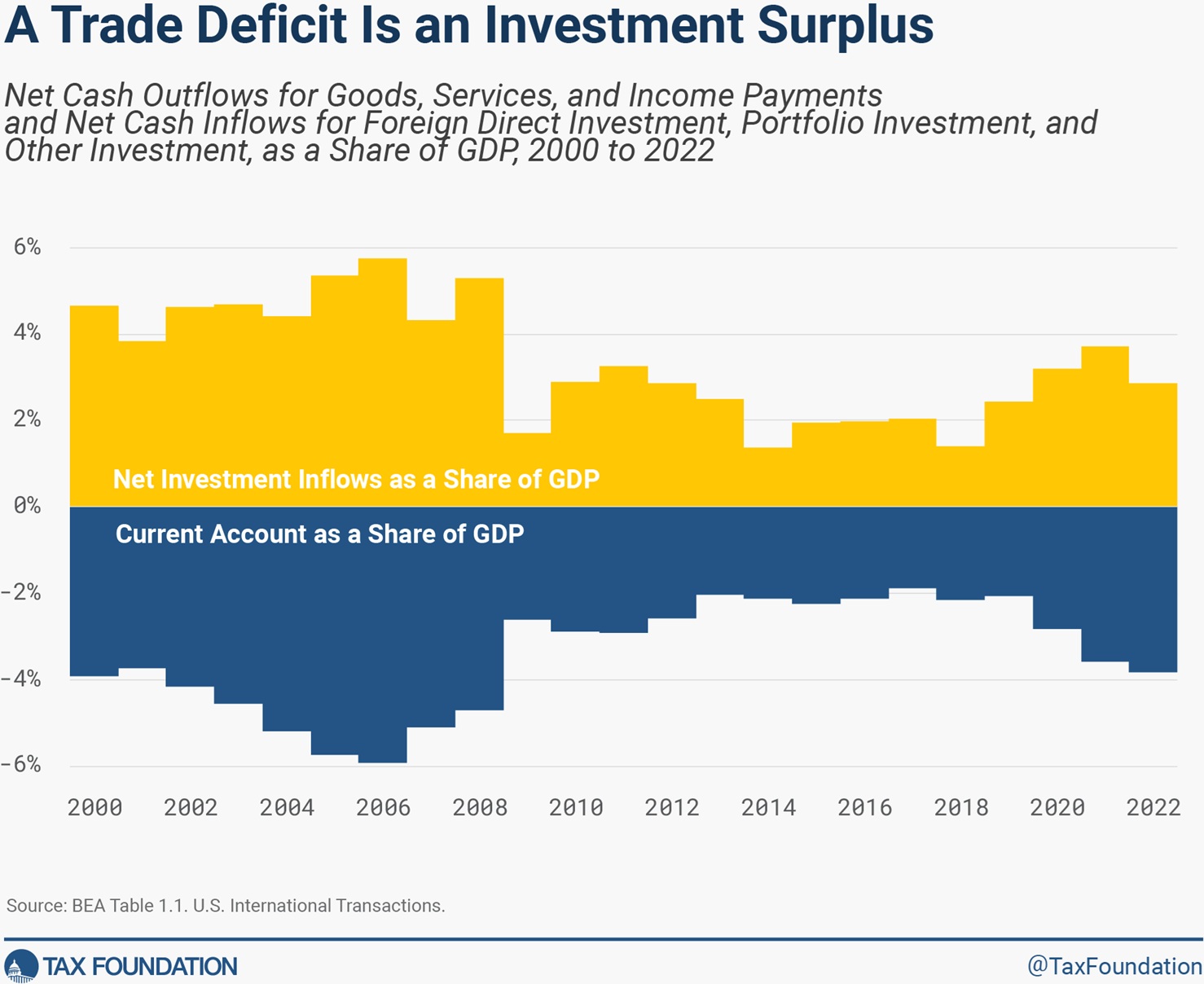

I’ve repeatedly shared a chart showing that a trade deficit is merely the flip side of an investment surplus.

But that chart had data through 2017, so let’s look at a new version of the chart, courtesy of the Tax Foundation.

What’s the takeaway from this chart? How should we interpret this data?

As I wrote earlier this year, it’s good that foreigners want to invest in the American economy.

When foreigners earn dollars by selling to Americans, they can either use those dollars to buy American products or they can invest those dollars in the American economy. If they invest in the American economy (which Trump recognizes is a good thing), that necessarily means a higher trade deficit (which Trump thinks is a bad thing). …that’s not a bad thing!

Since some people instinctively think trade deficits are bad (even though that means more investment in America), I encourage them to look at what I wrote back in 2020.

Simply stated, there is a correlation between American prosperity and trade deficit. By contrast, the trade deficit shrinks when the U.S. is suffering a recession.

