I wrote yesterday that I’m in China this week, teaching at Northeastern University in Shenyang.

This gives me a good excuse to write a series of columns about Chinese economic policy.

Our first entry was about demographics, which is a challenge in China (as well as in the U.S., Europe, and elsewhere).

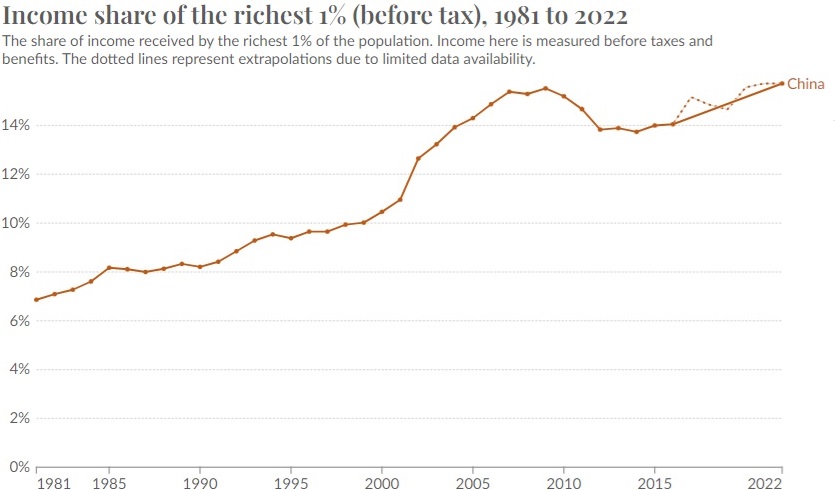

Today, let’s look at what China can teach us about inequality, and we’ll start with this chart from the folks at Oxford who run Our World in Data.

As you can see, the richest 1 percent of the population in China now earn a much bigger share of national income.

Our friends on the left tell us that inequality is terrible.

If they are right, the above chart is a damning indictment of China’s partial economic liberalization, which led to a significant increase in economic freedom in the 1980s and 1990s.

This may surprise readers, but I’m going to partially agree. I suspect China’s economic reforms probably did lead to growing inequality in China.

But now I’m going to explain why everyone (especially the Chinese!) should be very grateful for the partial shift to capitalism.

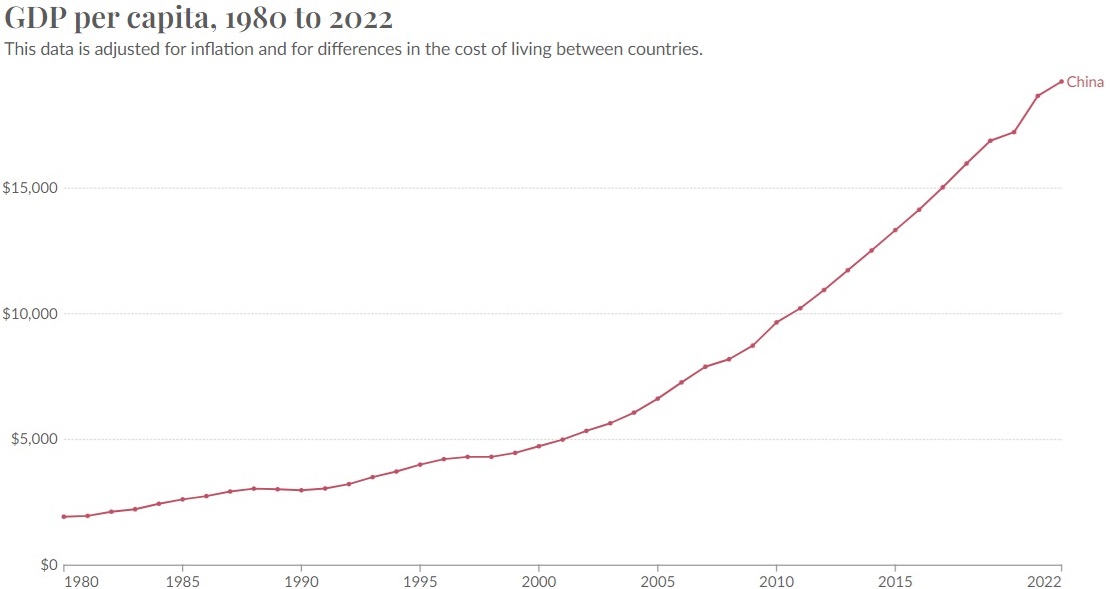

Once again, we’ll use numbers from Our World in Data, starting with this chart on what’s happened to per-capita economic output in China. It increased from less than $2,000 per person to more than $19,000 per person in just four decades.

