There is going to be a major battle over tax policy in 2025, triggered in part by an end-of-year deadline to extend (or not extend) major portions of the 2017 Trump tax reforms.

But lawmakers presumably will also be dealing with some of Trump’s new proposals, both the good ones and the bad ones.

At some point in the near future (probably after he makes some big personnel decisions such as Treasury Secretary), I’ll speculate on the potential policy changes as part of my “Second Edition of Trump” series.

To help set the stage for that future discussion, let’s look at some basic facts about tax burdens in the United States. I did something akin to this back in 2016, showing that the top 20 percent shoulder the cost for the vast majority of federal spending.

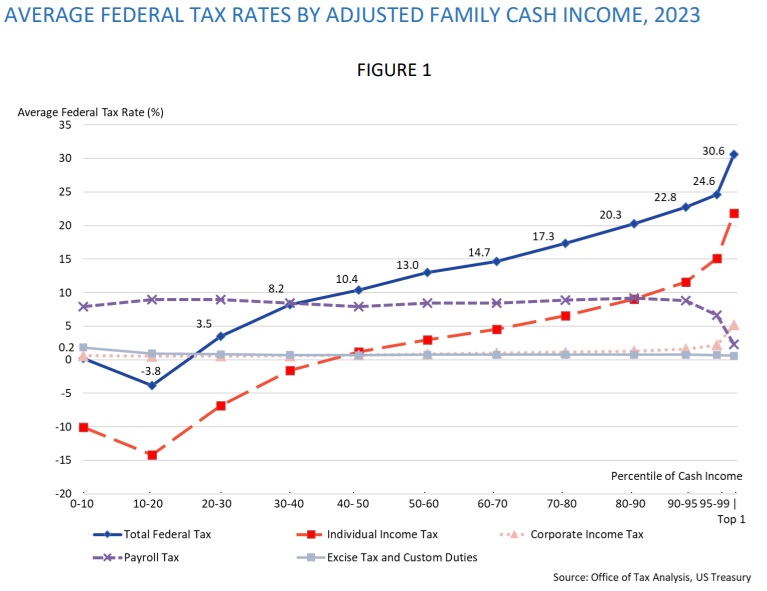

Here are some updated numbers from the Treasury Department showing the total federal tax burden (income taxes, payroll taxes, excise taxes, etc) for every income group in 2023.

As you can see, l0w-income people don’t pay any federal tax. Indeed, they actually get money from the tax system because of “refundable” tax provisions (redistribution spending that is allocated by the IRS).

Middle-class taxpayers, meanwhile, lose about 10-15 percent of their income, while upper-income taxpayers are forced to surrender 25-30 percent of their income to Uncle Sam.

In other words, the United States has a very “progressive” tax system, with the highest rates being imposed on the people contributing the most to economic output.

But that only tells part of the story.

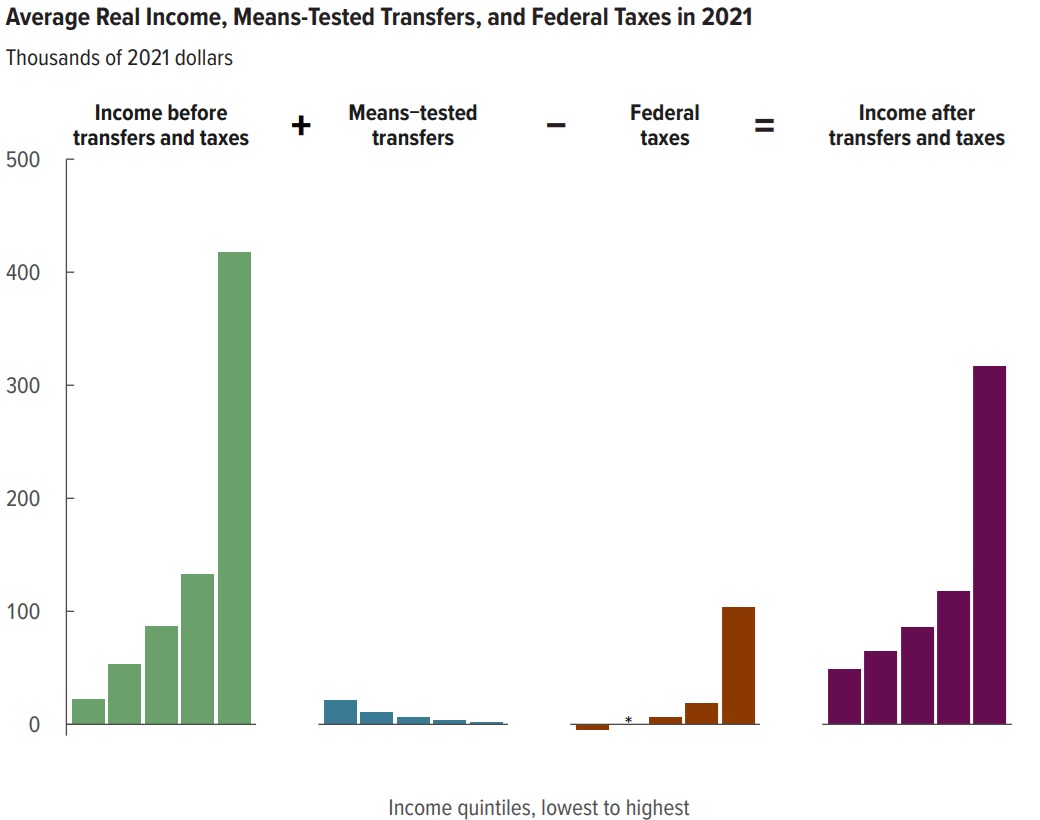

The Congressional Budget Office calculates the impact of both taxes and redistribution spending by income group. This is a more complicated procedure, so the most recent data is for 2021.

And those numbers – showing total income on both ends with transfers and taxes in the middle – are further confirmation that rich people are the ones who finance the bulk of the federal budget.

As you can probably guess, these official numbers contradict the dishonest nonsense disseminated by the Biden Administration.

However, Biden won’t be in office next year. But I suspect there will still be a lot of class-warfare dishonesty from politicians like AOC and Crazy Bernie.