The good news is that there is very little risk that President’s new budget – which is very similar to his previous budgets – will be approved by Congress.

The bad news is that his budget is filled with terrible policy. Big expansions in the burden of spending and big increases in tax rates.

At the risk of understatement, the economic consequences of those policies would be unfortunate.

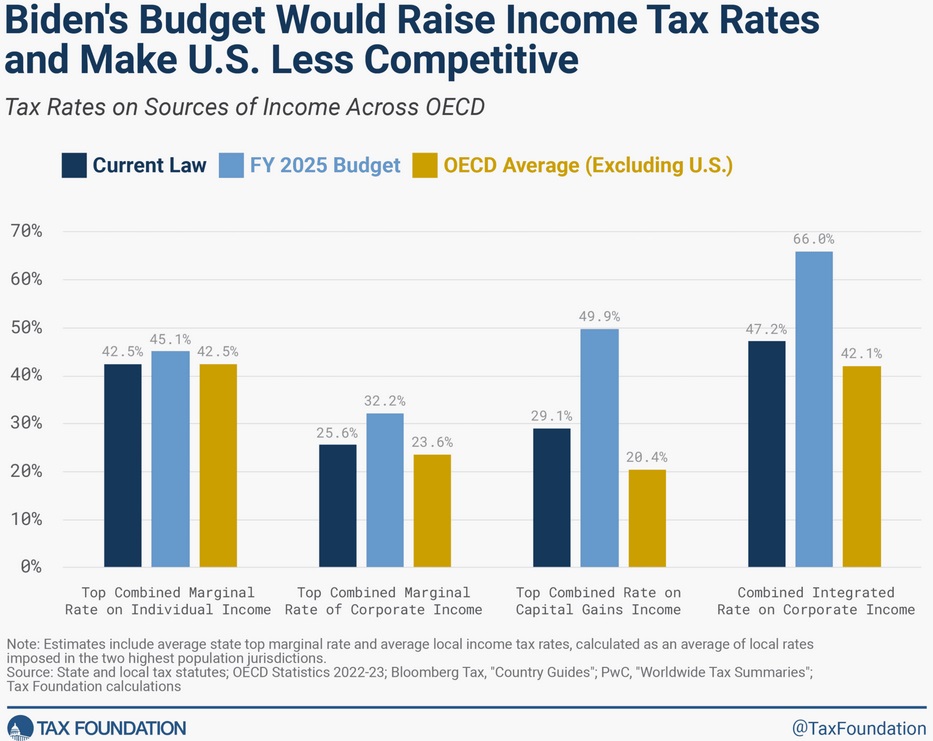

Given my interest in competitiveness, I think this visual from the Tax Foundation is the most important thing to understand. Biden wants tax rates in the United States to go from dark blue to light blue.

What makes this visual so disappointing is when you compare tax rates in the United States to other industrialized nations.

Tax rates in America already are high compared to those other countries, especially when looking at the taxation of saving and investment.

But the most shocking results are when you compare tax rates in other nations to Biden’s proposed tax rates. The United States would be shooting itself in the foot.

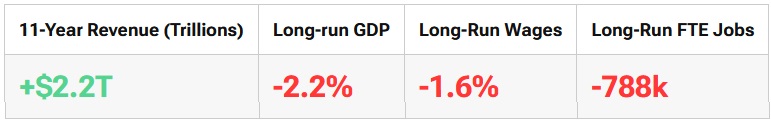

Given those terrible policies, this set of numbers from the Tax Foundation is hardly a surprise. Government would get more money and households would lose money.

I’ll close by observing that the Tax Foundation’s model is based on how higher tax rates discourage productive behavior. And there’s lots of academic evidence to support that approach.

As far as I know, though, the Tax Foundation does not quantify or estimate the economic damage from higher spending. So the actual consequences of Biden’s proposed budget surely would be even worse (the case for smaller government is bolstered by research from the Congressional Budget Office, as well as from generally left-leaning international bureaucracies such as the OECD, World Bank, ECB, and IMF).