The ideal pension system for workers is defined-contribution accounts – such as IRAs or 401(k)s – which is why it is so encouraging that many nations have moved in that direction.

One advantage of that approach is that, by definition, there are no unfunded liabilities with “DC” accounts. Your retirement income is based on how much money you save and how wisely the money is invested.

Many state and local bureaucrats, however, have defined-benefit pension systems. These “DB” systems are prone to systemic risk because politicians can promise lots of future benefits without setting aside the money to finance those goodies.

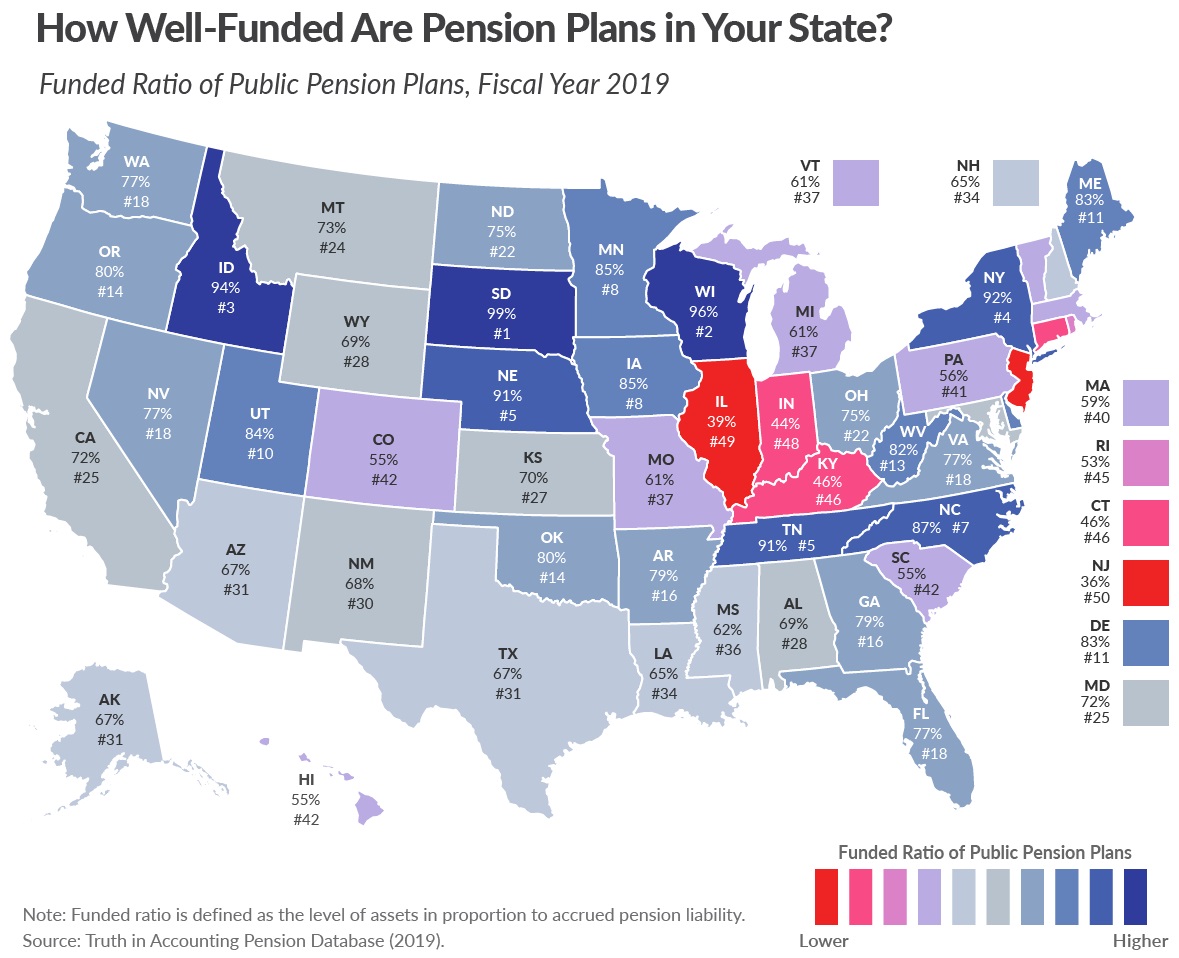

And that is a common problem, as shown by this map from the Tax Foundation based on 2019 data. No state at that time had a fully-funded system (based on how much money is set aside compared to have much pension benefits that have been promised).

