Elon Musk is in the news because of his opposition to Trump’s “Big Beautiful Bill.” At the risk of sounding wishy-washy, I’m not sure if he is right or wrong.

- The good news is that the bill prevents a massive automatic tax increase starting on January 1 of 2026.

- The bad news is that the bill only slightly reduces the excessive growth rate of government spending.

So I’m not going to takes sides in this looming Trump-Musk disagreement.

Instead, I’m going to focus on another bit of budget-related news from Musk. As reported by this tweet, he wants a fiscal rule to change the incentives of politicians.

Kudos to Musk. He understands “public choice,” at least implicitly.

To elaborate, politicians currently have an incentive to buy votes with other people’s money because they perceive that as the best way to win their next elections.

If the rules are changed so that they have to achieve certain goals to remain in power, they will change their behavior.

However, there are three reasons why Musk has picked the wrong rule.

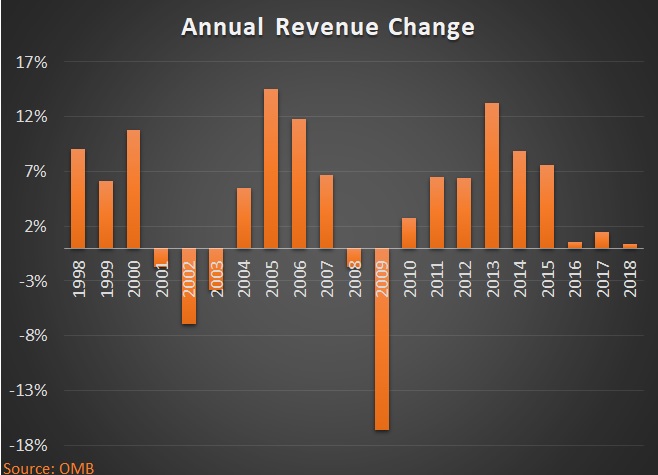

First, a rule based on the deficit suffers from the same flaw as a rule based on having a balanced budget, which is that tax revenues are very cyclical.

So that means that during a recession, when revenues fall, politicians would be expected to dramatically reduce government spending. That would warm my heart, but it seems impractical.

And when the economy is growing and generating lots of tax revenue, politicians would have too much leeway to increase the spending burden (as is happening currently in Texas!).

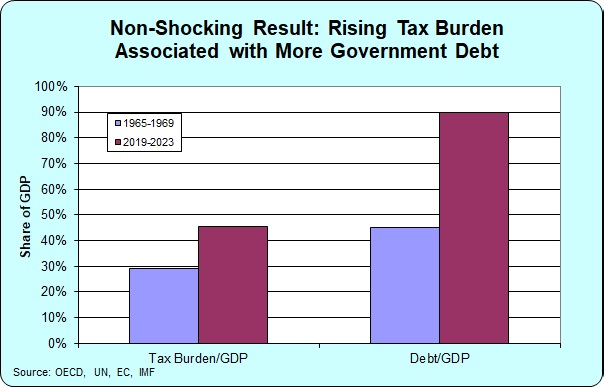

Second, a deficit rule gives politicians an excuse to raise taxes.

Most of them want more tax revenue, of course, but they are reluctant to increase tax burdens because they worry about a voter backlash in the next election.

But if they are not allowed to run for reelection because of too much red ink (deficit above 3 percent of GDP), they will quickly decide to vote for higher taxes.

And they’ll have the gall to claim that they had no choice because of Musk’s fiscal rule.

Third, America’s long-run fiscal problem is entirely because government is too big and growing too fast. This necessarily means some combination of higher taxes, additional borrowing, or more money-printing.

Musk’s rule focuses on one of those three symptoms (the additional borrowing).

But that won’t be effective if politicians can simply replace debt-financed spending with tax-financed spending.

And because higher tax burdens will weaken the economy (and also give politicians and excuse to increase spending), the end result will almost surely be even more red ink.

So politicians ultimately might be barred from running for reelection, but they’ll do great damage to the economy before that happens.

I’ll conclude today’s column by giving Musk some advice on a better approach. Simply stated, he should embrace an election rule based on a spending cap.

Switzerland’s spending cap is well designed and has an amazing track record of success, but Colorado’s spending cap might work even better for Musk because it has a very simple design that limits spending so it can’t grow faster than population plus inflation.

A practical application of my favorite rule.