I wrote 10 days ago about why a value-added tax would be a mistake for the United States.

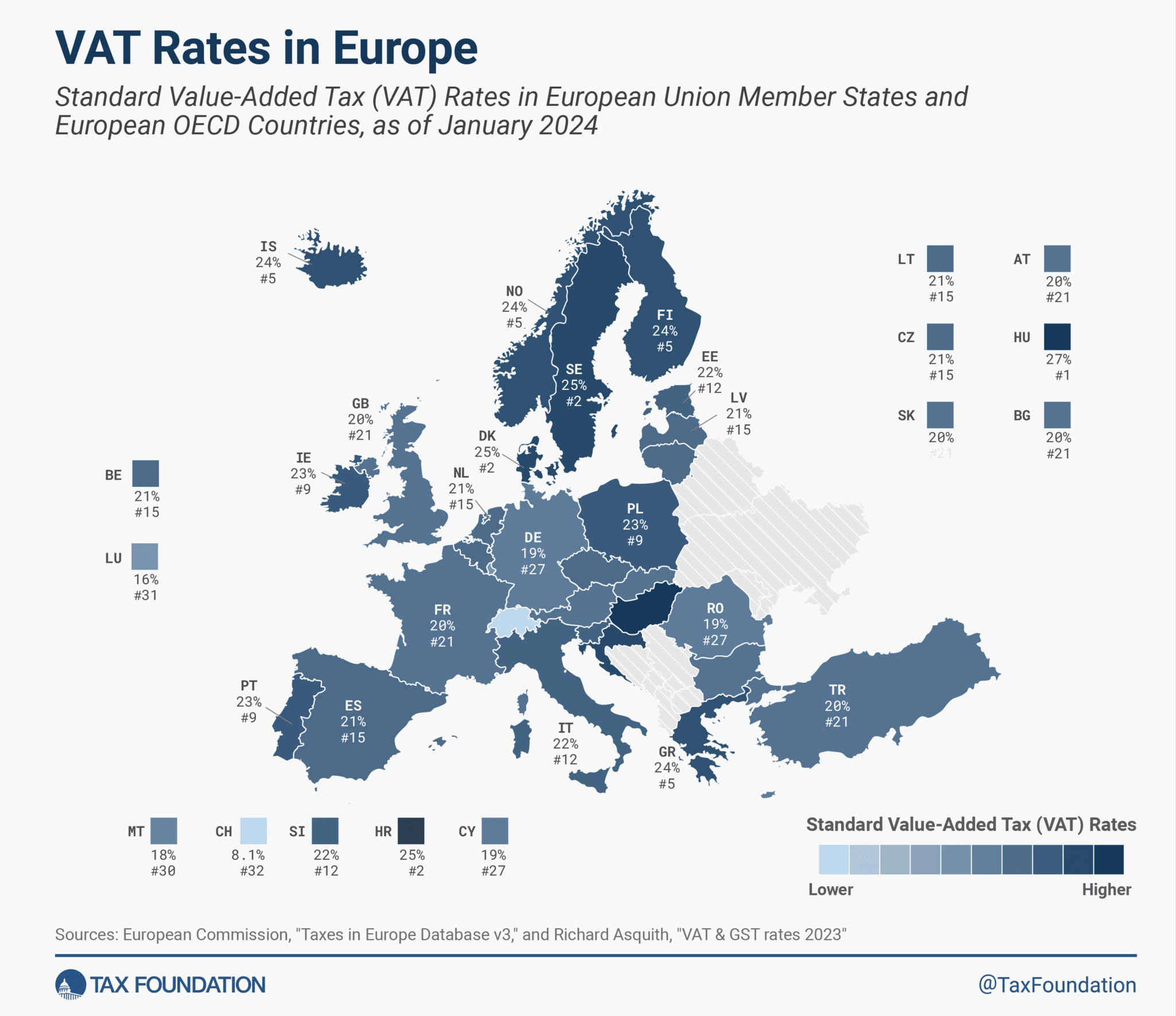

To help reinforce that argument, here’s a new map from the Tax Foundation showing VAT rates on the other side of the Atlantic Ocean.

With a few exceptions (notably Switzerland), these hidden taxes are an enormous burden. Indeed, the average EU VAT rate is approaching 22 percent, a huge increase over the past five decades.

