When I write about tax reform, I emphasize that there are three equally important features of the flat tax.

- One low tax rate on productive behavior.

- No double taxation of saving and investment.

- No distorting and inefficient loopholes.

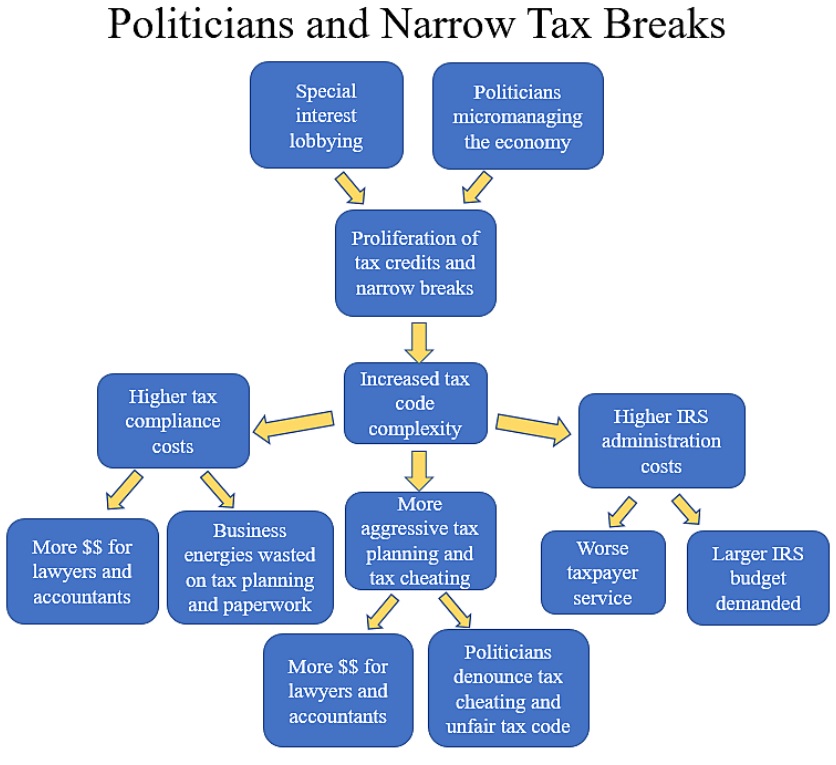

Regarding the third item, I don’t like special preferences because tax complexity is a back-door form of industrial policy (see the visual).

I also don’t like them because they are a breeding ground for corruption.

Last but not least, loopholes give politicians an incentive to raise taxes.

Lawmakers inevitably want to grab more money (by raising rates or increasing double taxation) to compensate for the revenue that is lost when taxpayers utilize deductions, credits, exemptions, and exclusions.

And the reverse argument is true. If we want revenue offsets to enable lower tax rates and reduce double taxation, we need to get rid of various loopholes.

That’s the intellectual argument. Now let’s have some fun.

