While in Sweden last week, I wrote several columns (here, here, and here) about that nation’s fiscal policy.

But I also had a discussion about American fiscal policy with one of the tax experts at the Confederation of Swedish Enterprise. That included a discussion of the value-added tax (VAT).

If you don’t want to spend a few minutes watching the video, I made two theoretical observations and two practical observations.

Here are my theoretical points.

- VATs tend to be less destructive than income taxes, largely because they don’t have “progressive” tax rates and also don’t exacerbate the tax bias against saving and investment.

- A VAT has the same “tax base” as a flat tax. The structural difference is that a flat tax takes a slice of your income as you earn and a VAT takes a slice of your income as you spend.

So if there ever was an opportunity to swap the income tax for a VAT, I would take that trade (assuming, of course, repeal of the 16th Amendment so politicians couldn’t pull a bait-and-switch scam). Just like I would swap the income tax for a national sales tax.

But we’ll never be given a chance to make that swap.

Instead, some people claim that we are facing a different type of choice. Should we finance our (baked-in-the-cake) expanding burden of government with class-warfare taxes or a value-added tax?

The right answer, needless to say, is to restrain spending. But if someone is holding a gun to your head and demanding that you choose a tax increase, which one do you pick?

Seems like a VAT would be the less-harmful approach, but this is a good opportunity to raise my two practical points.

- In the real world, adoption of a VAT almost surely will lead to more class warfare taxes because politicians will want to balance the harm to lower-income people by also imposing taxes that hurt higher-income people.

- In the real world, the level of government spending is not exogenous. More specifically, VATs have been money machines to finance bigger government in Europe and the same thing likely will happen in the United States.

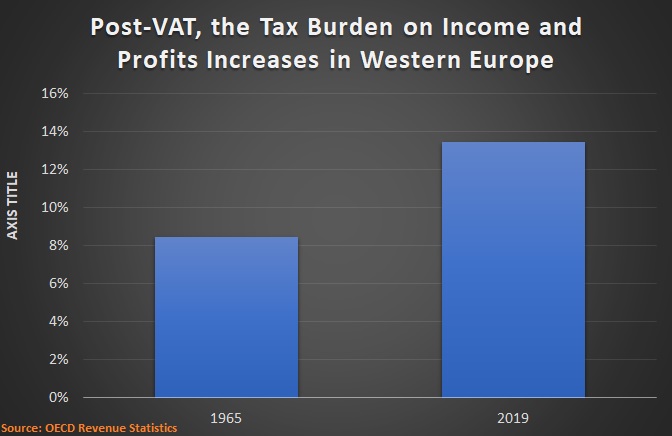

If you want evidence for my first point, this chart is very compelling.

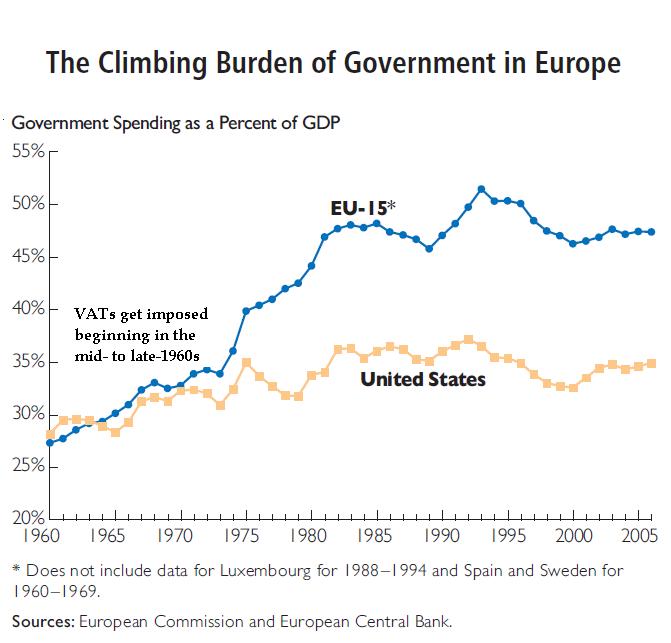

And if you want evidence for my second point, this chart tells you what you need to know.

P.S. You can enjoy some amusing – but also painfully accurate – cartoons about the VAT by clicking here, here, and here.

P.P.S. VAT rates tend not to be as high as income tax rates, but they are nonetheless very onerous.

P.P.P.S. In 2016, I debunked some VAT myths.