As part of her tax-and-spend agenda, Kamala Harris says she wants to increase the federal corporate tax rate from 21 percent to 28 percent.

While it doesn’t seem possible, there is a tiny sliver of good news in her proposal. I’m happy that she isn’t proposing to push the rate to 35 percent, which is where it was before the Trump tax cuts.

Though I guess that should be in the not-as-bad-as-it-could-have-been category rather than being considered good news.

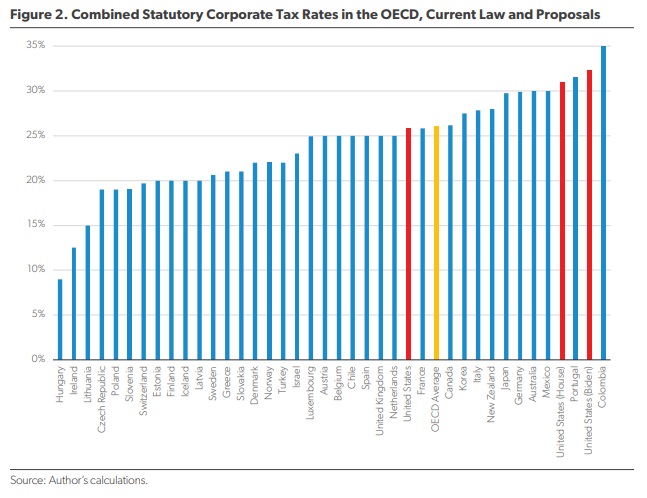

With that out of the way, let’s now look at the bad news, courtesy of Kyle Pomerleau of the American Enterprise Institute.

If Harris wins and her plan becomes law, the United States will have the developed world’s highest corporate tax rate.

Only Colombia’s rate would be higher, but I don’t count that country as being part of the developed world since it’s per-capita GDP is only about half the level of the poorest nations in Western Europe (the OECD added Colombia and Mexico as members primarily to counter accusations that it was a club of white-governed countries).

But regardless of how one categorizes Colombia, the big takeaway from Kyle’s chart is that the U.S. would have a higher corporate tax rate than every single European welfare state. Even France and Italy.

At the risk of understatement, that’s not a recipe for attracting jobs and investment.

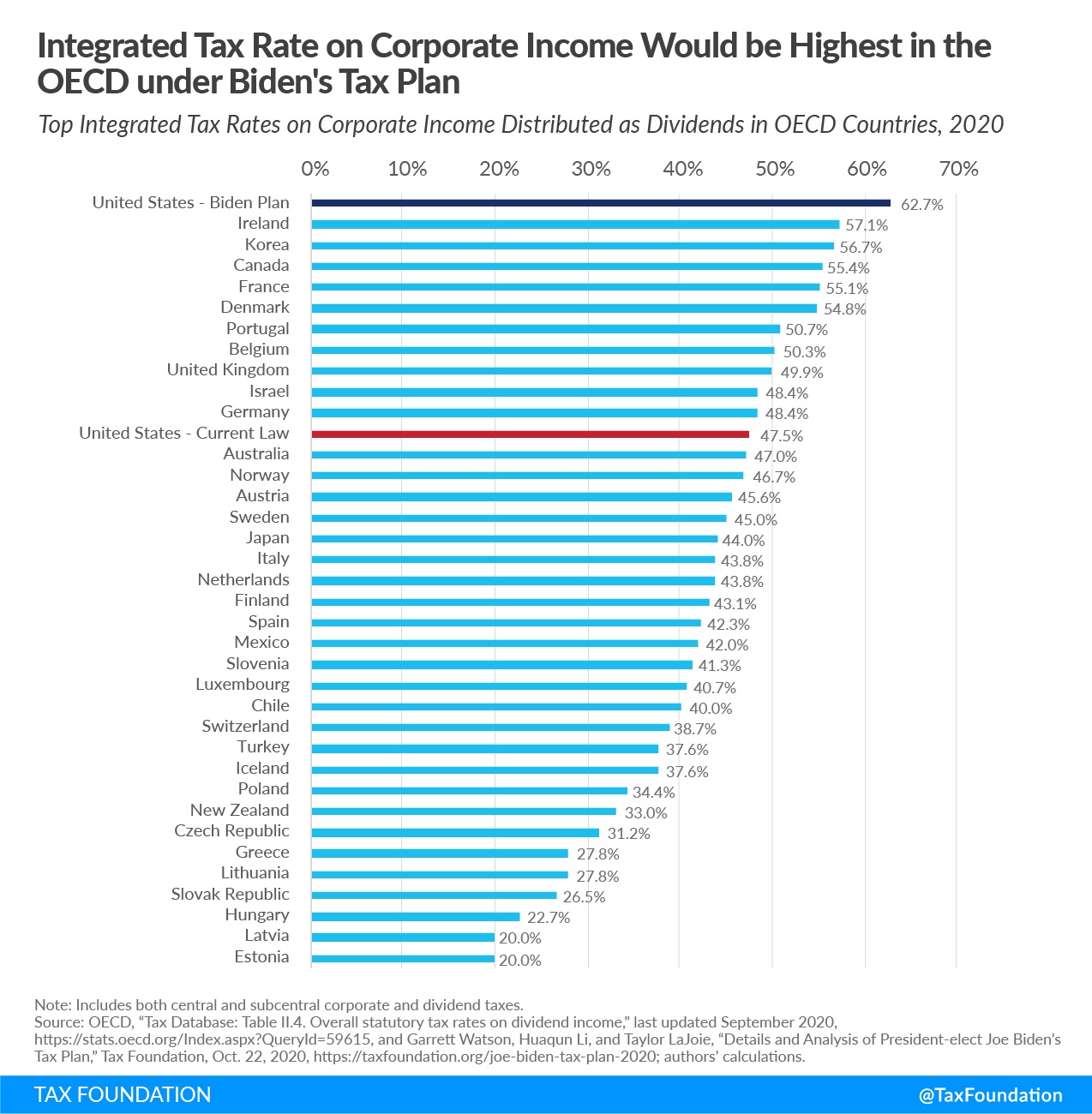

To make matters worse, the United States has a pervasive problem with double taxation.

A few years ago, when Biden was proposing the exact same policy, the Tax Foundation noted that the United States would have the highest tax on business income in the industrialized world (counting the corporate tax and the double tax on dividends).

And America also would be plagued by the highest capital gains tax.

And the highest personal income tax among developed countries.

Given what these policies would do to America’s competitiveness ranking, let’s keep our fingers crossed that she does not turn all of the Biden-Harris tax increases into Harris-Walz tax increases.

P.S. Click here for my explanation about why class-warfare taxation is a bad idea.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.