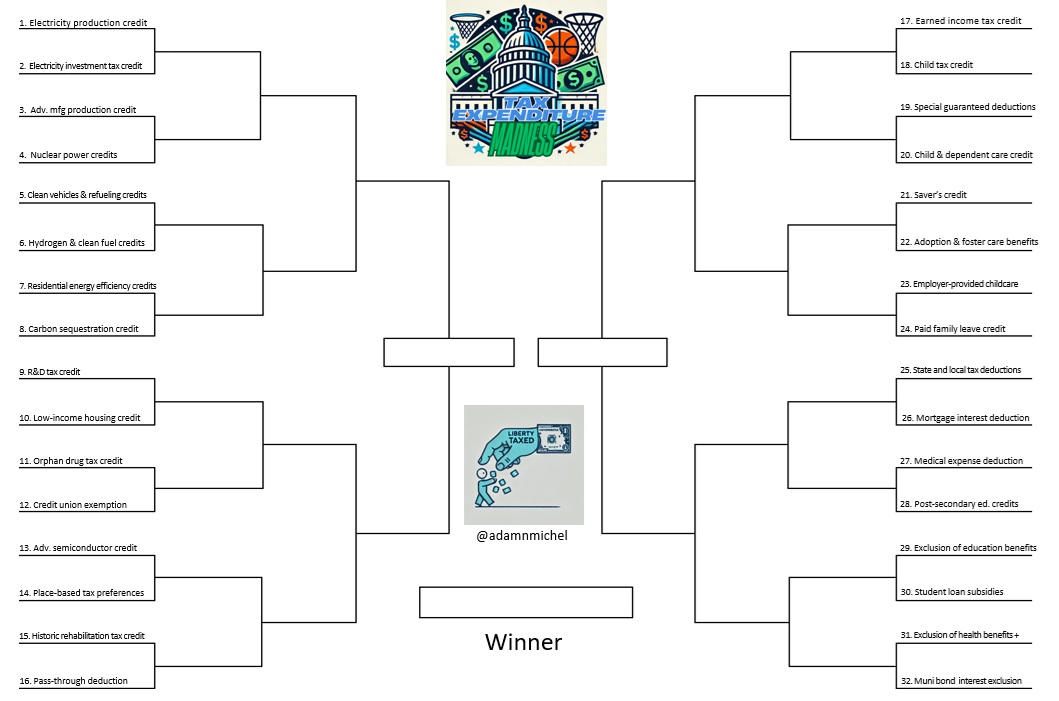

Adam Michel of the Cato Institute put together a tax nerd’s version of March Madness. But instead of picking the best basketball team, the goal is to pick the worst loophole.

Here are the 32 choices (click to enlarge).

According to votes on Twitter/X, the worst loophole is #16, the “Pass-through deduction.”

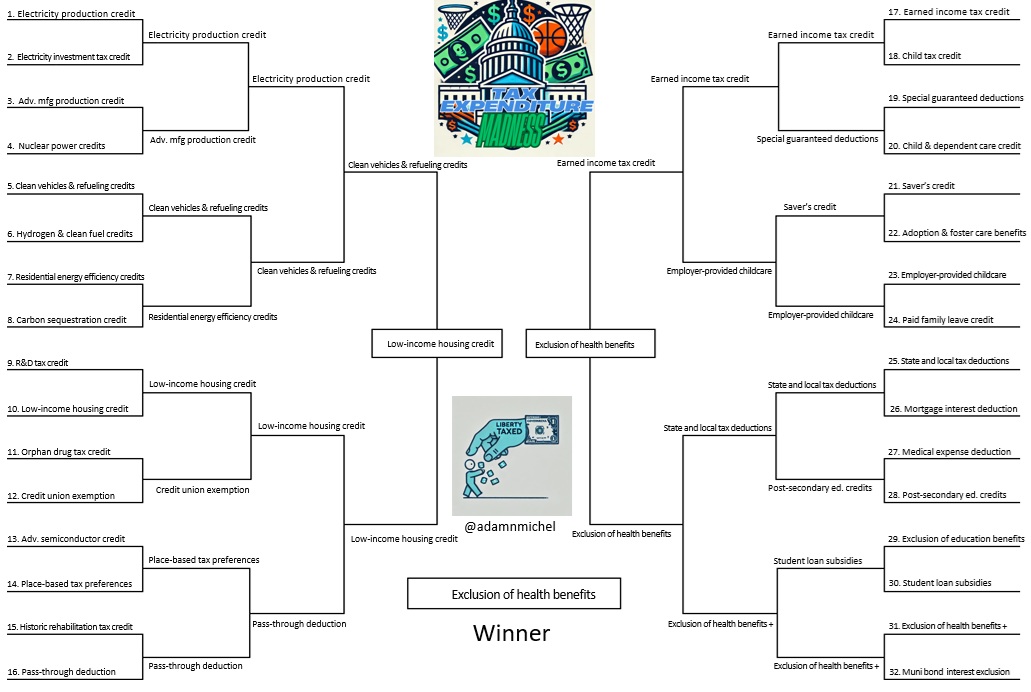

If I was the only voter, however, the winner (for reasons I explained in 2016) would have been #31, the “Exclusion of health benefits.”

Here’s my bracket (click to enlarge).

Kudos to Adam for putting this together, but I feel compelled to complain about his seeding.

For instance, two of the worst loopholes, the health exclusion and the muni-bond interest exemption, were matched up in the first round. That should have been a match-up in the Final Four, if not a contest in the title game.

And the state and local tax deduction also should have reached the Final Four, but it got knocked out in my Elite 8.

Though I was able to get the earned income credit (income redistribution laundered through the tax code) to the Final Four.

P.S. Adam correctly defines tax loopholes, which is more than can be said at times for the Joint Committee on Taxation, the Government Accountability Office, the Congressional Budget Office, and even some Republicans.