I periodically explain why and how to fix entitlements.

Here’s my latest attempt, as part of a conversation with David McIntosh of the Club for Growth.

A few months ago, I shared some alarming CBO data about the ever-growing burden of government.

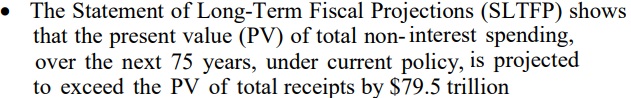

But rather than regurgitate that data, let’s look at the most-recent Financial Report of the United States Government, published each year by the Treasury Department.

There are dozens of tables and graphs in the report, but this excerpt from the executive summary captures the magnitude of America’s fiscal challenge.

At the risk of understatement, $79 trillion is a lot of money.

That number should be scary, but it’s probably not scary enough, because “PV” refers to “present value.”

So what the report is really saying is that we would need to set aside an extra $79 trillion of revenue today to cover the entitlement promises of politicians over the next 75 years.

And that’s far more than twice the size of the entire economy.

This is why I keep pointing out there we face an unavoidable choice of doing something good (entitlement reform) or doing something bad (massive tax increases).

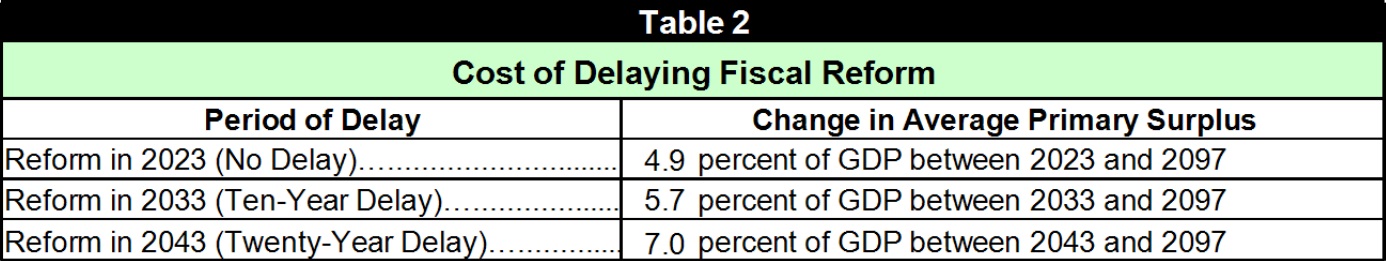

By the way, the report also contains this table, which basically shows the cost of kicking the can down the road.

It shows that the Biden-Trump policy will increase future pain.

Do they not care because they are very old? Do they not care because of “public choice.” Do they not care because of limited cognitive ability?

I don’t know. But I know that both Trump and Biden are doing something that will cause America to become a European-style welfare state. And that won’t be good for national prosperity.

———

Image credit: Pedro Ribeiro Simões | CC BY 2.0.