Some people may wonder if that big increase in per-capita GDP was simply because a handful of people got rich.

But that’s not the case.

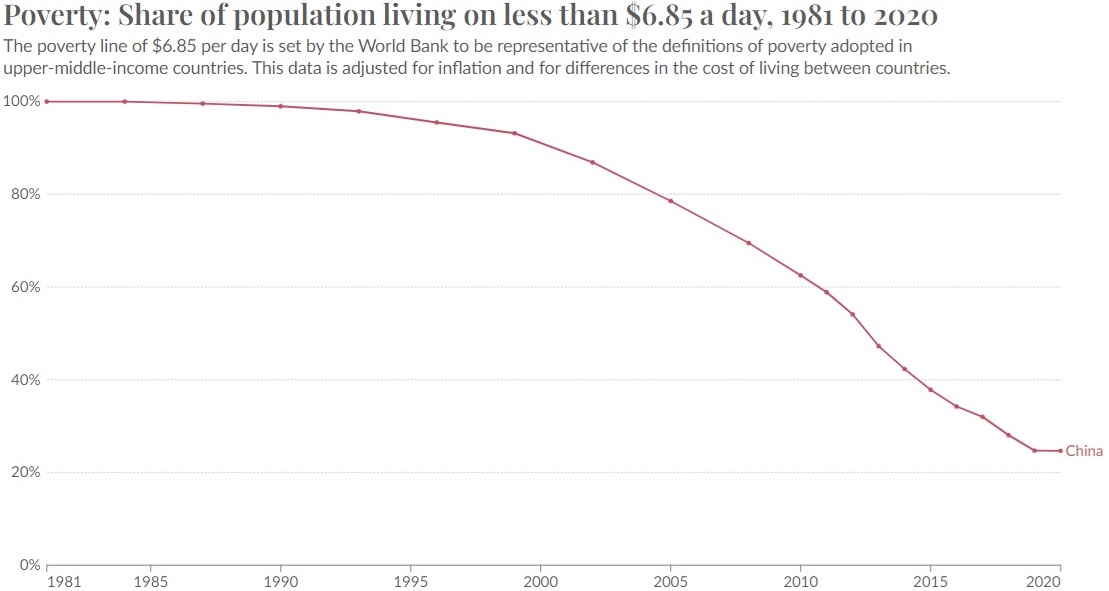

Indeed, poor people were the biggest winners, as illustrated by this chart showing an astounding reduction in poverty during the same four decades.

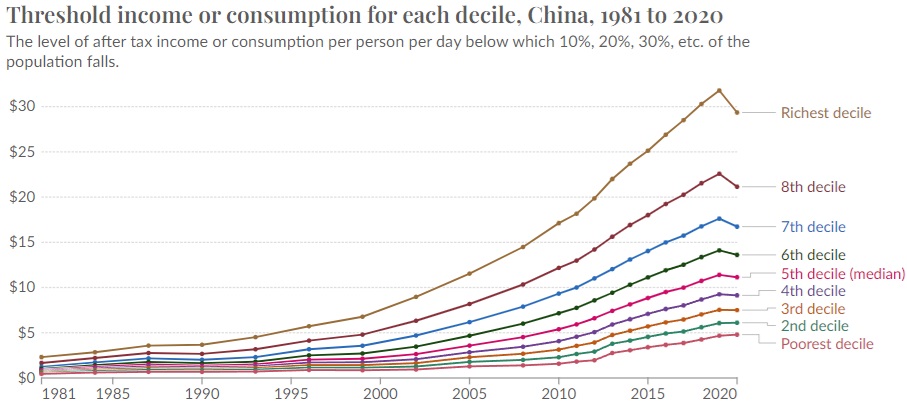

Last but not least, some readers may be asking what happened to the middle class.

So here’s a final chart showing that all income groups in China have enjoyed dramatic increases in prosperity.

The bottom line is that the people of China are much better off thanks to the partial shift to free markets.

Yes, the data shows that the rich got richer faster than everyone else got richer. But at least everyone else got richer.

And that’s much better than having a society where everyone is equally poor!

Looking at the data, the logical conclusion is that China’s leaders should engage in more pro-market reform. After all, if going from awful policy to bad policy helped boost per-capita GDP from $2,000 to $19,000, just imagine how rich China could be if it went from bad policy to good policy?

P.S. Sadly (and unsurprisingly), the OECD and IMF are urging China to adopt bad policy.

———

Image credit: judithscharnowski | Pixabay License.