Some traditions are enjoyable, like opening day of the baseball season or celebrating a child’s birthday.

Today, we’re going to continue an unpleasant annual tradition (see 2018, 2019, 2020, 2021, 2022, 2023, 2024) by looking at the Congressional Budget Office’s 30-year fiscal forecast.

You can click here to review the report. It’s filled with useful data for fiscal wonks.

But I’m going to highlight three charts that should worry every American. Heck, these charts should worry everyone in the world because when the U.S. screws up, other countries may suffer collateral damage.

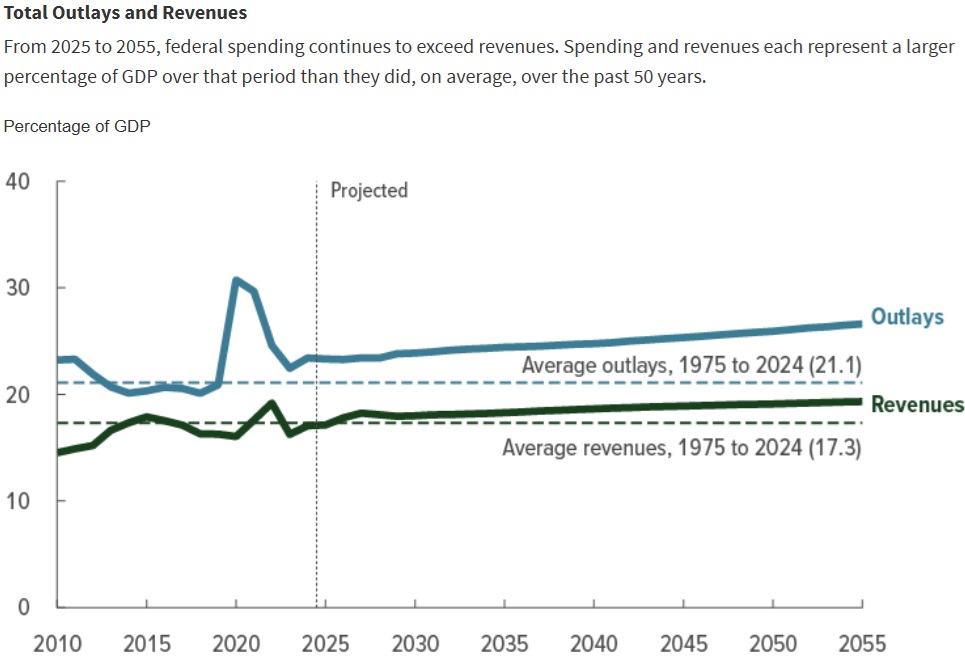

Our first chart shows the current projections for federal taxes and spending as a share of economic output (GDP).

The obvious takeaway is that the tax burden is gradually rising while the spending burden is rapidly rising.

In other words, it is wrong to claim that America’s fiscal problems are because of falling tax revenue.

Washington is going to get more of our money over the next three decades.

- More money in nominal dollars.

- More money in inflation-adjusted dollars.

- More money as a share of GDP.

The United States is in fiscal trouble because the spending burden is rising at an even faster rate, violating the all-important Golden Rule.

And what happens when spending keeps growing faster than revenue and faster than the private sector?

You get more red ink.