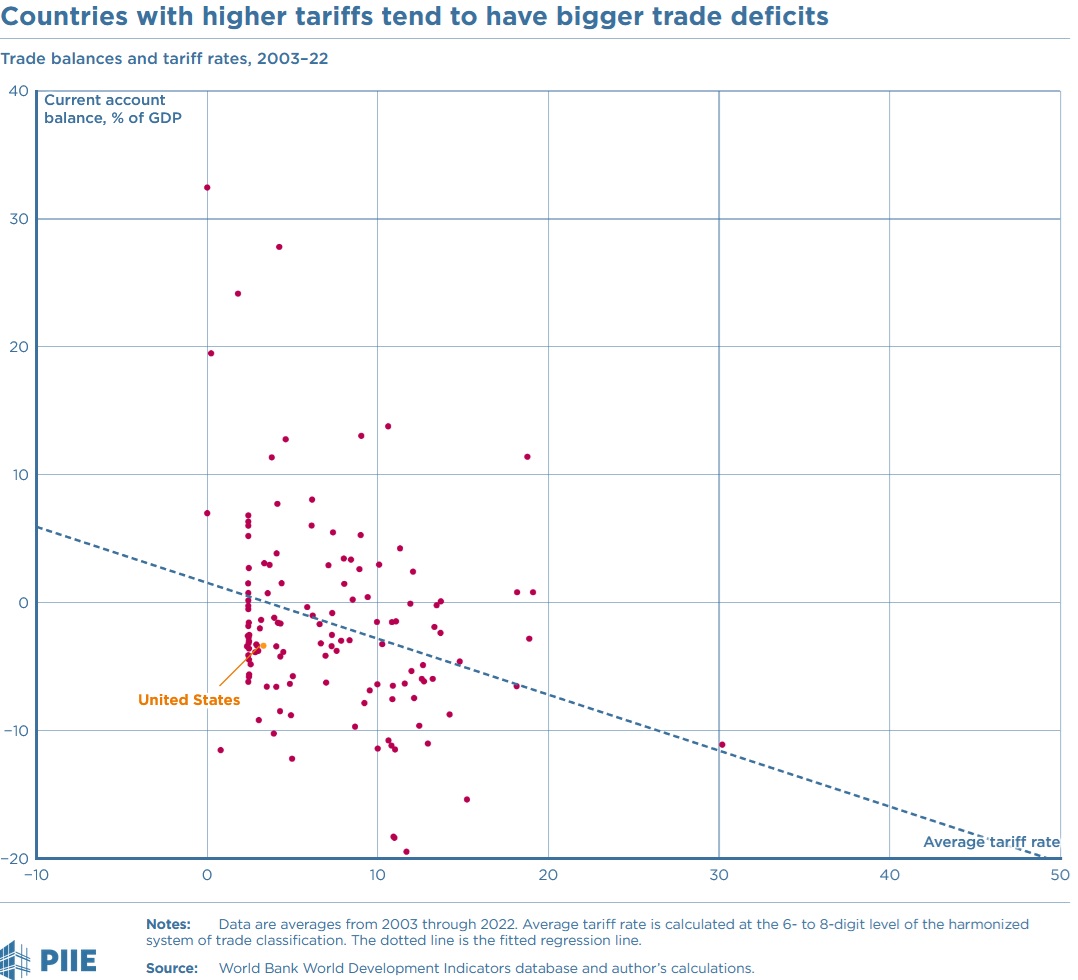

But let’s set that aside and instead focus on the practical question of whether higher trade taxes actually lead to lower trade deficits.

According to a report by the Peterson Institute of International Economics, the answer is no.

Here’s a chart showing that high-tariff nations usually have larger trade deficits.

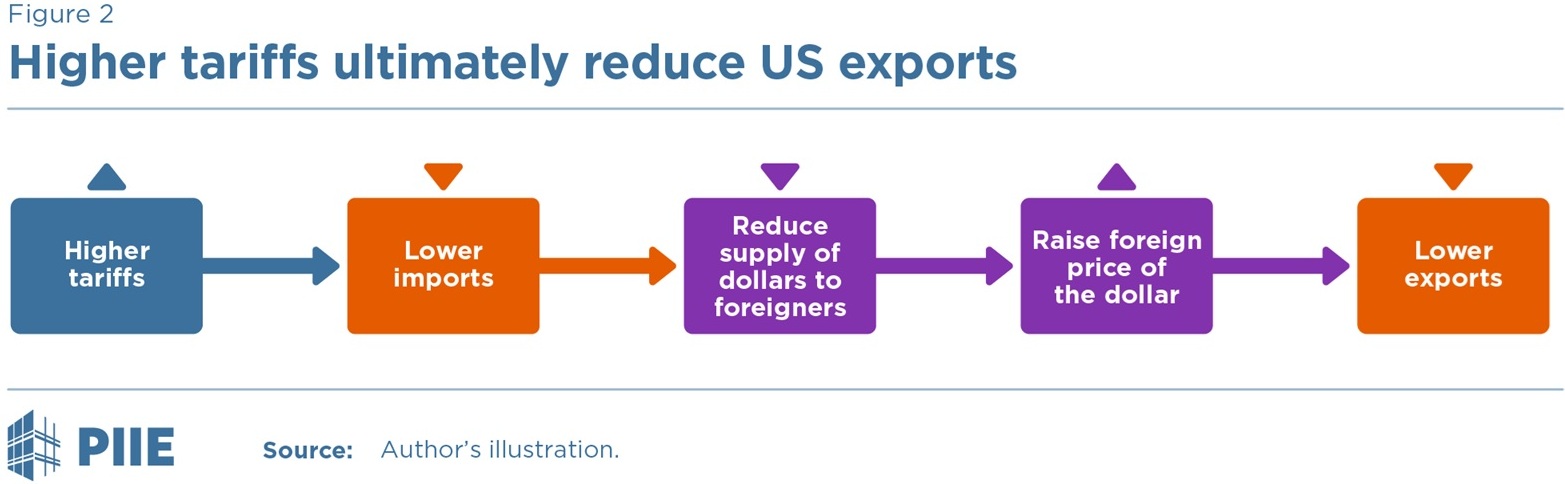

The report explains why this is the case, but here’s a simple flowchart for readers who are pressed for time.

By the way, this is what we saw during Trump’s first term.

The moral of the story is that Trump’s Hoover-style trade policy is a big mistake. America should be a country of free trade rather than protectionism.

———

Image credit: AKrebs60 | Pixabay License.