobs than California.

Heck, it’s almost as if California politicians want to drive successful people out ofthe Golden State (fortunately, the state’s politicians didn’t read Walter Williams’ satirical column about putting a barbed-wire fence at the border). And when upper-income taxpayers leave the state, that means taxable income and tax revenue also escape.

Though it’s worth pointing out that the case for low taxes isn’t based solely on comparisons of Texas and California. We know, for instance, that states with no income taxes generally outperform other states.

Moreover, we don’t need to rely on casual empiricism. Here are some of the results from a new study published by the Mercatus Center.

…this study uses the average tax rate as a practical approximation of the overall state tax burden. …The coefficient of average tax rate is negative and statistically significant in both models, suggesting that a higher tax burden as a share of income reduces state economic growth. …Elasticity of −2.6, for example, implies that a 1 percent increase in the tax rate decreases economic growth by 2.6 percent, not percentage points. …While the aforementioned income growth results are insightful, the impact of taxation on the level of income is also important. …income tax progressivity has a significant negative relationship with real GSP per capita. …An alternative way to measure economic activity is to look at the number of private firms that operate in each state. …The main conclusion from the two regression models is that only personal income tax progressivity seems to have a significant negative effect on the growth in the number of firms. … By voting with their feet, people send a clear signal about where they prefer to live and work. …an empirical analysis of migration may show, indirectly, how taxes affect the flow of economic activity across states. …state net immigration rate is negatively related to the personal income tax rate … The net immigration rate also seems to have a significantly negative correlation with the average tax rate and income tax progressivity.

These findings should not be a surprise.

It’s common sense that economic activity – and taxpayers – will flow to states that don’t punish people for creating wealth.

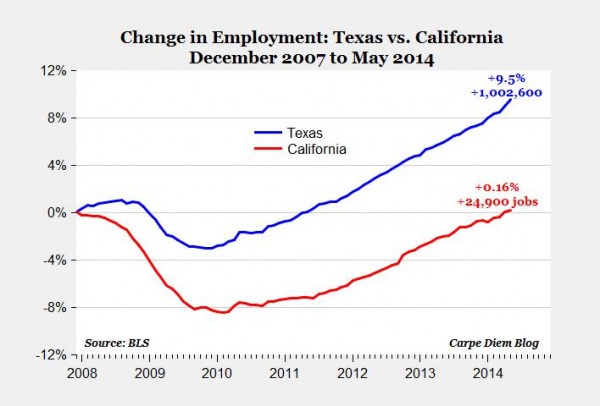

Let’s now circle back to the Texas-vs-California comparisons. Take a look at this remarkable chart put together by Mark Perry of the American Enterprise Institute.

As you can see, total employment in Texas has jumped almost 10 percent since 2008. In California, by contrast, total employment has increased by less than 2/10ths of 1 percent.

None of this should be interpreted to suggest that Texas is perfect. There’s too much government in the Lone Star state. It’s only a success story when compared to California. And even though California does worse than Texas in my Moocher Index, it’s worth pointing out that Californians are the least likely of all Americans to sign up for food stamps.