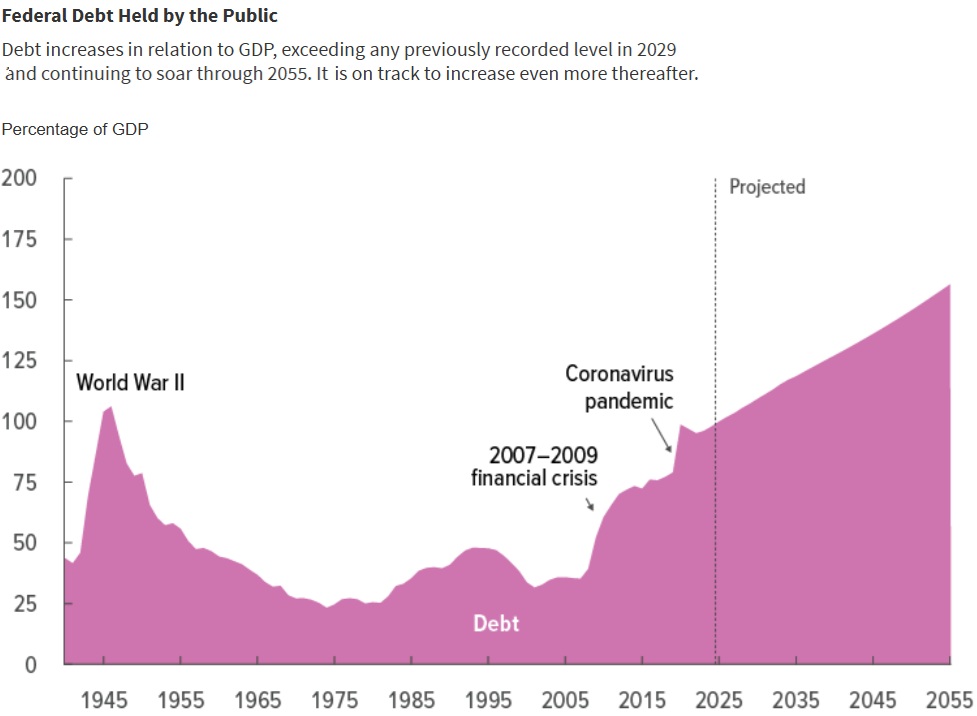

And that brings us to our second chart. At the risk of understatement, America is on an unsustainable path. Debt is climbing at an absurdly excessive rate.

I normally don’t pay much attention to red ink for the simple reason that the real problem is excessive government spending.

And the spending burden is bad for prosperity whether financed by taxes, borrowing, or printing money.

That being said, reckless politicians are creating the risk of a fiscal crisis (which is when interest rates spike because people no longer trust that a government will honor its debts).

So how do eliminate that risk?

The answer is obvious. If excessive spending growth is the cause of the problem, then the solution is to put some long-overdue limits on spending.

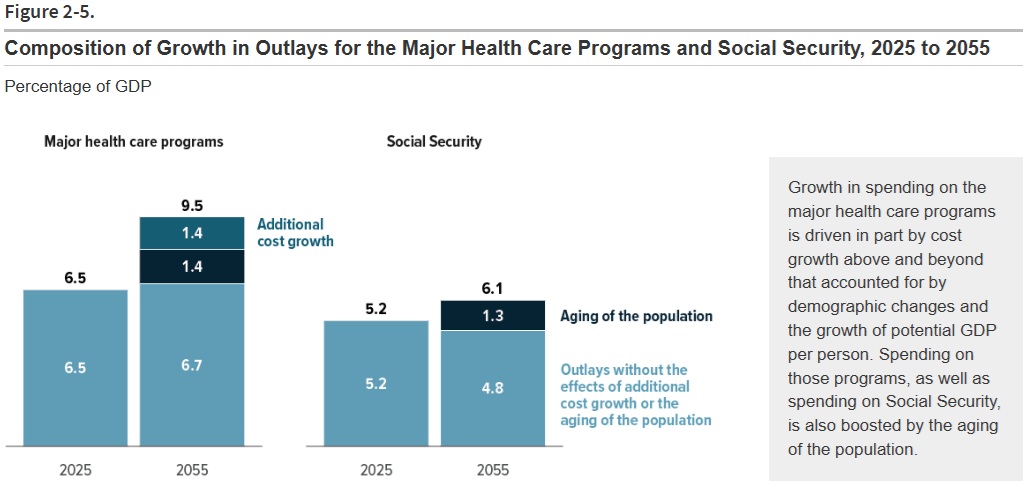

Which brings us to our third chart. It shows that America’s spending problem is actually a problem with entitlement programs.

This leads me to a sad conclusion.

The United States will have a fiscal crisis if politicians don’t get serious about entitlement reform.

I’ve been saying this for a long time. Sadly, nobody in Washington seems to be listening.