The Organization for Economic Cooperation and Development is a Paris-based international bureaucracy that originally was created to engage in benign activities such as gathering statistics about member nations.

It still does some of that, but it also has become an advocacy organization, pushing an agenda that reflects the statist orientation of the Western European nations that dominate the OECD’s membership.

The bureaucracy is especially notorious for its anti-tax competition efforts, such as the global corporate tax cartel.

But it also pushes for bad policy in member nations. Heck, it pushes for bad policy in non-member nations. Basically, OECD bureaucrats think “higher taxes” is the answer for almost any question.

I even created a sarcastic fill-in-the-blanks macro back in 2015 that can be used for any of their publications.

The bureaucrats even target the United States, which seems kind of foolish since American taxpayers finance the biggest share of the OECD’s budget.

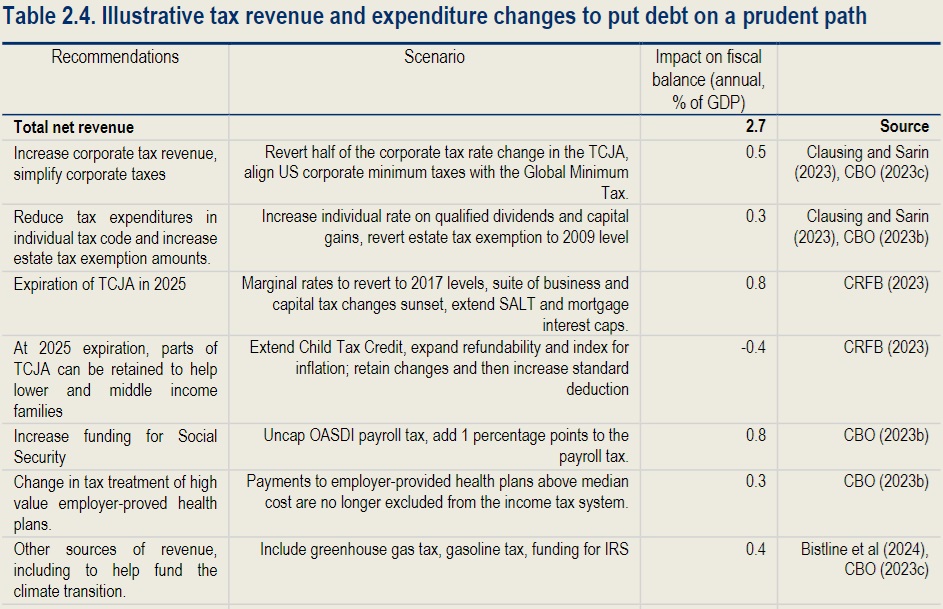

For example, they just released their Economic Survey of the United States and recommended massive tax increases. Everything from higher corporate tax rates to increased double taxation of dividends and capital gains. As well as higher individual tax rates, busting the wage-base cap, and expanding the death tax.

Most of those tax increases target upper-income taxpayers, which OECD economists recognize is a recipe for less prosperity, but OECD tax bureaucrats don’t care.

Moreover, they didn’t forget about the rest of us. The bureaucrats also want a carbon tax and an increase in the payroll tax rate.

I’m not joking. Here’s their list, directly copied from page 135.

To be fair, the OECD Survey also includes a few changes on the spending side of the budget.

But the bureaucrats failed to identify a single department to eliminate (there are many juicy targets). Not did they call for structural entitlement reform.

They merely suggested tinkering with program formulas – an approach that repeatedly has failed to produce meaningful savings.

Oh, and they also regurgitate their recommendation for a new parental leave entitlement.

P.S. You may be wondering why the OECD pushes bad policy. The answer is simple. That is the message that politicians prefer, and the bureaucrats at the OECD need to please those politicians in order to continue enjoying their lavish budgets and exceedingly generous tax-free salaries.

P.P.S. You may also be wondering why Republicans continue to send tens of millions of dollars to Paris to subsidize the OECD. That’s a very good question. I assume the answer is a mix of stupidity and masochism.