My primary criticism of the Organization for Economic Cooperation and Development is that the Paris-based international bureaucracy is trying to become some sort of global tax enforcer for left-wing policy.

Indeed, I founded CF&P in 2000 precisely because the OECD started its “harmful tax competition” project, which threatened low-tax jurisdictions with financial protectionism if they didn’t agree to help Europe’s welfare states enforce their anti-growth tax laws.

For the past 10 years, I’ve been fighting the OECD’s campaign to impose corporate tax harmonization and increase tax burdens on business (which, of course, means higher tax burdens on workers, consumers, and shareholders).

But there’s another activity of the OECD that also deserves attention. My secondary criticism of the bureaucracy is that it urges bad policy on a country-by-country basis.

On several occasions, I’ve criticized the bureaucrats for pushing bad policy on the United States (the fact that American taxpayers pay the biggest share of the OECD’s bloated budget makes that doubly outrageous).

Today, I’m going to criticize the bureaucrats for pushing bad policy on Chile.

I’ll start with the observation that Chile currently has a left-wing president, so it hardly needs any help doing dumb things.

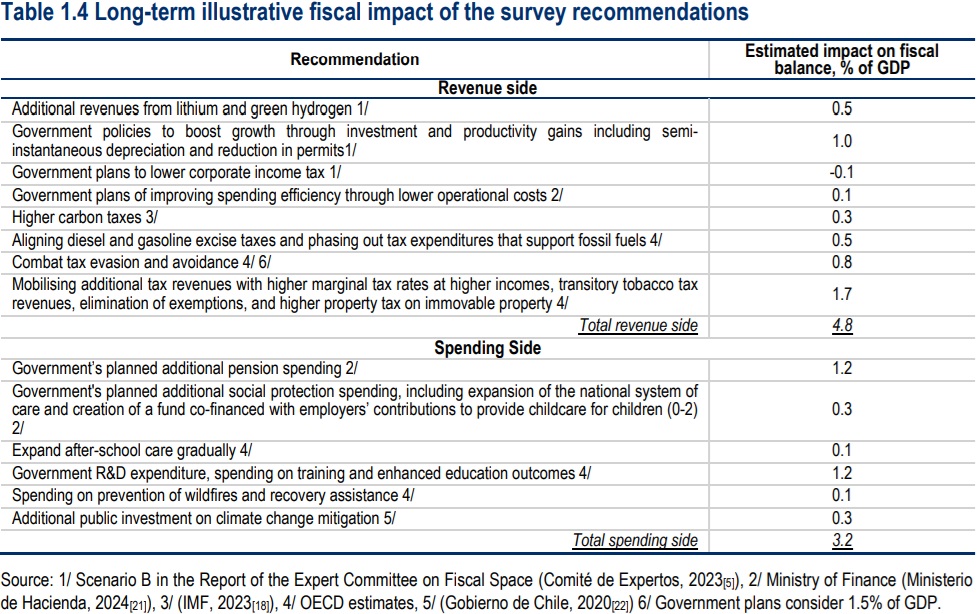

Yet the OECD just published its Economic Survey of Chile and explicitly recommends higher taxes to fund bigger government. They don’t even hide this statist agenda. It’s explicitly summarized in Table 1.4 of the report.

Here’s some of what was written.

Tax revenues of close to 21% of GDP are insufficient to meet spending needs and future fiscal pressures due to necessary spending in the green and digital transitions, to deal with more frequent and severe climate risks, and higher spending from population ageing. A comprehensive tax reform can increase fiscal space. Such reform should consider raising more revenue from personal income taxes, …higher immovable property taxes, and environmental and tobacco ones, even if transitory, while gradually lowering regressive income tax deductions and exemptions.

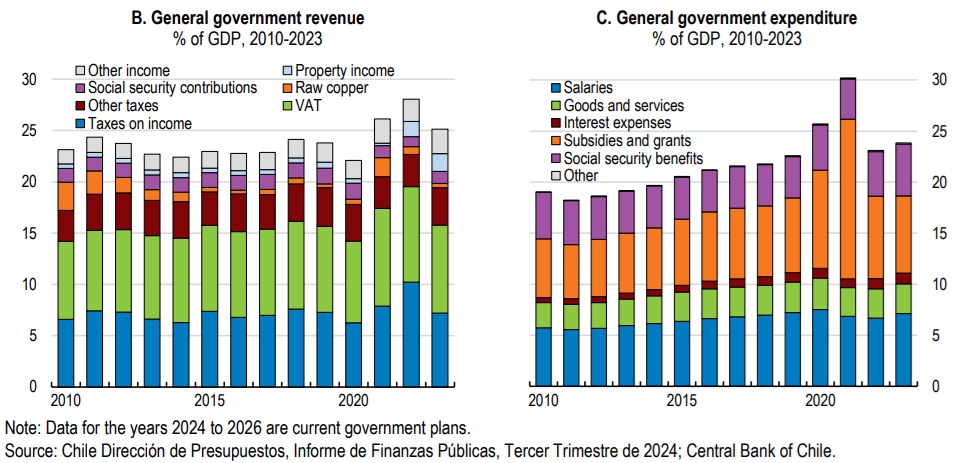

You may be wondering about the Chile’s fiscal situation. Has government been starved of resources? Has spending already been cut to the bone? Are the OECD’s recommendations a way of compensating for excessive frugality in the past.

Hardly.

Here are two more charts from the report. As you can see from the one of the right, the spending burden in Chile has already been on an upward trajectory.

At the risk of stating the obvious, I’ll point out that the public sector in Chile already is way too big and exceeds the gr0wth-maximizing size of government.

Yet the current socialist government wants to make it bigger and the OECD is aiding and abetting that mistake.

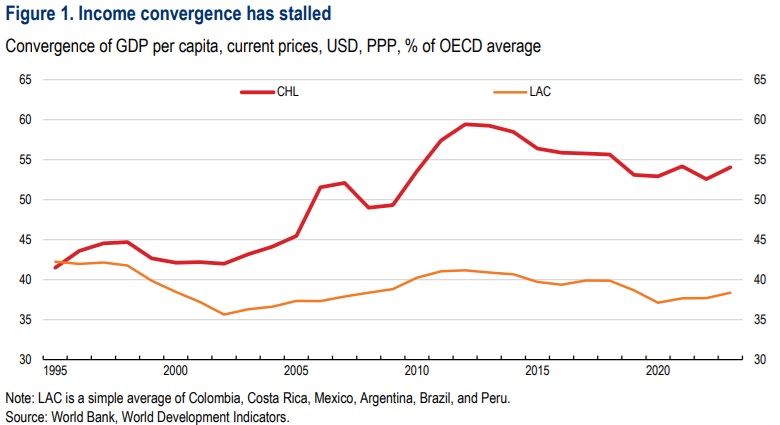

I’ll close with one final chart from the report. It shows that Chile was doing a decent job of converging with the developed world but that progress ground to a halt about 10 years ago and now there’s backsliding.

For what it’s worth, I don’t think any of this is a coincidence.

There was a great period of pro-market reform in Chile in the late 1970s and early 1980s, followed by a couple of decades that can be described as status quo.

And during that time, there was a lot of economic progress.

But things started heading south about a decade ago.

- I wrote back in 2014 that the country’s newly elected leftist president was taking the country in the wrong direction. And she did.

- She was then followed in office by Sebastian Pinera, who supposedly leaned to the right but governed like a big-government Republican.

- And now the country is plagued by Gabriel Boric and his awful economic agenda.

So I’m not surprised that Chile no longer is converging.

And I’m not surprised that the OECD is pushing Chile to further sabotage its own economy.