Dark blue states are at least close to being fully funded. The worst states are red, followed by pink and purple.

It’s no surprise to see that Illinois and New Jersey are the worst of the worst for unfunded liabilities.

Some readers may be surprised, though, to see that Kentucky and Indiana have a significant problem.

One thing this map does not do, however, is to measure the overall fiscal burden of unfunded liabilities. And that matters since it might be better for taxpayers to be in a state with a larger share of unfunded liabilities but a less extravagant pension system (I’d rather owe someone 50% of $10 instead of 10% of $100).

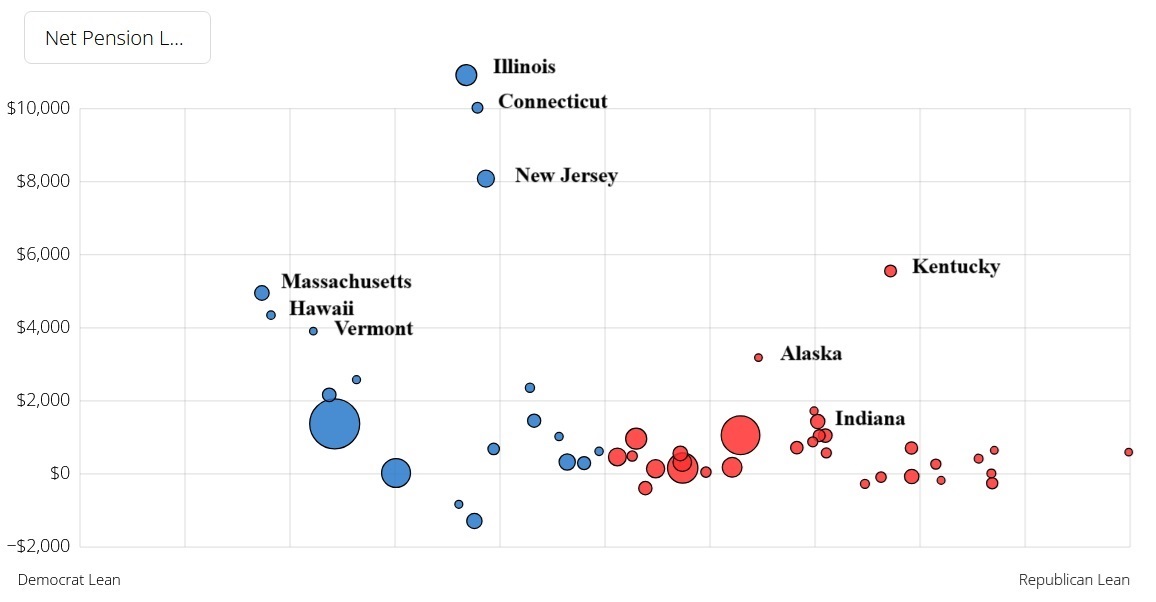

So here’s a visual from the folks at Reason showing per-capita net pension liabilities as of 2022. On this basis, Illinois is the worst of the worst, followed by Connecticut and New Jersey.

Kentucky also is very bad, though Indiana doesn’t look nearly as bad when using this measure.

It’s also important to consider a state’s ability to finance it’s unfunded liabilities. For instance, per-capita income in New Jersey is higher than it is in Kentucky, so the relative fiscal burden in Kentucky may be higher.

The good news is that the vast majority of states have relatively low unfunded liabilities – less than $2,000 per resident. It’s also good news that some states now have fully funded pensions, meaning more money is now set aside than is owed (largely because the stock market has increased in value since the Tax Foundation put together a map based on 2019 data).

That good news can quickly become bad news, though, if there is a recession and the stock market declines. Which is why DC systems are better than DB systems from the perspective of taxpayers.

P.S. Back in 2018, I conducted a poll asking readers which state would be the first to go bankrupt. Based on the data in today’s column, readers may have been wrong to vote California as the second-most likely state to go belly up. Though pension liabilities are not the only reason a state might go bankrupt. Perhaps readers think the exodus of businesses and taxpayers is going to saddle California with too many takers and not enough makers.