I’ve made the point before that the United States foolishly imposes the highest corporate tax rate of all developed nations.

But that obviously means it is theoretically possible for there to be a nation in the developing world that has a higher corporate tax rates.

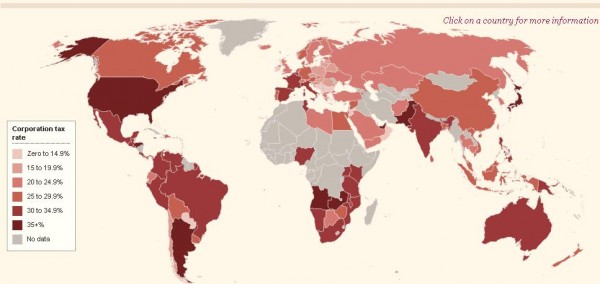

Well, according to this map produced by the Financial Times, there is one nation with a worse corporate tax regime.

It’s not China, which is nominally still a communist nation (though apparently with more of a pro-business mentality than the United States).

It’s not Venezuela or Argentina, corrupt and thuggish Latin American nations. And it’s not Zimbabwe, a statist kleptocracy in Africa.

The one nation in the world which is worse than the United States is the United Arab Emirates, with a corporate rate of 55 percent.

There’s no data on revenues collected by this onerous levy, but I’m going to make a sight-unseen prediction – based on Laffer Curve insights – that the UAE’s corporate income tax raises almost no money from the non-petroleum sector of the economy.

P.S. If the OECD succeeds in undermining corporate tax competition with its “BEPS” initiative, I expect we’ll see many nations raising corporate tax rates.