From a tax policy perspective, high VAT rates are misguided since they increase the gap between pre-tax income and post-tax consumption. And lower-income households are especially disadvantaged.

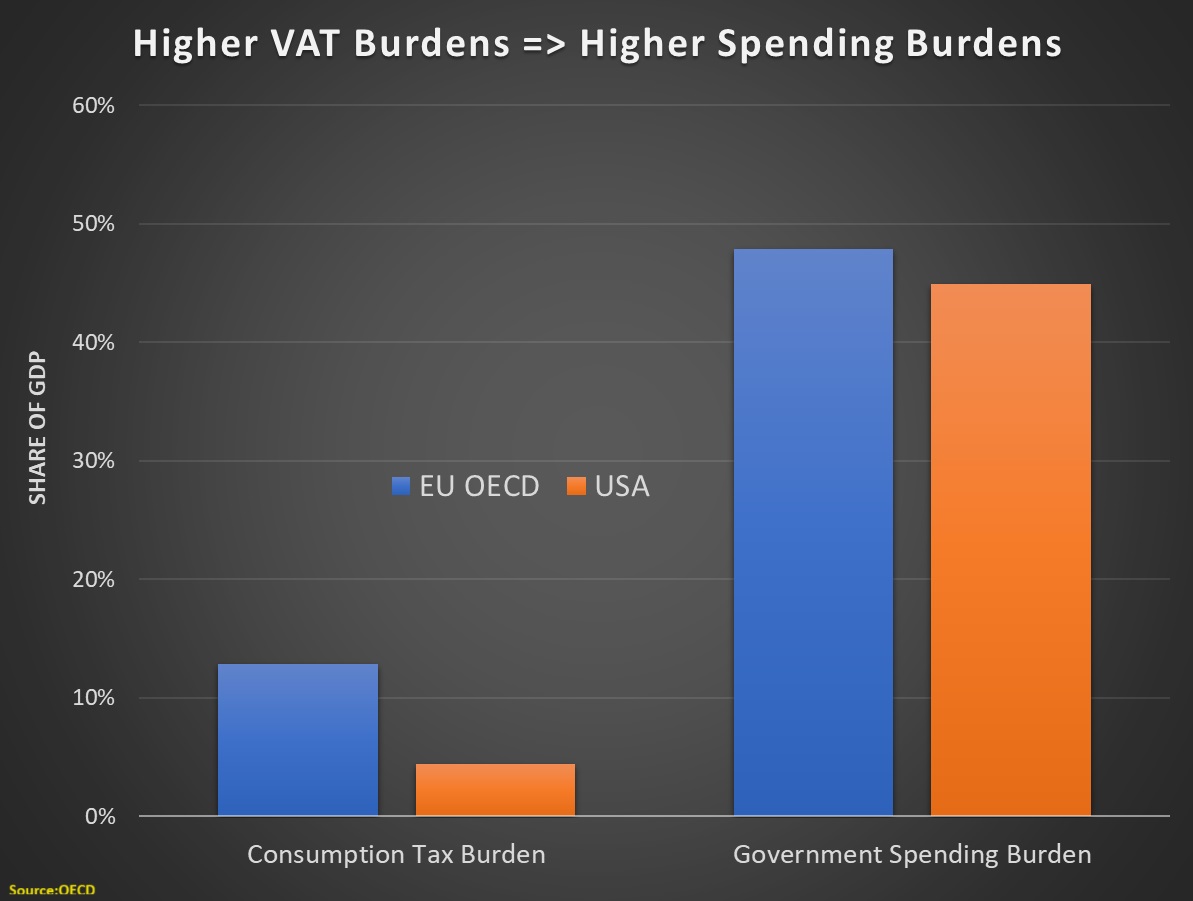

But high VAT rates also are misguided since they enable bigger burdens of government spending.

Here’s a chart based on OECD tax data and OECD spending data. As you can see, when compared to the United States, higher VAT burdens among EU/OECD members are associated with higher spending burdens.

The bottom line is that the VAT is a money machine for bigger government.

As such, American politicians should not impose this levy and make the US more like Europe.

Unless, of course, the goal is slower growth and less prosperity.